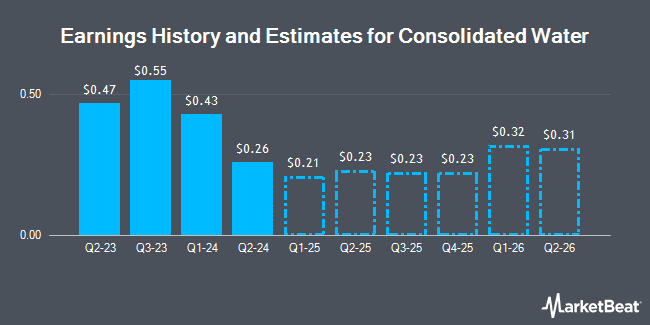

Consolidated Water Co. Ltd. (NASDAQ:CWCO - Free Report) - Analysts at Roth Capital cut their FY2024 earnings estimates for shares of Consolidated Water in a research report issued on Monday, November 18th. Roth Capital analyst G. Sweeney now expects that the utilities provider will earn $1.24 per share for the year, down from their previous estimate of $1.26. The consensus estimate for Consolidated Water's current full-year earnings is $1.27 per share. Roth Capital also issued estimates for Consolidated Water's Q4 2024 earnings at $0.26 EPS and Q2 2025 earnings at $0.30 EPS.

Consolidated Water Stock Performance

CWCO stock traded down $0.24 during trading on Thursday, hitting $26.11. 24,188 shares of the stock traded hands, compared to its average volume of 119,573. The firm's 50 day moving average is $25.24 and its two-hundred day moving average is $26.30. Consolidated Water has a 1 year low of $23.55 and a 1 year high of $38.29.

Institutional Trading of Consolidated Water

A number of institutional investors have recently made changes to their positions in the stock. Oliver Lagore Vanvalin Investment Group purchased a new position in shares of Consolidated Water in the second quarter worth approximately $27,000. nVerses Capital LLC purchased a new position in shares of Consolidated Water in the third quarter valued at $33,000. Copeland Capital Management LLC purchased a new position in Consolidated Water during the third quarter worth $48,000. Stanley Laman Group Ltd. purchased a new position in Consolidated Water during the third quarter worth $53,000. Finally, SG Americas Securities LLC purchased a new position in Consolidated Water during the third quarter worth $132,000. Hedge funds and other institutional investors own 55.16% of the company's stock.

About Consolidated Water

(

Get Free Report)

Consolidated Water Co Ltd., together with its subsidiaries, designs, constructs, manages, and operates water production and water treatment plants primarily in the Cayman Islands, the Bahamas, and the United States. The company operates through four segments: Retail, Bulk, Services, and Manufacturing.

See Also

Before you consider Consolidated Water, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Water wasn't on the list.

While Consolidated Water currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.