Rossby Financial LCC acquired a new stake in shares of Cameco Co. (NYSE:CCJ - Free Report) TSE: CCO in the fourth quarter, according to the company in its most recent filing with the SEC. The firm acquired 17,325 shares of the basic materials company's stock, valued at approximately $890,000.

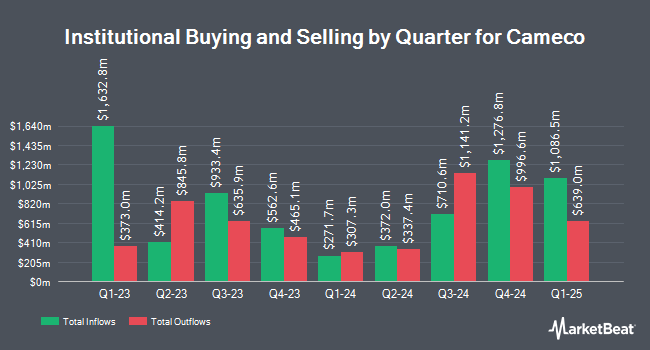

A number of other institutional investors have also modified their holdings of the stock. Larson Financial Group LLC increased its stake in shares of Cameco by 37.4% during the fourth quarter. Larson Financial Group LLC now owns 830 shares of the basic materials company's stock valued at $43,000 after buying an additional 226 shares during the period. Heritage Wealth Management Inc. increased its position in Cameco by 0.8% during the 4th quarter. Heritage Wealth Management Inc. now owns 30,875 shares of the basic materials company's stock valued at $1,587,000 after purchasing an additional 250 shares during the period. MassMutual Private Wealth & Trust FSB raised its holdings in shares of Cameco by 48.6% in the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 816 shares of the basic materials company's stock valued at $42,000 after purchasing an additional 267 shares in the last quarter. EdgeRock Capital LLC lifted its position in shares of Cameco by 2.2% in the 4th quarter. EdgeRock Capital LLC now owns 13,986 shares of the basic materials company's stock worth $719,000 after purchasing an additional 297 shares during the period. Finally, Highview Capital Management LLC DE boosted its stake in shares of Cameco by 5.0% during the fourth quarter. Highview Capital Management LLC DE now owns 6,246 shares of the basic materials company's stock valued at $321,000 after purchasing an additional 300 shares in the last quarter. 70.21% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

CCJ has been the topic of a number of analyst reports. Stifel Nicolaus assumed coverage on shares of Cameco in a research report on Wednesday, March 12th. They issued a "buy" rating on the stock. Glj Research raised their price objective on Cameco from $62.76 to $75.68 and gave the stock a "buy" rating in a research note on Wednesday, March 12th. Stifel Canada raised shares of Cameco to a "strong-buy" rating in a report on Wednesday, March 12th. StockNews.com cut Cameco from a "hold" rating to a "sell" rating in a report on Wednesday, April 2nd. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and set a $90.00 target price on shares of Cameco in a report on Tuesday, March 4th. One analyst has rated the stock with a sell rating, nine have assigned a buy rating and three have issued a strong buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Buy" and an average target price of $70.03.

Get Our Latest Analysis on CCJ

Cameco Trading Up 5.5 %

Shares of CCJ stock opened at $40.81 on Monday. Cameco Co. has a 1-year low of $35.00 and a 1-year high of $62.55. The company has a market cap of $17.76 billion, a price-to-earnings ratio of 145.74 and a beta of 1.04. The company has a debt-to-equity ratio of 0.20, a current ratio of 2.88 and a quick ratio of 1.26. The stock has a 50 day simple moving average of $43.54 and a 200-day simple moving average of $50.01.

Cameco (NYSE:CCJ - Get Free Report) TSE: CCO last posted its quarterly earnings data on Thursday, February 20th. The basic materials company reported $0.26 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.26. Cameco had a net margin of 5.39% and a return on equity of 4.34%. The business had revenue of $845.54 million for the quarter, compared to the consensus estimate of $1.09 billion. On average, equities research analysts expect that Cameco Co. will post 1.27 EPS for the current fiscal year.

About Cameco

(

Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.