Omega Healthcare Investors (NYSE:OHI - Free Report) had its target price upped by Royal Bank of Canada from $39.00 to $43.00 in a report published on Monday,Benzinga reports. They currently have a sector perform rating on the real estate investment trust's stock.

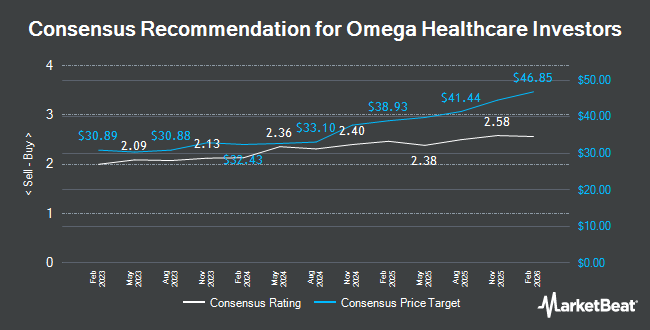

Several other equities research analysts also recently weighed in on the stock. Mizuho downgraded shares of Omega Healthcare Investors from an "outperform" rating to a "neutral" rating and boosted their target price for the stock from $34.00 to $35.00 in a research report on Thursday, July 25th. Berenberg Bank began coverage on shares of Omega Healthcare Investors in a research report on Friday, October 18th. They issued a "buy" rating and a $45.00 target price for the company. Wells Fargo & Company reissued an "overweight" rating and issued a $43.00 target price (up previously from $40.00) on shares of Omega Healthcare Investors in a research report on Tuesday, October 1st. Scotiabank boosted their target price on shares of Omega Healthcare Investors from $33.00 to $39.00 and gave the stock a "sector perform" rating in a research report on Monday, August 26th. Finally, BNP Paribas raised shares of Omega Healthcare Investors from a "neutral" rating to an "outperform" rating and set a $49.00 target price for the company in a research report on Thursday, October 31st. Seven research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $40.00.

Get Our Latest Research Report on OHI

Omega Healthcare Investors Stock Up 0.1 %

Omega Healthcare Investors stock traded up $0.04 during midday trading on Monday, hitting $41.39. 1,825,977 shares of the stock were exchanged, compared to its average volume of 1,670,961. Omega Healthcare Investors has a 1 year low of $27.53 and a 1 year high of $44.42. The firm has a market cap of $11.17 billion, a P/E ratio of 30.43, a P/E/G ratio of 1.33 and a beta of 0.99. The company has a debt-to-equity ratio of 1.10, a current ratio of 6.48 and a quick ratio of 6.48. The company has a 50 day moving average price of $40.59 and a two-hundred day moving average price of $36.40.

Omega Healthcare Investors Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 15th. Stockholders of record on Monday, November 4th will be issued a $0.67 dividend. This represents a $2.68 annualized dividend and a dividend yield of 6.47%. The ex-dividend date is Monday, November 4th. Omega Healthcare Investors's dividend payout ratio (DPR) is presently 197.06%.

Insider Buying and Selling at Omega Healthcare Investors

In other Omega Healthcare Investors news, COO Daniel J. Booth sold 56,725 shares of the business's stock in a transaction dated Friday, September 27th. The shares were sold at an average price of $40.25, for a total transaction of $2,283,181.25. Following the completion of the transaction, the chief operating officer now directly owns 100,000 shares of the company's stock, valued at $4,025,000. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other Omega Healthcare Investors news, COO Daniel J. Booth sold 56,725 shares of the business's stock in a transaction dated Friday, September 27th. The shares were sold at an average price of $40.25, for a total transaction of $2,283,181.25. Following the completion of the transaction, the chief operating officer now directly owns 100,000 shares of the company's stock, valued at $4,025,000. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Robert O. Stephenson sold 22,542 shares of the business's stock in a transaction dated Friday, September 27th. The shares were sold at an average price of $40.19, for a total transaction of $905,962.98. Following the transaction, the chief financial officer now directly owns 183,076 shares of the company's stock, valued at $7,357,824.44. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.37% of the stock is currently owned by company insiders.

Institutional Trading of Omega Healthcare Investors

Institutional investors have recently made changes to their positions in the stock. Versant Capital Management Inc acquired a new stake in shares of Omega Healthcare Investors in the 2nd quarter worth approximately $26,000. UMB Bank n.a. lifted its stake in shares of Omega Healthcare Investors by 353.4% in the 3rd quarter. UMB Bank n.a. now owns 662 shares of the real estate investment trust's stock worth $27,000 after acquiring an additional 516 shares during the period. DiNuzzo Private Wealth Inc. acquired a new stake in shares of Omega Healthcare Investors in the 3rd quarter worth approximately $33,000. V Square Quantitative Management LLC lifted its stake in shares of Omega Healthcare Investors by 49.5% in the 3rd quarter. V Square Quantitative Management LLC now owns 976 shares of the real estate investment trust's stock worth $40,000 after acquiring an additional 323 shares during the period. Finally, Covestor Ltd lifted its stake in shares of Omega Healthcare Investors by 47.6% in the 1st quarter. Covestor Ltd now owns 1,337 shares of the real estate investment trust's stock worth $42,000 after acquiring an additional 431 shares during the period. 65.25% of the stock is owned by institutional investors and hedge funds.

About Omega Healthcare Investors

(

Get Free Report)

Omega is a REIT that invests in the long-term healthcare industry, primarily in skilled nursing and assisted living facilities. Its portfolio of assets is operated by a diverse group of healthcare companies, predominantly in a triple-net lease structure. The assets span all regions within the U.S., as well as in the U.K.

See Also

Before you consider Omega Healthcare Investors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omega Healthcare Investors wasn't on the list.

While Omega Healthcare Investors currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.