Five9 (NASDAQ:FIVN - Get Free Report) had its price target lifted by stock analysts at Rosenblatt Securities from $45.00 to $50.00 in a note issued to investors on Friday,Benzinga reports. The brokerage currently has a "buy" rating on the software maker's stock. Rosenblatt Securities' price target would indicate a potential upside of 35.80% from the company's previous close.

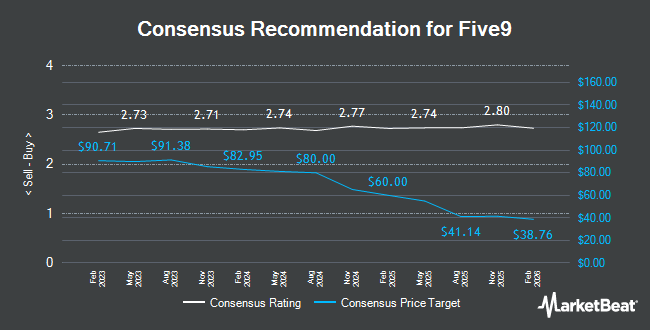

A number of other research firms have also commented on FIVN. Bank of America upgraded shares of Five9 from an "underperform" rating to a "buy" rating and set a $63.00 price objective on the stock in a research report on Monday, August 5th. Piper Sandler lifted their price target on Five9 from $35.00 to $46.00 and gave the company an "overweight" rating in a report on Friday. Northland Securities reduced their price objective on Five9 from $95.00 to $50.00 and set an "outperform" rating for the company in a research note on Friday, August 9th. DA Davidson raised their price objective on Five9 from $40.00 to $45.00 and gave the stock a "neutral" rating in a research report on Friday. Finally, Truist Financial reiterated a "buy" rating and issued a $65.00 target price on shares of Five9 in a report on Tuesday, August 27th. Five equities research analysts have rated the stock with a hold rating and fifteen have given a buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $59.89.

Check Out Our Latest Research Report on Five9

Five9 Price Performance

Shares of FIVN traded up $4.01 during trading hours on Friday, hitting $36.82. 6,455,404 shares of the company were exchanged, compared to its average volume of 1,483,559. The company has a debt-to-equity ratio of 1.39, a current ratio of 2.15 and a quick ratio of 2.15. The company has a market capitalization of $2.75 billion, a PE ratio of -51.14 and a beta of 0.85. The firm has a fifty day simple moving average of $29.37 and a 200-day simple moving average of $39.54. Five9 has a one year low of $26.60 and a one year high of $92.40.

Five9 (NASDAQ:FIVN - Get Free Report) last issued its quarterly earnings results on Thursday, August 8th. The software maker reported ($0.06) earnings per share for the quarter, topping analysts' consensus estimates of ($0.20) by $0.14. Five9 had a negative return on equity of 6.59% and a negative net margin of 5.44%. The firm had revenue of $252.09 million for the quarter, compared to analysts' expectations of $244.54 million. As a group, sell-side analysts predict that Five9 will post -0.09 earnings per share for the current year.

Insider Activity

In other Five9 news, CFO Barry Zwarenstein sold 4,408 shares of the firm's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $26.97, for a total value of $118,883.76. Following the completion of the sale, the chief financial officer now owns 101,732 shares in the company, valued at approximately $2,743,712.04. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, CFO Barry Zwarenstein sold 4,408 shares of the firm's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $26.97, for a total transaction of $118,883.76. Following the completion of the transaction, the chief financial officer now directly owns 101,732 shares of the company's stock, valued at approximately $2,743,712.04. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Panos Kozanian sold 7,617 shares of the company's stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $30.02, for a total transaction of $228,662.34. Following the completion of the sale, the executive vice president now directly owns 76,628 shares in the company, valued at approximately $2,300,372.56. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 36,493 shares of company stock valued at $1,097,753 over the last 90 days. 1.80% of the stock is currently owned by company insiders.

Institutional Trading of Five9

Several hedge funds have recently modified their holdings of the stock. Signaturefd LLC lifted its holdings in Five9 by 1,892.3% during the 3rd quarter. Signaturefd LLC now owns 1,036 shares of the software maker's stock worth $30,000 after buying an additional 984 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund acquired a new position in shares of Five9 during the second quarter valued at $57,000. Quest Partners LLC bought a new position in Five9 in the third quarter valued at about $95,000. nVerses Capital LLC acquired a new stake in Five9 in the third quarter worth about $141,000. Finally, Quent Capital LLC raised its holdings in Five9 by 8.7% during the 2nd quarter. Quent Capital LLC now owns 4,379 shares of the software maker's stock worth $193,000 after purchasing an additional 352 shares during the last quarter. 96.64% of the stock is owned by institutional investors.

About Five9

(

Get Free Report)

Five9, Inc, together with its subsidiaries, provides intelligent cloud software for contact centers in the United States, India, and internationally. It offers a virtual contact center cloud platform that delivers a suite of applications, which enables the breadth of contact center-related customer service, sales, and marketing functions.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Five9, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five9 wasn't on the list.

While Five9 currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.