Infinera (NASDAQ:INFN - Get Free Report)'s stock had its "neutral" rating reaffirmed by equities researchers at Rosenblatt Securities in a report released on Wednesday, Benzinga reports. They currently have a $6.65 price target on the communications equipment provider's stock. Rosenblatt Securities' price target would indicate a potential downside of 0.75% from the company's previous close.

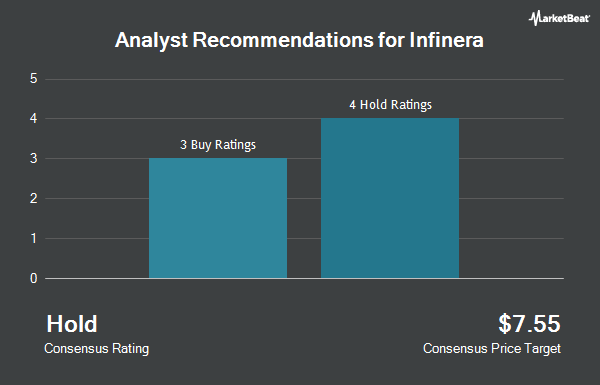

INFN has been the topic of several other research reports. StockNews.com lowered shares of Infinera from a "hold" rating to a "sell" rating in a report on Monday, October 21st. B. Riley dropped their price objective on shares of Infinera from $9.00 to $6.65 and set a "buy" rating on the stock in a report on Monday, August 5th. JPMorgan Chase & Co. upped their price objective on shares of Infinera from $5.00 to $6.00 and gave the company an "underweight" rating in a report on Tuesday, August 6th. Finally, Berenberg Bank upgraded shares of Infinera to a "hold" rating in a report on Monday, August 5th. Two equities research analysts have rated the stock with a sell rating, five have given a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $7.09.

View Our Latest Report on INFN

Infinera Stock Down 0.1 %

Shares of NASDAQ INFN traded down $0.01 during trading on Wednesday, hitting $6.70. 1,720,380 shares of the company traded hands, compared to its average volume of 5,075,968. The business's fifty day moving average is $6.62 and its 200 day moving average is $5.96. Infinera has a fifty-two week low of $2.98 and a fifty-two week high of $6.92. The firm has a market capitalization of $1.58 billion, a price-to-earnings ratio of -14.61 and a beta of 1.71. The company has a debt-to-equity ratio of 5.02, a quick ratio of 0.94 and a current ratio of 1.57.

Institutional Investors Weigh In On Infinera

A number of institutional investors and hedge funds have recently made changes to their positions in INFN. AIGH Capital Management LLC increased its stake in Infinera by 278.8% in the 2nd quarter. AIGH Capital Management LLC now owns 3,368,556 shares of the communications equipment provider's stock valued at $20,515,000 after buying an additional 2,479,272 shares during the last quarter. Vanguard Group Inc. grew its position in shares of Infinera by 9.3% during the 1st quarter. Vanguard Group Inc. now owns 27,049,371 shares of the communications equipment provider's stock valued at $163,108,000 after acquiring an additional 2,299,025 shares during the period. Barrow Hanley Mewhinney & Strauss LLC grew its position in shares of Infinera by 22.4% during the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 11,057,935 shares of the communications equipment provider's stock valued at $67,343,000 after acquiring an additional 2,025,658 shares during the period. Water Island Capital LLC bought a new position in shares of Infinera during the 2nd quarter valued at approximately $9,196,000. Finally, Hood River Capital Management LLC grew its position in shares of Infinera by 52.5% during the 1st quarter. Hood River Capital Management LLC now owns 4,162,231 shares of the communications equipment provider's stock valued at $25,098,000 after acquiring an additional 1,432,016 shares during the period. Institutional investors and hedge funds own 97.54% of the company's stock.

About Infinera

(

Get Free Report)

Infinera Corporation provides optical transport networking equipment, software, and services worldwide. The company's product portfolio includes Infinera Groove series for modular and sled-based platforms to support a various transport network applications; Infinera 7300 series, an SDN-ready coherent optical transport system; Infinera FlexILS open optical line system that connects various Infinera and third-party terminal equipment platforms over long-distance fiber optic cable providing switching, multiplexing, amplification, and management channels; and Infinera 7090 and 7100 series for transport platforms.

Recommended Stories

Before you consider Infinera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Infinera wasn't on the list.

While Infinera currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.