Northern Oil and Gas (NYSE:NOG - Free Report) had its target price cut by Royal Bank of Canada from $45.00 to $40.00 in a research report sent to investors on Thursday,Benzinga reports. They currently have a sector perform rating on the stock.

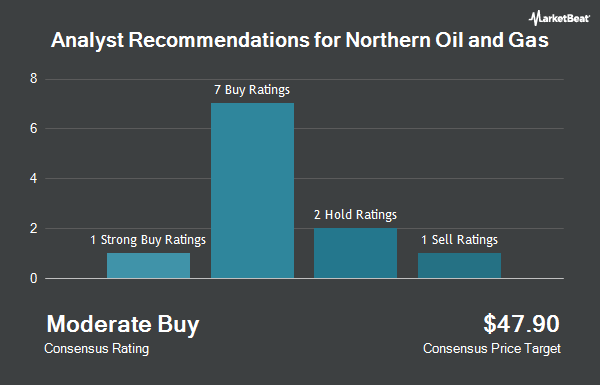

A number of other brokerages also recently issued reports on NOG. Truist Financial upped their price target on Northern Oil and Gas from $52.00 to $55.00 and gave the company a "buy" rating in a report on Monday, January 13th. Mizuho lowered Northern Oil and Gas from an "outperform" rating to a "neutral" rating and set a $47.00 price target on the stock. in a research report on Monday, December 16th. Finally, Piper Sandler reduced their price objective on Northern Oil and Gas from $37.00 to $35.00 and set a "neutral" rating for the company in a research note on Wednesday, January 29th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $47.00.

View Our Latest Analysis on NOG

Northern Oil and Gas Stock Up 1.8 %

Shares of NOG traded up $0.61 during midday trading on Thursday, hitting $35.12. The company had a trading volume of 1,307,240 shares, compared to its average volume of 1,433,516. Northern Oil and Gas has a 1 year low of $33.05 and a 1 year high of $44.31. The company's 50-day simple moving average is $38.07 and its 200-day simple moving average is $38.41. The company has a debt-to-equity ratio of 0.84, a quick ratio of 1.23 and a current ratio of 1.23. The firm has a market capitalization of $3.51 billion, a P/E ratio of 4.22 and a beta of 1.81.

Northern Oil and Gas Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 30th. Shareholders of record on Friday, March 28th will be given a dividend of $0.45 per share. The ex-dividend date of this dividend is Friday, March 28th. This represents a $1.80 dividend on an annualized basis and a yield of 5.13%. This is an increase from Northern Oil and Gas's previous quarterly dividend of $0.42. Northern Oil and Gas's dividend payout ratio is presently 21.61%.

Insider Transactions at Northern Oil and Gas

In related news, President Adam A. Dirlam sold 836 shares of Northern Oil and Gas stock in a transaction that occurred on Monday, January 6th. The stock was sold at an average price of $39.00, for a total value of $32,604.00. Following the sale, the president now directly owns 96,223 shares in the company, valued at $3,752,697. The trade was a 0.86 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Company insiders own 2.80% of the company's stock.

Institutional Investors Weigh In On Northern Oil and Gas

A number of hedge funds and other institutional investors have recently modified their holdings of NOG. Avior Wealth Management LLC grew its position in Northern Oil and Gas by 23.3% in the 4th quarter. Avior Wealth Management LLC now owns 1,372 shares of the company's stock worth $51,000 after purchasing an additional 259 shares during the last quarter. First Horizon Advisors Inc. lifted its stake in shares of Northern Oil and Gas by 9.1% in the fourth quarter. First Horizon Advisors Inc. now owns 3,473 shares of the company's stock valued at $129,000 after buying an additional 289 shares during the period. Avantax Advisory Services Inc. grew its position in Northern Oil and Gas by 2.3% during the fourth quarter. Avantax Advisory Services Inc. now owns 13,112 shares of the company's stock worth $487,000 after buying an additional 298 shares in the last quarter. Ameritas Investment Partners Inc. lifted its position in Northern Oil and Gas by 3.3% in the fourth quarter. Ameritas Investment Partners Inc. now owns 10,378 shares of the company's stock worth $386,000 after purchasing an additional 329 shares during the period. Finally, Legato Capital Management LLC lifted its position in Northern Oil and Gas by 5.8% in the fourth quarter. Legato Capital Management LLC now owns 6,383 shares of the company's stock worth $237,000 after purchasing an additional 349 shares during the period. 98.80% of the stock is currently owned by institutional investors and hedge funds.

About Northern Oil and Gas

(

Get Free Report)

Northern Oil and Gas, Inc, an independent energy company, engages in the acquisition, exploration, exploitation, development, and production of crude oil and natural gas properties in the United States. It primarily holds interests in the Williston Basin, the Appalachian Basin, and the Permian Basin in the United States.

Read More

Before you consider Northern Oil and Gas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northern Oil and Gas wasn't on the list.

While Northern Oil and Gas currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.