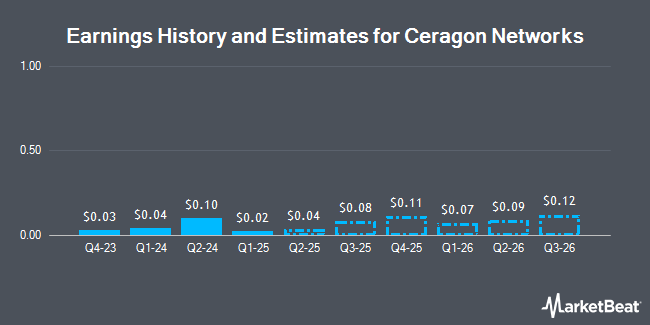

Ceragon Networks Ltd. (NASDAQ:CRNT - Free Report) - Equities researchers at Roth Capital boosted their FY2024 earnings estimates for shares of Ceragon Networks in a research note issued to investors on Wednesday, November 13th. Roth Capital analyst S. Searle now anticipates that the communications equipment provider will post earnings per share of $0.32 for the year, up from their previous forecast of $0.31. Roth Capital currently has a "Strong-Buy" rating on the stock. The consensus estimate for Ceragon Networks' current full-year earnings is $0.28 per share. Roth Capital also issued estimates for Ceragon Networks' Q1 2025 earnings at $0.07 EPS and Q2 2025 earnings at $0.09 EPS.

CRNT has been the subject of several other research reports. Roth Mkm initiated coverage on shares of Ceragon Networks in a research note on Monday, October 28th. They set a "buy" rating and a $4.50 price target for the company. Needham & Company LLC reiterated a "buy" rating and issued a $5.25 price objective on shares of Ceragon Networks in a research note on Thursday, August 8th. Two analysts have rated the stock with a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Strong Buy" and an average target price of $4.88.

Get Our Latest Stock Analysis on Ceragon Networks

Ceragon Networks Stock Performance

Shares of Ceragon Networks stock traded down $0.11 during mid-day trading on Friday, hitting $2.71. 776,800 shares of the stock were exchanged, compared to its average volume of 456,227. The company has a 50-day simple moving average of $2.60 and a 200 day simple moving average of $2.66. Ceragon Networks has a 12 month low of $1.72 and a 12 month high of $3.38. The company has a market capitalization of $231.48 million, a P/E ratio of 12.32 and a beta of 1.35.

Institutional Inflows and Outflows

Hedge funds have recently made changes to their positions in the company. Acadian Asset Management LLC grew its position in shares of Ceragon Networks by 126.4% during the 1st quarter. Acadian Asset Management LLC now owns 1,555,000 shares of the communications equipment provider's stock valued at $4,966,000 after purchasing an additional 868,138 shares in the last quarter. Lazard Asset Management LLC grew its position in shares of Ceragon Networks by 9,906.9% during the 1st quarter. Lazard Asset Management LLC now owns 94,765 shares of the communications equipment provider's stock valued at $303,000 after purchasing an additional 93,818 shares in the last quarter. Cubist Systematic Strategies LLC purchased a new position in shares of Ceragon Networks during the 2nd quarter valued at $56,000. WINTON GROUP Ltd purchased a new position in shares of Ceragon Networks during the 2nd quarter valued at $26,000. Finally, Sei Investments Co. grew its position in shares of Ceragon Networks by 45.7% during the 2nd quarter. Sei Investments Co. now owns 27,423 shares of the communications equipment provider's stock valued at $69,000 after purchasing an additional 8,607 shares in the last quarter. 13.31% of the stock is currently owned by hedge funds and other institutional investors.

Ceragon Networks Company Profile

(

Get Free Report)

Ceragon Networks Ltd., together with its subsidiaries, provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America. The company's solutions use microwave and millimeter wave radio technology to transfer telecommunication traffic between base stations, small/distributed cells, and the service provider's network.

Featured Stories

Before you consider Ceragon Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ceragon Networks wasn't on the list.

While Ceragon Networks currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.