Huntsman (NYSE:HUN - Get Free Report) had its price target dropped by equities researchers at Royal Bank of Canada from $23.00 to $20.00 in a report issued on Thursday,Benzinga reports. The firm currently has a "sector perform" rating on the basic materials company's stock. Royal Bank of Canada's target price indicates a potential upside of 11.86% from the stock's current price.

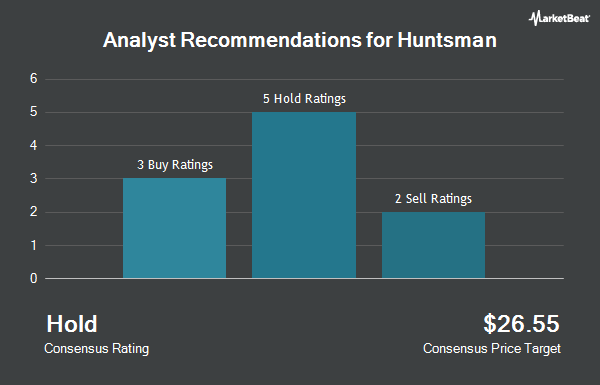

A number of other equities analysts also recently weighed in on HUN. UBS Group reduced their price target on Huntsman from $24.00 to $23.00 and set a "neutral" rating for the company in a research report on Tuesday, November 5th. Wells Fargo & Company decreased their target price on shares of Huntsman from $26.00 to $25.00 and set an "overweight" rating for the company in a research report on Wednesday, November 6th. Finally, Citigroup cut their price target on shares of Huntsman from $22.00 to $19.00 and set a "neutral" rating on the stock in a research report on Wednesday. One research analyst has rated the stock with a sell rating, three have given a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $24.14.

Read Our Latest Report on Huntsman

Huntsman Stock Down 2.3 %

Shares of Huntsman stock traded down $0.42 on Thursday, hitting $17.88. The company had a trading volume of 3,097,925 shares, compared to its average volume of 1,942,932. The stock has a 50-day moving average of $20.85 and a 200-day moving average of $21.98. The company has a debt-to-equity ratio of 0.45, a current ratio of 1.47 and a quick ratio of 0.83. Huntsman has a twelve month low of $17.67 and a twelve month high of $27.01. The firm has a market capitalization of $3.09 billion, a P/E ratio of -25.91 and a beta of 0.97.

Huntsman (NYSE:HUN - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The basic materials company reported $0.10 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.10. The firm had revenue of $1.54 billion for the quarter, compared to the consensus estimate of $1.55 billion. Huntsman had a negative return on equity of 0.03% and a negative net margin of 1.99%. The company's revenue for the quarter was up 2.3% on a year-over-year basis. During the same quarter last year, the business posted $0.15 EPS. Research analysts predict that Huntsman will post 0.09 earnings per share for the current year.

Insider Activity

In related news, Director Mary C. Beckerle sold 20,201 shares of the business's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $21.42, for a total transaction of $432,705.42. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 5.60% of the stock is owned by insiders.

Hedge Funds Weigh In On Huntsman

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in HUN. Matrix Trust Co acquired a new stake in shares of Huntsman during the 3rd quarter worth about $25,000. True Wealth Design LLC bought a new position in Huntsman in the 3rd quarter valued at about $62,000. nVerses Capital LLC lifted its position in Huntsman by 1,250.0% during the second quarter. nVerses Capital LLC now owns 2,700 shares of the basic materials company's stock worth $61,000 after acquiring an additional 2,500 shares during the last quarter. Innealta Capital LLC bought a new stake in shares of Huntsman during the second quarter worth approximately $65,000. Finally, Capital Performance Advisors LLP acquired a new position in shares of Huntsman in the third quarter valued at approximately $78,000. 84.81% of the stock is owned by institutional investors.

Huntsman Company Profile

(

Get Free Report)

Huntsman Corporation manufactures and sells diversified organic chemical products worldwide. The company operates in three segments: Polyurethanes, Performance Products, and Advanced Materials. The Polyurethanes segment offers polyurethane chemicals, including methyl diphenyl diisocyanate, polyether and polyester polyols, and thermoplastic polyurethane; and aniline, benzene, nitrobenzene and other co-products.

See Also

Before you consider Huntsman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntsman wasn't on the list.

While Huntsman currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.