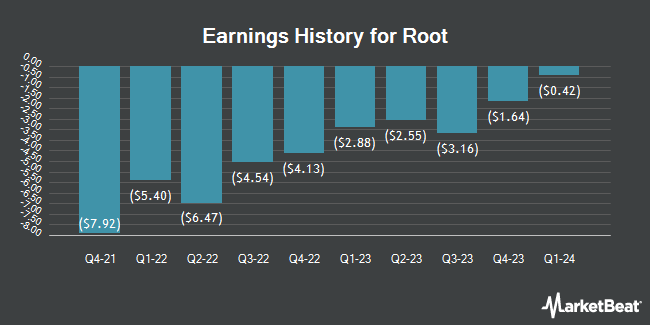

Root (NASDAQ:ROOT - Get Free Report) released its earnings results on Wednesday. The company reported $1.30 EPS for the quarter, topping analysts' consensus estimates of ($0.63) by $1.93, Zacks reports. Root had a negative net margin of 1.56% and a negative return on equity of 9.81%. The business had revenue of $326.70 million during the quarter, compared to analysts' expectations of $287.79 million.

Root Trading Up 9.1 %

Shares of ROOT stock traded up $11.22 during trading hours on Friday, hitting $135.17. The company had a trading volume of 1,259,349 shares, compared to its average volume of 492,107. Root has a fifty-two week low of $27.24 and a fifty-two week high of $141.23. The company has a debt-to-equity ratio of 1.65, a current ratio of 1.39 and a quick ratio of 1.39. The company's fifty day moving average is $94.20 and its 200 day moving average is $71.36. The stock has a market capitalization of $2.04 billion, a PE ratio of -109.89 and a beta of 2.58.

Analyst Upgrades and Downgrades

ROOT has been the topic of a number of recent research reports. Wells Fargo & Company boosted their price target on shares of Root from $80.00 to $97.00 and gave the stock an "equal weight" rating in a research report on Thursday. Keefe, Bruyette & Woods reaffirmed an "outperform" rating and issued a $90.00 target price (up from $82.00) on shares of Root in a research note on Tuesday, November 5th. Citizens Jmp cut shares of Root from a "strong-buy" rating to a "hold" rating in a research report on Friday, November 22nd. UBS Group raised their price objective on shares of Root from $61.00 to $67.00 and gave the stock a "neutral" rating in a research report on Monday, November 4th. Finally, JMP Securities lowered shares of Root from an "outperform" rating to a "market perform" rating in a report on Friday, November 22nd. Five equities research analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, Root presently has a consensus rating of "Moderate Buy" and an average target price of $77.83.

View Our Latest Report on ROOT

Root Company Profile

(

Get Free Report)

Root, Inc provides insurance products and services in the United States. The company offers automobile, homeowners, and renters insurance products. It operates a direct-to-consumer model; and serves customers primarily through mobile applications, as well as through its website. The company's direct distribution channels also cover digital, media, and referral channels, as well as distribution partners and agencies.

See Also

Before you consider Root, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Root wasn't on the list.

While Root currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.