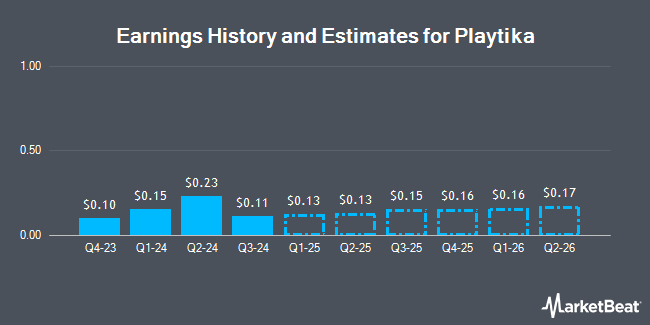

Playtika Holding Corp. (NASDAQ:PLTK - Free Report) - Equities research analysts at Roth Capital cut their Q4 2024 earnings per share estimates for shares of Playtika in a report released on Friday, November 8th. Roth Capital analyst E. Handler now anticipates that the company will earn $0.14 per share for the quarter, down from their prior forecast of $0.16. The consensus estimate for Playtika's current full-year earnings is $0.71 per share.

Playtika (NASDAQ:PLTK - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported $0.11 EPS for the quarter, missing analysts' consensus estimates of $0.18 by ($0.07). Playtika had a negative return on equity of 129.21% and a net margin of 8.52%. The company had revenue of $620.80 million for the quarter, compared to the consensus estimate of $622.46 million. During the same quarter in the previous year, the company earned $0.19 earnings per share. Playtika's quarterly revenue was down 1.5% compared to the same quarter last year.

A number of other research analysts have also issued reports on the company. Roth Mkm boosted their price target on Playtika from $8.00 to $9.00 and gave the stock a "neutral" rating in a research report on Friday. Macquarie reiterated a "neutral" rating and set a $7.00 price target on shares of Playtika in a research report on Friday. Wedbush reiterated an "outperform" rating and set a $11.50 price target on shares of Playtika in a research report on Thursday, September 19th. Finally, Morgan Stanley boosted their price target on Playtika from $7.40 to $8.25 and gave the stock an "equal weight" rating in a research report on Tuesday, July 23rd. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $9.18.

Read Our Latest Stock Report on PLTK

Playtika Stock Up 1.2 %

PLTK stock traded up $0.10 during trading on Monday, reaching $8.41. 767,083 shares of the company's stock were exchanged, compared to its average volume of 863,516. Playtika has a 1-year low of $6.25 and a 1-year high of $9.23. The company's fifty day moving average price is $7.71 and its 200-day moving average price is $7.82. The firm has a market cap of $3.13 billion, a PE ratio of 14.45, a P/E/G ratio of 1.72 and a beta of 0.85.

Playtika Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Stockholders of record on Friday, December 20th will be issued a dividend of $0.10 per share. This represents a $0.40 annualized dividend and a dividend yield of 4.76%. The ex-dividend date is Friday, December 20th. Playtika's dividend payout ratio is 68.97%.

Institutional Investors Weigh In On Playtika

Several hedge funds have recently modified their holdings of the stock. Banque Cantonale Vaudoise lifted its holdings in shares of Playtika by 142.9% during the third quarter. Banque Cantonale Vaudoise now owns 29,875 shares of the company's stock valued at $237,000 after purchasing an additional 17,574 shares during the last quarter. Quest Partners LLC raised its position in Playtika by 705.5% during the third quarter. Quest Partners LLC now owns 161,249 shares of the company's stock valued at $1,277,000 after buying an additional 141,231 shares during the period. KBC Group NV raised its position in Playtika by 19.3% during the third quarter. KBC Group NV now owns 7,820 shares of the company's stock valued at $62,000 after buying an additional 1,266 shares during the period. MQS Management LLC acquired a new position in Playtika during the third quarter valued at $135,000. Finally, Capital Performance Advisors LLP acquired a new position in Playtika during the third quarter valued at $62,000. 11.94% of the stock is owned by hedge funds and other institutional investors.

Playtika Company Profile

(

Get Free Report)

Playtika Holding Corp., together with its subsidiaries, develops mobile games in the United States, Europe, Middle East, Africa, Asia pacific, and internationally. The company owns a portfolio of casual and social casino-themed games. It distributes its games to the end customer through various web and mobile platforms and direct-to-consumer platforms.

Featured Articles

Before you consider Playtika, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Playtika wasn't on the list.

While Playtika currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.