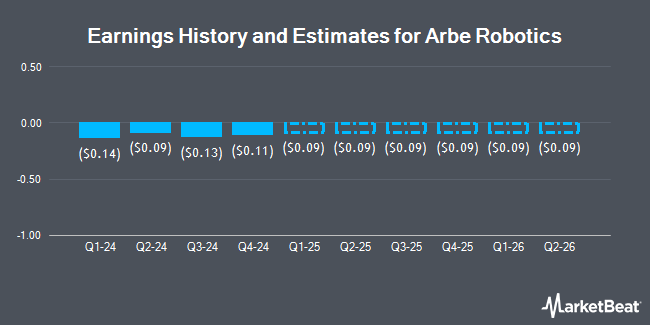

Arbe Robotics Ltd. (NASDAQ:ARBE - Free Report) - Roth Capital issued their Q1 2026 earnings per share estimates for shares of Arbe Robotics in a research report issued to clients and investors on Sunday, January 12th. Roth Capital analyst S. Desilva forecasts that the company will post earnings of ($0.09) per share for the quarter. The consensus estimate for Arbe Robotics' current full-year earnings is ($0.58) per share. Roth Capital also issued estimates for Arbe Robotics' Q2 2026 earnings at ($0.09) EPS, Q3 2026 earnings at ($0.09) EPS, Q4 2026 earnings at ($0.09) EPS and FY2026 earnings at ($0.35) EPS.

Separately, Maxim Group cut their price objective on Arbe Robotics from $4.00 to $3.00 and set a "buy" rating for the company in a research report on Friday, November 29th.

Check Out Our Latest Research Report on Arbe Robotics

Arbe Robotics Stock Performance

NASDAQ ARBE traded up $0.20 on Tuesday, reaching $3.00. The company's stock had a trading volume of 15,911,998 shares, compared to its average volume of 40,855,813. The firm's 50 day moving average is $1.99 and its two-hundred day moving average is $2.01. The stock has a market cap of $242.18 million, a PE ratio of -4.05 and a beta of -0.04. Arbe Robotics has a twelve month low of $1.39 and a twelve month high of $5.09.

Hedge Funds Weigh In On Arbe Robotics

A hedge fund recently raised its stake in Arbe Robotics stock. Ground Swell Capital LLC boosted its holdings in shares of Arbe Robotics Ltd. (NASDAQ:ARBE - Free Report) by 114.8% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 38,024 shares of the company's stock after buying an additional 20,324 shares during the period. Ground Swell Capital LLC's holdings in Arbe Robotics were worth $73,000 as of its most recent filing with the Securities and Exchange Commission. Hedge funds and other institutional investors own 33.42% of the company's stock.

About Arbe Robotics

(

Get Free Report)

Arbe Robotics Ltd., a semiconductor company, provides 4D imaging radar solutions for tier 1 automotive suppliers and automotive manufacturers in China, Hong Kong, Sweden, Germany, the United States, Israel, and internationally. It offers 4D imaging radar chipset solutions that address the core issues that have caused autonomous vehicle and autopilot accidents, such as detecting stationary objects, identifying vulnerable road users, operation at poor lighting conditions, and eliminating false alarms without radar ambiguities.

Recommended Stories

Before you consider Arbe Robotics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arbe Robotics wasn't on the list.

While Arbe Robotics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.