United Natural Foods (NYSE:UNFI - Free Report) had its price target lifted by Roth Mkm from $20.00 to $26.00 in a research report report published on Thursday,Benzinga reports. The brokerage currently has a neutral rating on the stock.

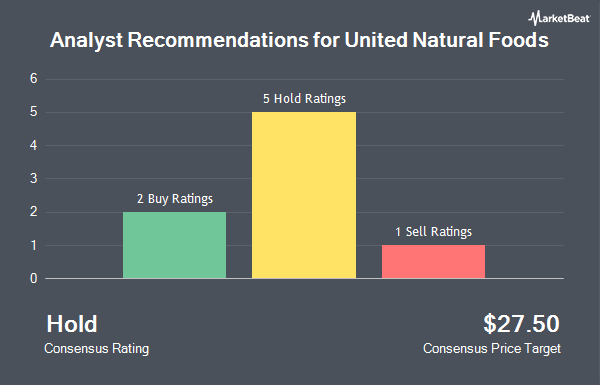

Several other brokerages have also weighed in on UNFI. BMO Capital Markets increased their price objective on United Natural Foods from $23.00 to $32.00 and gave the stock a "market perform" rating in a research report on Wednesday. Northcoast Research upgraded United Natural Foods from a "neutral" rating to a "buy" rating in a research report on Friday, October 11th. The Goldman Sachs Group lifted their target price on United Natural Foods from $15.00 to $22.00 and gave the company a "neutral" rating in a report on Monday, October 7th. Finally, UBS Group raised their price target on United Natural Foods from $16.00 to $21.00 and gave the company a "neutral" rating in a research note on Wednesday, October 2nd. One analyst has rated the stock with a sell rating, six have assigned a hold rating and one has given a buy rating to the stock. According to MarketBeat, United Natural Foods currently has a consensus rating of "Hold" and a consensus price target of $22.60.

Read Our Latest Stock Analysis on United Natural Foods

United Natural Foods Stock Performance

United Natural Foods stock traded up $0.38 during trading hours on Thursday, hitting $28.46. 711,309 shares of the stock traded hands, compared to its average volume of 694,102. The company has a debt-to-equity ratio of 1.28, a current ratio of 1.44 and a quick ratio of 0.52. The firm's 50 day moving average price is $22.07 and its 200-day moving average price is $16.92. The stock has a market capitalization of $1.71 billion, a price-to-earnings ratio of -18.13 and a beta of 0.64. United Natural Foods has a 1 year low of $8.58 and a 1 year high of $32.20.

United Natural Foods (NYSE:UNFI - Get Free Report) last issued its earnings results on Tuesday, December 10th. The company reported $0.16 EPS for the quarter, topping analysts' consensus estimates of ($0.02) by $0.18. The firm had revenue of $7.90 billion for the quarter, compared to the consensus estimate of $7.61 billion. United Natural Foods had a positive return on equity of 0.54% and a negative net margin of 0.36%. The company's revenue was up 4.6% compared to the same quarter last year. During the same quarter in the prior year, the business earned ($0.04) earnings per share. As a group, equities analysts expect that United Natural Foods will post 0.64 EPS for the current fiscal year.

Insider Buying and Selling at United Natural Foods

In related news, insider Danielle Benedict sold 9,050 shares of the firm's stock in a transaction that occurred on Thursday, October 17th. The shares were sold at an average price of $22.10, for a total value of $200,005.00. Following the transaction, the insider now owns 88,218 shares in the company, valued at approximately $1,949,617.80. This trade represents a 9.30 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. 2.10% of the stock is owned by company insiders.

Institutional Trading of United Natural Foods

Large investors have recently bought and sold shares of the company. CWM LLC increased its holdings in United Natural Foods by 661.8% in the second quarter. CWM LLC now owns 3,314 shares of the company's stock valued at $43,000 after buying an additional 2,879 shares during the last quarter. SummerHaven Investment Management LLC raised its position in shares of United Natural Foods by 3.6% during the 2nd quarter. SummerHaven Investment Management LLC now owns 37,235 shares of the company's stock valued at $488,000 after acquiring an additional 1,303 shares in the last quarter. Keynote Financial Services LLC lifted its stake in United Natural Foods by 6.6% during the second quarter. Keynote Financial Services LLC now owns 17,517 shares of the company's stock worth $229,000 after purchasing an additional 1,091 shares during the last quarter. Bfsg LLC boosted its holdings in United Natural Foods by 27.8% in the second quarter. Bfsg LLC now owns 13,214 shares of the company's stock worth $173,000 after purchasing an additional 2,874 shares during the period. Finally, Panagora Asset Management Inc. raised its holdings in shares of United Natural Foods by 4.0% during the second quarter. Panagora Asset Management Inc. now owns 343,052 shares of the company's stock worth $4,494,000 after purchasing an additional 13,165 shares during the period. Institutional investors and hedge funds own 87.63% of the company's stock.

United Natural Foods Company Profile

(

Get Free Report)

United Natural Foods, Inc, together with its subsidiaries, distributes natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada. It operates in two segments, Wholesale and Retail. The company offers grocery and general merchandise, produce, perishables and frozen foods, wellness and personal care items, and bulk and foodservice products.

See Also

Before you consider United Natural Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Natural Foods wasn't on the list.

While United Natural Foods currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.