Chipotle Mexican Grill (NYSE:CMG - Get Free Report) had its price objective raised by stock analysts at Royal Bank of Canada from $70.00 to $75.00 in a report released on Tuesday,Benzinga reports. The brokerage presently has an "outperform" rating on the restaurant operator's stock. Royal Bank of Canada's price objective would suggest a potential upside of 16.70% from the stock's current price.

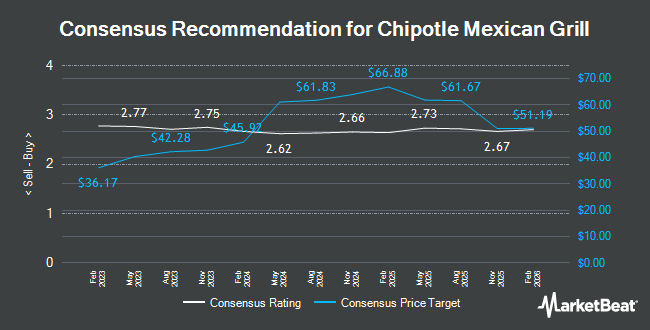

Other research analysts have also issued reports about the stock. TD Cowen lifted their price target on shares of Chipotle Mexican Grill from $65.00 to $68.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Evercore ISI raised their target price on shares of Chipotle Mexican Grill from $70.00 to $72.00 and gave the stock an "outperform" rating in a report on Thursday, December 5th. Barclays upped their target price on Chipotle Mexican Grill from $55.00 to $60.00 and gave the company an "equal weight" rating in a report on Wednesday, October 30th. BMO Capital Markets raised their price target on Chipotle Mexican Grill from $55.00 to $56.00 and gave the stock a "market perform" rating in a report on Wednesday, October 30th. Finally, Citigroup lowered their price objective on Chipotle Mexican Grill from $71.00 to $70.00 and set a "buy" rating for the company in a research note on Wednesday, October 30th. Ten equities research analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the company. Based on data from MarketBeat.com, Chipotle Mexican Grill currently has a consensus rating of "Moderate Buy" and an average price target of $66.55.

Read Our Latest Stock Report on CMG

Chipotle Mexican Grill Price Performance

NYSE:CMG traded down $0.53 during mid-day trading on Tuesday, reaching $64.27. The stock had a trading volume of 7,543,329 shares, compared to its average volume of 13,372,647. The company has a market capitalization of $87.57 billion, a price-to-earnings ratio of 60.07, a price-to-earnings-growth ratio of 2.64 and a beta of 1.27. Chipotle Mexican Grill has a 1-year low of $44.08 and a 1-year high of $69.26. The stock's 50 day simple moving average is $60.49 and its two-hundred day simple moving average is $81.22.

Chipotle Mexican Grill (NYSE:CMG - Get Free Report) last issued its earnings results on Tuesday, October 29th. The restaurant operator reported $0.27 EPS for the quarter, topping the consensus estimate of $0.25 by $0.02. Chipotle Mexican Grill had a return on equity of 43.20% and a net margin of 13.51%. The company had revenue of $2.79 billion during the quarter, compared to analyst estimates of $2.82 billion. During the same quarter last year, the firm earned $0.23 EPS. The business's revenue was up 13.0% on a year-over-year basis. Sell-side analysts anticipate that Chipotle Mexican Grill will post 1.11 EPS for the current fiscal year.

Insider Activity at Chipotle Mexican Grill

In other Chipotle Mexican Grill news, insider Laurie Schalow sold 4,404 shares of the company's stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of $65.01, for a total transaction of $286,304.04. Following the completion of the sale, the insider now directly owns 185,792 shares of the company's stock, valued at approximately $12,078,337.92. This represents a 2.32 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Curtis E. Garner sold 15,750 shares of Chipotle Mexican Grill stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $57.05, for a total transaction of $898,537.50. Following the completion of the transaction, the insider now directly owns 457,764 shares in the company, valued at approximately $26,115,436.20. This trade represents a 3.33 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.02% of the company's stock.

Hedge Funds Weigh In On Chipotle Mexican Grill

Several institutional investors and hedge funds have recently bought and sold shares of the business. B. Riley Wealth Advisors Inc. boosted its position in Chipotle Mexican Grill by 22.8% during the third quarter. B. Riley Wealth Advisors Inc. now owns 156,250 shares of the restaurant operator's stock valued at $8,921,000 after purchasing an additional 29,018 shares during the last quarter. 1ST Source Bank raised its stake in shares of Chipotle Mexican Grill by 4.1% during the 3rd quarter. 1ST Source Bank now owns 40,800 shares of the restaurant operator's stock worth $2,351,000 after purchasing an additional 1,600 shares in the last quarter. Garden State Investment Advisory Services LLC lifted its holdings in shares of Chipotle Mexican Grill by 31.9% during the 3rd quarter. Garden State Investment Advisory Services LLC now owns 5,052 shares of the restaurant operator's stock valued at $291,000 after buying an additional 1,222 shares during the last quarter. FFG Partners LLC grew its stake in shares of Chipotle Mexican Grill by 4,032.6% in the 3rd quarter. FFG Partners LLC now owns 144,640 shares of the restaurant operator's stock valued at $8,334,000 after buying an additional 141,140 shares in the last quarter. Finally, Retirement Systems of Alabama increased its holdings in Chipotle Mexican Grill by 29.8% in the third quarter. Retirement Systems of Alabama now owns 1,196,083 shares of the restaurant operator's stock worth $68,918,000 after buying an additional 274,533 shares during the last quarter. Hedge funds and other institutional investors own 91.31% of the company's stock.

About Chipotle Mexican Grill

(

Get Free Report)

Chipotle Mexican Grill, Inc, together with its subsidiaries, owns and operates Chipotle Mexican Grill restaurants. It sells food and beverages through offering burritos, burrito bowls, quesadillas, tacos, and salads. The company also provides delivery and related services its app and website. It has operations in the United States, Canada, France, Germany, and the United Kingdom.

Read More

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.