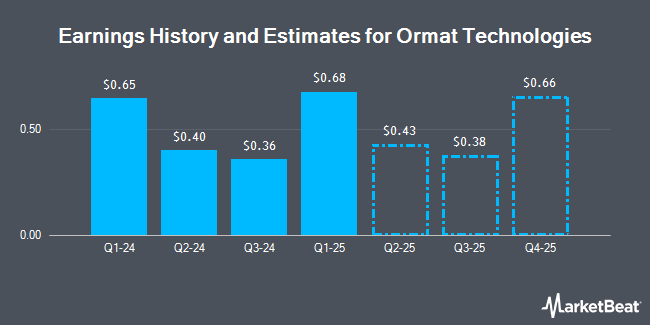

Ormat Technologies, Inc. (NYSE:ORA - Free Report) - Research analysts at Roth Capital decreased their FY2024 earnings per share (EPS) estimates for Ormat Technologies in a note issued to investors on Thursday, November 7th. Roth Capital analyst J. Clare now expects that the energy company will earn $1.88 per share for the year, down from their prior estimate of $1.96. The consensus estimate for Ormat Technologies' current full-year earnings is $1.90 per share. Roth Capital also issued estimates for Ormat Technologies' Q4 2024 earnings at $0.51 EPS, Q3 2025 earnings at $0.45 EPS, Q4 2025 earnings at $0.69 EPS, FY2025 earnings at $2.30 EPS and FY2026 earnings at $2.69 EPS.

Several other equities analysts have also recently issued reports on the company. JPMorgan Chase & Co. raised their price target on Ormat Technologies from $69.00 to $75.00 and gave the company a "neutral" rating in a report on Tuesday, July 16th. Oppenheimer raised their price target on Ormat Technologies from $86.00 to $91.00 and gave the company an "outperform" rating in a report on Friday. Finally, Roth Mkm reiterated a "buy" rating and issued a $92.00 price target (up previously from $87.00) on shares of Ormat Technologies in a report on Friday. Three analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $84.50.

Check Out Our Latest Research Report on Ormat Technologies

Ormat Technologies Price Performance

Shares of NYSE:ORA traded up $0.71 during midday trading on Monday, reaching $83.84. The company's stock had a trading volume of 596,236 shares, compared to its average volume of 438,002. Ormat Technologies has a fifty-two week low of $58.73 and a fifty-two week high of $84.30. The company has a market capitalization of $5.07 billion, a P/E ratio of 42.78, a P/E/G ratio of 4.34 and a beta of 0.53. The company has a debt-to-equity ratio of 0.73, a current ratio of 0.95 and a quick ratio of 0.89. The business's fifty day simple moving average is $76.96 and its 200-day simple moving average is $74.21.

Ormat Technologies (NYSE:ORA - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The energy company reported $0.36 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.31 by $0.05. Ormat Technologies had a return on equity of 5.27% and a net margin of 13.33%. The firm had revenue of $211.80 million during the quarter, compared to analyst estimates of $215.53 million. During the same period in the prior year, the company posted $0.47 earnings per share. The business's revenue for the quarter was up 1.8% compared to the same quarter last year.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in ORA. Texas Permanent School Fund Corp lifted its position in Ormat Technologies by 1.3% during the 1st quarter. Texas Permanent School Fund Corp now owns 46,945 shares of the energy company's stock worth $3,107,000 after buying an additional 601 shares in the last quarter. Swiss National Bank grew its holdings in shares of Ormat Technologies by 0.4% in the 1st quarter. Swiss National Bank now owns 107,234 shares of the energy company's stock valued at $7,098,000 after acquiring an additional 400 shares in the last quarter. Susquehanna Fundamental Investments LLC bought a new position in shares of Ormat Technologies in the 1st quarter valued at about $2,075,000. Sei Investments Co. grew its holdings in shares of Ormat Technologies by 10.4% in the 1st quarter. Sei Investments Co. now owns 17,197 shares of the energy company's stock valued at $1,138,000 after acquiring an additional 1,615 shares in the last quarter. Finally, Meeder Asset Management Inc. bought a new position in shares of Ormat Technologies in the 1st quarter valued at about $631,000. Institutional investors and hedge funds own 95.49% of the company's stock.

Insiders Place Their Bets

In other news, Director Dafna Sharir sold 433 shares of the firm's stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $74.91, for a total transaction of $32,436.03. Following the sale, the director now owns 3,561 shares of the company's stock, valued at $266,754.51. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. In other Ormat Technologies news, Director Byron G. Wong sold 1,266 shares of the business's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $74.98, for a total value of $94,924.68. Following the sale, the director now owns 6,906 shares in the company, valued at approximately $517,811.88. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Dafna Sharir sold 433 shares of the firm's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $74.91, for a total transaction of $32,436.03. Following the transaction, the director now directly owns 3,561 shares of the company's stock, valued at $266,754.51. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.00% of the company's stock.

Ormat Technologies Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, December 4th. Shareholders of record on Wednesday, November 20th will be issued a dividend of $0.12 per share. This represents a $0.48 dividend on an annualized basis and a yield of 0.57%. The ex-dividend date of this dividend is Wednesday, November 20th. Ormat Technologies's dividend payout ratio (DPR) is currently 24.49%.

Ormat Technologies Company Profile

(

Get Free Report)

Ormat Technologies, Inc engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, and internationally. It operates in three segments: Electricity, Product, and Energy Storage. The Electricity segment develops, builds, owns, and operates geothermal, solar photovoltaic, and recovered energy-based power plants; and sells electricity.

Further Reading

Before you consider Ormat Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ormat Technologies wasn't on the list.

While Ormat Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.