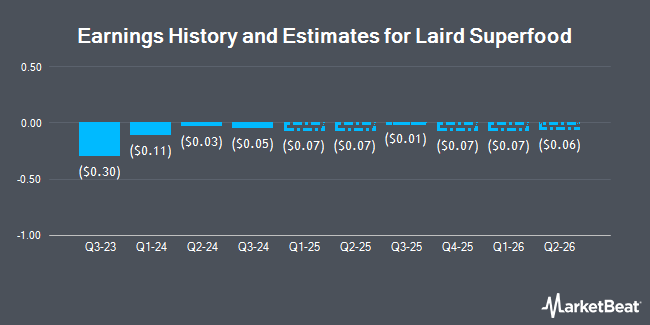

Laird Superfood, Inc. (NYSEAMERICAN:LSF - Free Report) - Equities research analysts at Roth Capital issued their FY2026 earnings per share estimates for shares of Laird Superfood in a research report issued on Monday, November 18th. Roth Capital analyst G. Kelly anticipates that the company will post earnings per share of $0.01 for the year. The consensus estimate for Laird Superfood's current full-year earnings is ($0.16) per share.

Separately, Roth Mkm reiterated a "buy" rating and set a $12.00 price objective (up from $8.00) on shares of Laird Superfood in a research report on Thursday, November 7th.

Get Our Latest Analysis on LSF

Laird Superfood Stock Down 6.3 %

Shares of LSF traded down $0.53 during trading hours on Wednesday, hitting $7.94. 88,148 shares of the company were exchanged, compared to its average volume of 256,130. The firm has a market cap of $81.54 million, a PE ratio of -56.35 and a beta of 2.20. Laird Superfood has a one year low of $0.71 and a one year high of $10.35.

Institutional Investors Weigh In On Laird Superfood

Hedge funds have recently made changes to their positions in the stock. Renaissance Technologies LLC lifted its holdings in shares of Laird Superfood by 86.2% during the 2nd quarter. Renaissance Technologies LLC now owns 327,600 shares of the company's stock worth $1,841,000 after acquiring an additional 151,679 shares during the period. Geode Capital Management LLC boosted its holdings in Laird Superfood by 29.3% during the third quarter. Geode Capital Management LLC now owns 80,253 shares of the company's stock valued at $398,000 after purchasing an additional 18,187 shares in the last quarter. Dimensional Fund Advisors LP bought a new stake in shares of Laird Superfood in the 2nd quarter valued at approximately $155,000. Virtu Financial LLC acquired a new position in shares of Laird Superfood in the 1st quarter worth approximately $61,000. Finally, XTX Topco Ltd lifted its position in shares of Laird Superfood by 41.6% during the 3rd quarter. XTX Topco Ltd now owns 15,957 shares of the company's stock worth $79,000 after buying an additional 4,690 shares during the period. Institutional investors own 8.56% of the company's stock.

Laird Superfood Company Profile

(

Get Free Report)

Laird Superfood, Inc manufactures and markets plant-based natural and functional food in the United States. The company provides powdered and liquid coffee creamers, and hydration and beverage enhancing supplements; hydrate coconut water products; performance mushroom supplements; functional, organic roasted, and instant coffee, tea, hot chocolate products; harvest snacks; and other food items.

Further Reading

Before you consider Laird Superfood, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Laird Superfood wasn't on the list.

While Laird Superfood currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.