Calian Group (TSE:CGY - Get Free Report) had its price objective decreased by research analysts at Royal Bank of Canada from C$65.00 to C$60.00 in a research note issued to investors on Tuesday,BayStreet.CA reports. The firm currently has an "outperform" rating on the stock. Royal Bank of Canada's target price would suggest a potential upside of 26.50% from the stock's previous close.

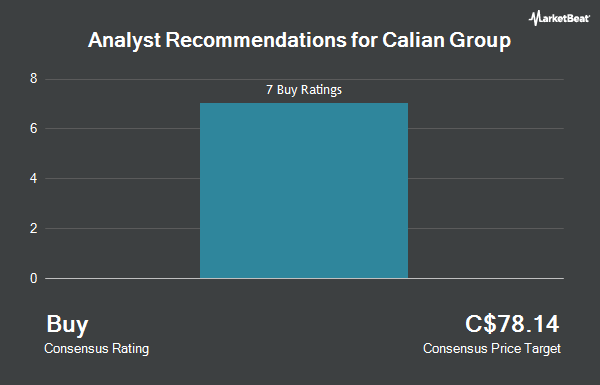

Separately, CIBC reduced their price target on Calian Group from C$63.00 to C$62.00 in a research report on Friday, February 14th. Four investment analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, Calian Group presently has a consensus rating of "Buy" and a consensus target price of C$68.83.

Check Out Our Latest Report on Calian Group

Calian Group Stock Up 3.8 %

Shares of CGY traded up C$1.72 during midday trading on Tuesday, reaching C$47.43. 5,818 shares of the company were exchanged, compared to its average volume of 32,985. Calian Group has a 1-year low of C$39.41 and a 1-year high of C$59.27. The stock has a 50-day moving average price of C$43.20 and a 200-day moving average price of C$46.90. The company has a current ratio of 1.29, a quick ratio of 1.20 and a debt-to-equity ratio of 39.54. The company has a market cap of C$563.04 million, a price-to-earnings ratio of 50.79, a P/E/G ratio of 2.50 and a beta of 0.88.

Insider Activity at Calian Group

In related news, Director Lori O'neill purchased 600 shares of the business's stock in a transaction that occurred on Tuesday, February 18th. The shares were purchased at an average cost of C$44.75 per share, with a total value of C$26,850.00. Following the completion of the acquisition, the director now directly owns 600 shares of the company's stock, valued at approximately C$26,850. The trade was a ∞ increase in their position. 0.63% of the stock is currently owned by company insiders.

About Calian Group

(

Get Free Report)

Calian Group Ltd operates through four segments namely Advanced Technologies, Health, Learning, and Information Technology. It generates maximum revenue from the Health segment. The company serves health, defence, security, aerospace, engineering, AgTech, and IT industries. Its Health segment includes Clinical Services; Nursing Services; Psychological Services and Medical Property Management.

Featured Stories

Before you consider Calian Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calian Group wasn't on the list.

While Calian Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.