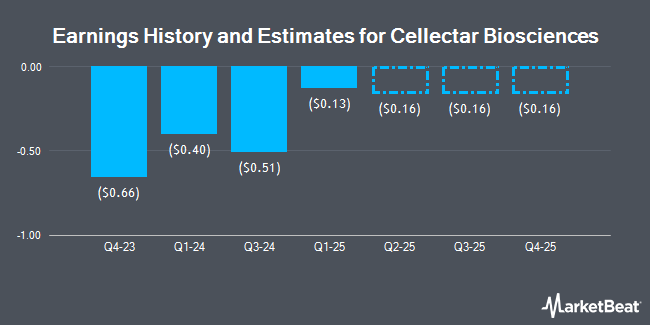

Cellectar Biosciences, Inc. (NASDAQ:CLRB - Free Report) - Equities researchers at Roth Capital dropped their FY2024 EPS estimates for Cellectar Biosciences in a note issued to investors on Monday, November 18th. Roth Capital analyst J. Aschoff now expects that the biopharmaceutical company will post earnings per share of ($1.53) for the year, down from their previous forecast of ($1.52). The consensus estimate for Cellectar Biosciences' current full-year earnings is ($1.57) per share. Roth Capital also issued estimates for Cellectar Biosciences' Q4 2024 earnings at ($0.32) EPS, Q2 2025 earnings at ($0.25) EPS, Q3 2025 earnings at ($0.20) EPS, Q4 2025 earnings at $0.05 EPS, FY2025 earnings at ($0.65) EPS, FY2026 earnings at $0.50 EPS, FY2027 earnings at $1.10 EPS and FY2028 earnings at $1.71 EPS.

Cellectar Biosciences (NASDAQ:CLRB - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The biopharmaceutical company reported ($0.51) earnings per share (EPS) for the quarter.

CLRB has been the topic of a number of other research reports. StockNews.com upgraded Cellectar Biosciences to a "sell" rating in a report on Thursday, September 26th. Oppenheimer lowered their price target on shares of Cellectar Biosciences from $14.00 to $12.00 and set an "outperform" rating on the stock in a research report on Tuesday.

Get Our Latest Analysis on Cellectar Biosciences

Cellectar Biosciences Stock Performance

NASDAQ CLRB opened at $1.56 on Thursday. The stock's 50 day simple moving average is $2.06 and its 200-day simple moving average is $2.41. Cellectar Biosciences has a 1-year low of $1.55 and a 1-year high of $4.45.

Institutional Investors Weigh In On Cellectar Biosciences

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Rosalind Advisors Inc. raised its stake in shares of Cellectar Biosciences by 35.7% in the 3rd quarter. Rosalind Advisors Inc. now owns 3,671,550 shares of the biopharmaceutical company's stock valued at $7,857,000 after acquiring an additional 965,934 shares during the period. AIGH Capital Management LLC increased its stake in Cellectar Biosciences by 8.2% during the second quarter. AIGH Capital Management LLC now owns 3,036,187 shares of the biopharmaceutical company's stock worth $7,590,000 after purchasing an additional 231,270 shares during the period. Vanguard Group Inc. lifted its position in shares of Cellectar Biosciences by 146.7% during the first quarter. Vanguard Group Inc. now owns 1,191,081 shares of the biopharmaceutical company's stock worth $4,741,000 after purchasing an additional 708,191 shares in the last quarter. Geode Capital Management LLC boosted its stake in shares of Cellectar Biosciences by 3.3% in the third quarter. Geode Capital Management LLC now owns 352,452 shares of the biopharmaceutical company's stock valued at $754,000 after purchasing an additional 11,266 shares during the period. Finally, XTX Topco Ltd grew its holdings in shares of Cellectar Biosciences by 432.4% in the second quarter. XTX Topco Ltd now owns 63,304 shares of the biopharmaceutical company's stock valued at $158,000 after purchasing an additional 51,413 shares in the last quarter. Institutional investors and hedge funds own 16.41% of the company's stock.

Cellectar Biosciences Company Profile

(

Get Free Report)

Cellectar Biosciences, Inc, a clinical biopharmaceutical company, focuses on the discovery, development, and commercialization of drugs for the treatment of cancer. Its lead phospholipid drug conjugate (PDC) candidate is CLR 131 (iopofosine I-131), which is in Phase 2 clinical study for patients with B-cell malignancies; Phase 2a clinical study for patients with relapsed or refractory (r/r) Waldenstrom's macroglobulinemia cohort, r/r multiple myeloma (MM) cohort, and r/r non-Hodgkin's lymphoma cohort; Phase 1 clinical study for r/r pediatric patients with select solid tumors, lymphomas, and malignant brain tumors; and Phase 1 clinical study for r/r head and neck cancer.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cellectar Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cellectar Biosciences wasn't on the list.

While Cellectar Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.