Nurix Therapeutics (NASDAQ:NRIX - Get Free Report) had its price target raised by research analysts at Royal Bank of Canada from $26.00 to $27.00 in a research note issued on Wednesday,Benzinga reports. The firm presently has an "outperform" rating on the stock. Royal Bank of Canada's target price would suggest a potential upside of 35.00% from the company's current price.

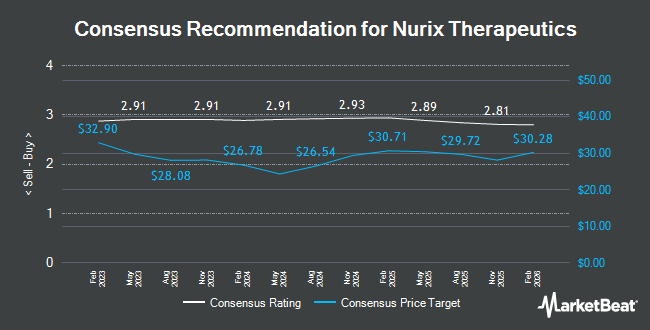

Several other brokerages have also issued reports on NRIX. BMO Capital Markets assumed coverage on Nurix Therapeutics in a research report on Friday, December 6th. They set an "outperform" rating and a $35.00 target price for the company. JPMorgan Chase & Co. cut their price objective on Nurix Therapeutics from $31.00 to $30.00 and set an "overweight" rating on the stock in a research note on Wednesday. Stifel Nicolaus increased their target price on shares of Nurix Therapeutics from $34.00 to $36.00 and gave the company a "buy" rating in a research report on Wednesday. HC Wainwright boosted their price target on shares of Nurix Therapeutics from $35.00 to $36.00 and gave the stock a "buy" rating in a research report on Wednesday. Finally, UBS Group assumed coverage on shares of Nurix Therapeutics in a report on Thursday, October 24th. They issued a "buy" rating and a $35.00 target price on the stock. One equities research analyst has rated the stock with a hold rating and sixteen have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $30.71.

Get Our Latest Stock Report on NRIX

Nurix Therapeutics Trading Up 2.2 %

Shares of NASDAQ:NRIX traded up $0.44 during trading on Wednesday, hitting $20.00. 179,868 shares of the company's stock traded hands, compared to its average volume of 637,777. The company has a 50-day moving average price of $20.20 and a 200-day moving average price of $22.42. Nurix Therapeutics has a 52 week low of $7.79 and a 52 week high of $29.56. The company has a market cap of $1.42 billion, a price-to-earnings ratio of -6.87 and a beta of 2.14.

Nurix Therapeutics (NASDAQ:NRIX - Get Free Report) last posted its quarterly earnings results on Tuesday, January 28th. The company reported ($0.75) earnings per share for the quarter, missing the consensus estimate of ($0.67) by ($0.08). Nurix Therapeutics had a negative return on equity of 63.39% and a negative net margin of 313.65%. On average, analysts predict that Nurix Therapeutics will post -2.81 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CFO Houte Hans Van sold 3,546 shares of the company's stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $24.28, for a total value of $86,096.88. Following the completion of the sale, the chief financial officer now owns 33,724 shares of the company's stock, valued at $818,818.72. This represents a 9.51 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 7.20% of the company's stock.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in the stock. Sumitomo Mitsui Trust Group Inc. acquired a new stake in shares of Nurix Therapeutics in the third quarter worth $12,432,000. FMR LLC lifted its position in Nurix Therapeutics by 675.9% during the 3rd quarter. FMR LLC now owns 586,902 shares of the company's stock worth $13,188,000 after acquiring an additional 511,256 shares during the last quarter. Lord Abbett & CO. LLC bought a new stake in Nurix Therapeutics during the third quarter valued at about $7,879,000. Patient Square Capital LP acquired a new stake in shares of Nurix Therapeutics in the third quarter valued at about $7,320,000. Finally, Wellington Management Group LLP lifted its position in shares of Nurix Therapeutics by 8.8% during the 3rd quarter. Wellington Management Group LLP now owns 3,482,105 shares of the company's stock worth $78,243,000 after purchasing an additional 280,240 shares during the last quarter.

Nurix Therapeutics Company Profile

(

Get Free Report)

Nurix Therapeutics, Inc, a clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and cell therapies for the treatment of cancer, inflammatory conditions, and other diseases. The company develops NX-2127, an orally bioavailable Bruton's tyrosine kinase (BTK) degrader for the treatment of relapsed or refractory B-cell malignancies; NX-5948, an orally bioavailable BTK degrader for the treatment of relapsed or refractory B-cell malignancies and autoimmune diseases; and NX-1607, an orally bioavailable Casitas B-lineage lymphoma proto-oncogene-B (CBL-B) inhibitor for immuno-oncology indications.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nurix Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nurix Therapeutics wasn't on the list.

While Nurix Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.