Sun Communities (NYSE:SUI - Get Free Report) had its target price dropped by equities researchers at Royal Bank of Canada from $147.00 to $135.00 in a report issued on Thursday,Benzinga reports. The brokerage currently has an "outperform" rating on the real estate investment trust's stock. Royal Bank of Canada's target price would indicate a potential upside of 9.89% from the stock's previous close.

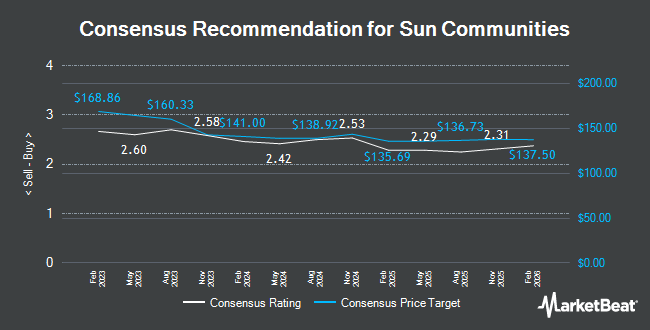

SUI has been the topic of several other research reports. Evercore ISI lifted their price objective on shares of Sun Communities from $149.00 to $150.00 and gave the stock an "in-line" rating in a research note on Monday, October 21st. StockNews.com lowered Sun Communities from a "hold" rating to a "sell" rating in a report on Friday, October 18th. Truist Financial increased their price target on Sun Communities from $127.00 to $138.00 and gave the stock a "hold" rating in a report on Tuesday, August 13th. BMO Capital Markets decreased their price objective on Sun Communities from $145.00 to $138.00 and set an "outperform" rating for the company in a research report on Thursday. Finally, UBS Group raised Sun Communities to a "strong-buy" rating in a research note on Thursday, October 10th. One research analyst has rated the stock with a sell rating, six have assigned a hold rating, five have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $141.82.

View Our Latest Report on Sun Communities

Sun Communities Trading Down 6.8 %

NYSE SUI traded down $8.91 during trading hours on Thursday, hitting $122.85. The company's stock had a trading volume of 3,296,305 shares, compared to its average volume of 817,802. Sun Communities has a twelve month low of $110.98 and a twelve month high of $147.83. The company has a quick ratio of 1.42, a current ratio of 1.42 and a debt-to-equity ratio of 1.09. The firm has a market capitalization of $15.32 billion, a P/E ratio of 141.28, a PEG ratio of 0.95 and a beta of 0.91. The stock has a fifty day moving average of $135.71 and a 200 day moving average of $126.78.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Assetmark Inc. lifted its position in shares of Sun Communities by 2,111.1% during the 3rd quarter. Assetmark Inc. now owns 199 shares of the real estate investment trust's stock worth $27,000 after buying an additional 190 shares during the last quarter. Quest Partners LLC grew its stake in shares of Sun Communities by 12,700.0% in the second quarter. Quest Partners LLC now owns 384 shares of the real estate investment trust's stock worth $46,000 after purchasing an additional 381 shares during the last quarter. 1620 Investment Advisors Inc. bought a new stake in Sun Communities in the second quarter valued at approximately $62,000. Farther Finance Advisors LLC increased its position in shares of Sun Communities by 89.1% during the third quarter. Farther Finance Advisors LLC now owns 501 shares of the real estate investment trust's stock worth $68,000 after buying an additional 236 shares during the period. Finally, Blue Trust Inc. lifted its holdings in Sun Communities by 230.7% in the third quarter. Blue Trust Inc. now owns 625 shares of the real estate investment trust's stock valued at $84,000 after buying an additional 436 shares during the period. 99.59% of the stock is owned by institutional investors and hedge funds.

Sun Communities Company Profile

(

Get Free Report)

Established in 1975, Sun Communities, Inc became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of December 31, 2023, the Company owned, operated, or had an interest in a portfolio of 667 developed MH, RV and Marina properties comprising 179,310 developed sites and approximately 48,030 wet slips and dry storage spaces in the U.S., the UK and Canada.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sun Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Communities wasn't on the list.

While Sun Communities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.