DoubleVerify (NYSE:DV - Get Free Report) had its target price dropped by stock analysts at Royal Bank of Canada from $27.00 to $22.00 in a note issued to investors on Thursday,Benzinga reports. The brokerage currently has an "outperform" rating on the stock. Royal Bank of Canada's target price suggests a potential upside of 11.59% from the stock's previous close.

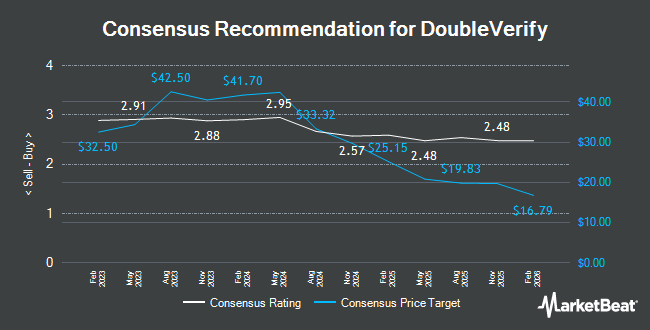

Other equities research analysts also recently issued research reports about the company. JMP Securities decreased their price target on DoubleVerify from $34.00 to $33.00 and set a "market outperform" rating for the company in a report on Wednesday, October 23rd. Stifel Nicolaus lowered their target price on shares of DoubleVerify from $25.00 to $22.00 and set a "buy" rating for the company in a report on Monday, October 14th. Macquarie cut their price target on shares of DoubleVerify from $25.00 to $19.00 and set an "outperform" rating on the stock in a report on Friday, October 11th. Wells Fargo & Company initiated coverage on shares of DoubleVerify in a research note on Monday, October 28th. They issued an "underweight" rating and a $14.00 price objective for the company. Finally, The Goldman Sachs Group cut their target price on DoubleVerify from $28.00 to $25.00 and set a "buy" rating on the stock in a research note on Monday, October 14th. Two research analysts have rated the stock with a sell rating, five have issued a hold rating and twelve have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $24.47.

View Our Latest Research Report on DoubleVerify

DoubleVerify Trading Up 0.8 %

Shares of DV traded up $0.16 during trading hours on Thursday, reaching $19.72. The stock had a trading volume of 5,259,088 shares, compared to its average volume of 2,369,863. The firm has a 50-day simple moving average of $17.54 and a 200 day simple moving average of $19.59. DoubleVerify has a 12 month low of $16.11 and a 12 month high of $43.00. The company has a market capitalization of $3.35 billion, a price-to-earnings ratio of 56.66, a P/E/G ratio of 2.44 and a beta of 0.90.

DoubleVerify (NYSE:DV - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.10 earnings per share for the quarter, beating the consensus estimate of $0.07 by $0.03. The business had revenue of $169.56 million for the quarter, compared to analysts' expectations of $168.93 million. DoubleVerify had a net margin of 9.97% and a return on equity of 5.70%. On average, equities analysts forecast that DoubleVerify will post 0.3 EPS for the current year.

DoubleVerify declared that its board has approved a share buyback program on Wednesday, November 6th that authorizes the company to repurchase $200.00 million in shares. This repurchase authorization authorizes the company to repurchase up to 6% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's board of directors believes its shares are undervalued.

Insider Activity

In related news, CFO Nicola T. Allais sold 1,764 shares of the stock in a transaction dated Friday, September 27th. The stock was sold at an average price of $17.28, for a total transaction of $30,481.92. Following the sale, the chief financial officer now owns 81,598 shares of the company's stock, valued at approximately $1,410,013.44. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Over the last three months, insiders sold 7,056 shares of company stock worth $119,634. 3.00% of the stock is owned by corporate insiders.

Institutional Trading of DoubleVerify

Several institutional investors and hedge funds have recently bought and sold shares of the company. United Services Automobile Association increased its holdings in shares of DoubleVerify by 7.4% in the second quarter. United Services Automobile Association now owns 10,798 shares of the company's stock worth $210,000 after purchasing an additional 746 shares during the period. Whittier Trust Co. bought a new position in DoubleVerify in the 1st quarter worth about $28,000. Arizona State Retirement System raised its holdings in shares of DoubleVerify by 2.3% in the 2nd quarter. Arizona State Retirement System now owns 40,751 shares of the company's stock valued at $793,000 after acquiring an additional 927 shares in the last quarter. Gagnon Securities LLC boosted its holdings in shares of DoubleVerify by 1.2% during the first quarter. Gagnon Securities LLC now owns 86,018 shares of the company's stock worth $3,024,000 after purchasing an additional 1,045 shares during the period. Finally, The Manufacturers Life Insurance Company grew its stake in shares of DoubleVerify by 3.7% in the second quarter. The Manufacturers Life Insurance Company now owns 34,040 shares of the company's stock worth $663,000 after purchasing an additional 1,218 shares during the last quarter. 97.29% of the stock is currently owned by hedge funds and other institutional investors.

About DoubleVerify

(

Get Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Featured Articles

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.