Roth Mkm assumed coverage on shares of Core Scientific (NASDAQ:CORZ - Free Report) in a research note released on Friday, Marketbeat reports. The brokerage issued a buy rating and a $25.50 price target on the stock.

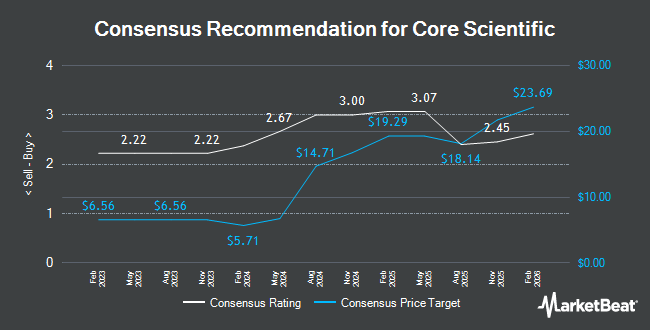

Several other brokerages have also recently commented on CORZ. Compass Point lifted their price objective on shares of Core Scientific from $18.00 to $20.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. HC Wainwright upped their price target on shares of Core Scientific from $15.00 to $17.00 and gave the company a "buy" rating in a report on Thursday, November 7th. Canaccord Genuity Group reaffirmed a "buy" rating and set a $17.00 price target on shares of Core Scientific in a research report on Thursday, November 7th. Canaccord Genuity Group began coverage on Core Scientific in a report on Monday, September 23rd. They issued a "buy" rating and a $16.00 price objective for the company. Finally, Jefferies Financial Group assumed coverage on Core Scientific in a report on Monday, October 28th. They set a "buy" rating and a $19.00 target price on the stock. Thirteen research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock presently has a consensus rating of "Buy" and an average price target of $18.38.

Get Our Latest Research Report on CORZ

Core Scientific Price Performance

Shares of NASDAQ:CORZ remained flat at $15.44 during trading on Friday. The stock had a trading volume of 4,050,303 shares, compared to its average volume of 8,872,985. Core Scientific has a 1 year low of $2.61 and a 1 year high of $18.03. The firm has a market capitalization of $4.31 billion and a PE ratio of -2.84. The business's 50-day moving average price is $12.76 and its 200-day moving average price is $9.72.

Insider Activity at Core Scientific

In other news, Director Jarrod M. Patten acquired 5,021 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were bought at an average price of $9.68 per share, for a total transaction of $48,603.28. Following the acquisition, the director now owns 285,760 shares of the company's stock, valued at approximately $2,766,156.80. This trade represents a 1.79 % increase in their position. The acquisition was disclosed in a filing with the SEC, which is available through this hyperlink. In the last quarter, insiders have purchased 12,761 shares of company stock valued at $127,080. 32.00% of the stock is owned by company insiders.

Hedge Funds Weigh In On Core Scientific

A number of institutional investors and hedge funds have recently bought and sold shares of the business. Rush Island Management LP purchased a new position in Core Scientific during the third quarter worth approximately $32,221,000. Point72 Asset Management L.P. grew its stake in shares of Core Scientific by 27.7% in the third quarter. Point72 Asset Management L.P. now owns 579,735 shares of the company's stock valued at $6,876,000 after buying an additional 125,810 shares in the last quarter. Portolan Capital Management LLC purchased a new stake in Core Scientific during the third quarter worth about $6,546,000. Parsifal Capital Management LP increased its stake in Core Scientific by 3.9% during the 3rd quarter. Parsifal Capital Management LP now owns 5,412,825 shares of the company's stock worth $64,196,000 after buying an additional 204,314 shares during the period. Finally, Janus Henderson Group PLC purchased a new stake in shares of Core Scientific during the third quarter worth $706,000.

Core Scientific Company Profile

(

Get Free Report)

Core Scientific, Inc provides digital asset mining services in North America. It operates through two segments, Mining and Hosting. The company offers blockchain infrastructure, software solutions, and services; and operates data center mining facilities. It also mines digital assets for its own account; and provides hosting services for other large bitcoin miners, which include deployment, monitoring, trouble shooting, optimization, and maintenance of its customers' digital asset mining equipment.

Featured Articles

Before you consider Core Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Scientific wasn't on the list.

While Core Scientific currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.