Equities research analysts at Royal Bank of Canada assumed coverage on shares of Exact Sciences (NASDAQ:EXAS - Get Free Report) in a report released on Thursday,Briefing.com Automated Import reports. The brokerage set a "sector perform" rating and a $52.00 price target on the medical research company's stock. Royal Bank of Canada's price objective suggests a potential upside of 12.19% from the stock's current price.

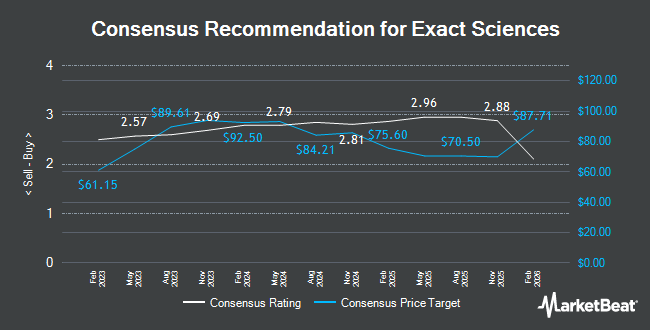

Several other research firms have also commented on EXAS. TD Cowen raised their target price on shares of Exact Sciences from $82.00 to $86.00 and gave the company a "buy" rating in a report on Tuesday, November 26th. Piper Sandler lowered their price objective on shares of Exact Sciences from $75.00 to $70.00 and set an "overweight" rating for the company in a research report on Wednesday, February 26th. Benchmark restated a "buy" rating and set a $65.00 target price on shares of Exact Sciences in a research note on Monday, January 13th. Bank of America decreased their price target on Exact Sciences from $72.00 to $65.00 and set a "buy" rating on the stock in a research note on Thursday, February 20th. Finally, BTIG Research upped their price objective on Exact Sciences from $65.00 to $75.00 and gave the stock a "buy" rating in a research report on Tuesday, November 26th. Two research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $70.83.

Get Our Latest Analysis on Exact Sciences

Exact Sciences Trading Up 1.0 %

Shares of EXAS stock opened at $46.35 on Thursday. The stock has a 50 day simple moving average of $52.26 and a 200 day simple moving average of $59.06. Exact Sciences has a 1 year low of $40.62 and a 1 year high of $79.62. The company has a current ratio of 2.15, a quick ratio of 1.93 and a debt-to-equity ratio of 0.97. The stock has a market cap of $8.61 billion, a P/E ratio of -8.32 and a beta of 1.25.

Exact Sciences (NASDAQ:EXAS - Get Free Report) last released its earnings results on Wednesday, February 19th. The medical research company reported ($0.06) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.29) by $0.23. The company had revenue of $713.42 million for the quarter, compared to analyst estimates of $701.45 million. Exact Sciences had a negative return on equity of 5.29% and a negative net margin of 37.29%. On average, research analysts predict that Exact Sciences will post -0.58 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Exact Sciences

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Perigon Wealth Management LLC boosted its holdings in Exact Sciences by 3.2% in the fourth quarter. Perigon Wealth Management LLC now owns 8,436 shares of the medical research company's stock valued at $474,000 after acquiring an additional 264 shares during the last quarter. Sanctuary Advisors LLC lifted its position in shares of Exact Sciences by 2.0% in the 4th quarter. Sanctuary Advisors LLC now owns 13,625 shares of the medical research company's stock worth $763,000 after purchasing an additional 269 shares during the period. Daiwa Securities Group Inc. boosted its stake in shares of Exact Sciences by 2.1% in the 4th quarter. Daiwa Securities Group Inc. now owns 14,447 shares of the medical research company's stock valued at $812,000 after purchasing an additional 300 shares during the last quarter. Huntington National Bank increased its position in shares of Exact Sciences by 838.1% during the third quarter. Huntington National Bank now owns 394 shares of the medical research company's stock worth $27,000 after buying an additional 352 shares during the period. Finally, CIBC Asset Management Inc raised its stake in Exact Sciences by 6.1% during the third quarter. CIBC Asset Management Inc now owns 6,489 shares of the medical research company's stock worth $442,000 after buying an additional 371 shares during the last quarter. Institutional investors and hedge funds own 88.82% of the company's stock.

Exact Sciences Company Profile

(

Get Free Report)

Exact Sciences Corporation provides cancer screening and diagnostic test products in the United States and internationally. The company offers Cologuard, a non-invasive stool-based DNA screening test to detect DNA and hemoglobin biomarkers associated with colorectal cancer and pre-cancer. It also provides Oncotype DX Breast Recurrence Score Test; Oncotype DX Breast DCIS Score Test; Oncotype DX Colon Recurrence Score Test; OncoExTra Test for tumor profiling for patients with advanced, metastatic, refractory, relapsed, or recurrent cancer; and Covid-19 testing services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Exact Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exact Sciences wasn't on the list.

While Exact Sciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.