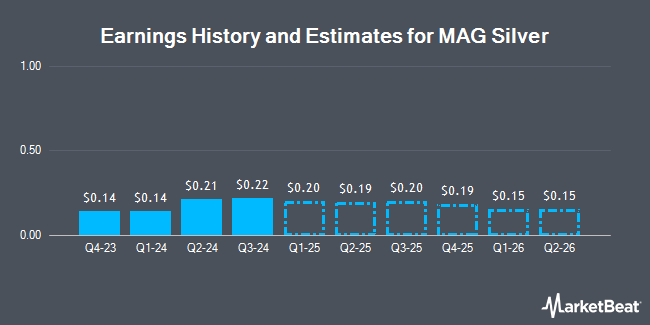

MAG Silver Corp. (NYSEAMERICAN:MAG - Free Report) - Research analysts at Roth Capital reduced their Q1 2025 earnings per share estimates for MAG Silver in a report issued on Tuesday, March 25th. Roth Capital analyst J. Reagor now expects that the company will earn $0.15 per share for the quarter, down from their prior forecast of $0.17. The consensus estimate for MAG Silver's current full-year earnings is $0.73 per share. Roth Capital also issued estimates for MAG Silver's Q4 2025 earnings at $0.14 EPS, Q1 2026 earnings at $0.15 EPS, Q2 2026 earnings at $0.15 EPS, Q3 2026 earnings at $0.15 EPS, Q4 2026 earnings at $0.15 EPS and FY2026 earnings at $0.60 EPS.

A number of other research firms have also recently weighed in on MAG. HC Wainwright increased their price objective on MAG Silver from $21.00 to $22.00 and gave the stock a "buy" rating in a research report on Tuesday, March 25th. TD Securities upgraded shares of MAG Silver to a "strong-buy" rating in a research report on Monday, March 10th. Roth Mkm reduced their target price on shares of MAG Silver from $16.50 to $16.00 and set a "neutral" rating for the company in a research note on Tuesday, March 25th. Finally, Raymond James reissued an "outperform" rating on shares of MAG Silver in a report on Tuesday. Four analysts have rated the stock with a hold rating, four have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, MAG Silver has an average rating of "Moderate Buy" and a consensus target price of $18.00.

Get Our Latest Report on MAG Silver

MAG Silver Price Performance

Shares of MAG traded down $0.93 during mid-day trading on Wednesday, hitting $15.70. 1,089,570 shares of the company's stock were exchanged, compared to its average volume of 628,689. The stock has a market cap of $1.62 billion, a price-to-earnings ratio of 22.11 and a beta of 1.09. MAG Silver has a fifty-two week low of $10.62 and a fifty-two week high of $18.27. The company has a 50 day simple moving average of $15.70.

Hedge Funds Weigh In On MAG Silver

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the business. First Eagle Investment Management LLC lifted its position in MAG Silver by 46.4% during the fourth quarter. First Eagle Investment Management LLC now owns 7,839,793 shares of the company's stock worth $106,379,000 after buying an additional 2,486,538 shares during the period. Millennium Management LLC grew its holdings in MAG Silver by 3,324.7% in the fourth quarter. Millennium Management LLC now owns 886,203 shares of the company's stock valued at $12,052,000 after purchasing an additional 860,326 shares during the period. Raymond James Financial Inc. acquired a new position in MAG Silver during the fourth quarter worth approximately $3,482,000. The Manufacturers Life Insurance Company raised its stake in MAG Silver by 199.7% during the third quarter. The Manufacturers Life Insurance Company now owns 382,027 shares of the company's stock worth $5,374,000 after purchasing an additional 254,553 shares during the period. Finally, Sprott Inc. raised its stake in MAG Silver by 8.5% during the fourth quarter. Sprott Inc. now owns 2,649,507 shares of the company's stock worth $36,004,000 after purchasing an additional 208,252 shares during the period. Institutional investors and hedge funds own 52.50% of the company's stock.

MAG Silver Announces Dividend

The company also recently declared a -- dividend, which will be paid on Monday, April 21st. Stockholders of record on Friday, April 4th will be given a $0.18 dividend. This represents a dividend yield of 1.5%. The ex-dividend date is Friday, April 4th.

About MAG Silver

(

Get Free Report)

MAG Silver Corp. develops and explores for precious metal properties in Canada. It explores for silver, gold, lead, copper, and zinc deposits. The company's flagship property is the 44% owned Juanicipio property located in the Fresnillo District, Zacatecas State, Mexico. MAG Silver Corp. is headquartered in Vancouver, Canada.

See Also

Before you consider MAG Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MAG Silver wasn't on the list.

While MAG Silver currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.