Accent Capital Management LLC raised its holdings in Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report) by 2,127.1% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 2,962 shares of the company's stock after purchasing an additional 2,829 shares during the period. Accent Capital Management LLC's holdings in Royal Caribbean Cruises were worth $525,000 at the end of the most recent reporting period.

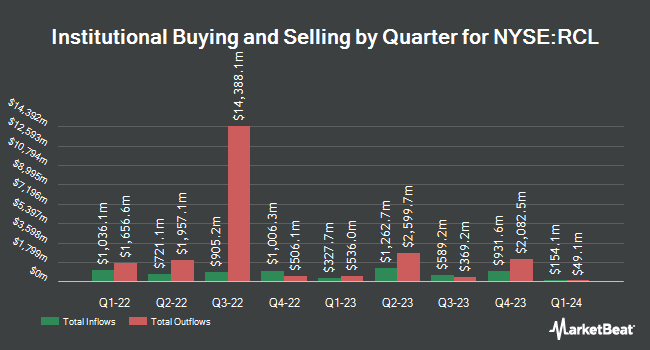

Other large investors have also modified their holdings of the company. D1 Capital Partners L.P. boosted its stake in shares of Royal Caribbean Cruises by 105.7% during the second quarter. D1 Capital Partners L.P. now owns 1,512,103 shares of the company's stock valued at $241,075,000 after acquiring an additional 777,103 shares during the last quarter. International Assets Investment Management LLC boosted its stake in shares of Royal Caribbean Cruises by 10,599.0% during the 3rd quarter. International Assets Investment Management LLC now owns 409,879 shares of the company's stock worth $72,696,000 after purchasing an additional 406,048 shares during the last quarter. Dimensional Fund Advisors LP boosted its stake in shares of Royal Caribbean Cruises by 24.3% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,048,501 shares of the company's stock worth $326,616,000 after purchasing an additional 400,565 shares during the last quarter. Capital International Investors grew its holdings in shares of Royal Caribbean Cruises by 1.0% during the first quarter. Capital International Investors now owns 29,596,455 shares of the company's stock worth $4,114,203,000 after buying an additional 286,868 shares in the last quarter. Finally, Forest Avenue Capital Management LP acquired a new position in shares of Royal Caribbean Cruises in the second quarter valued at approximately $35,038,000. 87.53% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

RCL has been the subject of several recent analyst reports. Wells Fargo & Company lifted their target price on shares of Royal Caribbean Cruises from $180.00 to $232.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 30th. Citigroup lifted their price objective on Royal Caribbean Cruises from $253.00 to $257.00 and gave the company a "buy" rating in a research report on Wednesday, October 30th. Macquarie increased their target price on Royal Caribbean Cruises from $189.00 to $250.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 30th. Stifel Nicolaus lifted their price target on Royal Caribbean Cruises from $200.00 to $230.00 and gave the company a "buy" rating in a report on Friday, October 11th. Finally, StockNews.com raised shares of Royal Caribbean Cruises from a "sell" rating to a "hold" rating in a research note on Thursday, November 7th. Three equities research analysts have rated the stock with a hold rating and thirteen have given a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $220.00.

Read Our Latest Stock Report on Royal Caribbean Cruises

Insider Buying and Selling at Royal Caribbean Cruises

In other news, insider Laura H. Bethge sold 3,073 shares of the company's stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $168.71, for a total value of $518,445.83. Following the completion of the transaction, the insider now directly owns 27,388 shares in the company, valued at approximately $4,620,629.48. This represents a 10.09 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Richard D. Fain sold 25,000 shares of Royal Caribbean Cruises stock in a transaction on Wednesday, October 30th. The stock was sold at an average price of $210.02, for a total transaction of $5,250,500.00. Following the sale, the director now directly owns 204,521 shares in the company, valued at $42,953,500.42. This trade represents a 10.89 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 34,796 shares of company stock valued at $7,170,759 over the last 90 days. 7.95% of the stock is owned by corporate insiders.

Royal Caribbean Cruises Stock Down 0.7 %

Shares of Royal Caribbean Cruises stock opened at $231.49 on Friday. Royal Caribbean Cruises Ltd. has a twelve month low of $101.04 and a twelve month high of $238.10. The stock has a market cap of $62.24 billion, a price-to-earnings ratio of 23.79, a price-to-earnings-growth ratio of 0.61 and a beta of 2.59. The company has a current ratio of 0.19, a quick ratio of 0.16 and a debt-to-equity ratio of 2.63. The company has a fifty day moving average price of $193.66 and a 200 day moving average price of $168.11.

Royal Caribbean Cruises (NYSE:RCL - Get Free Report) last issued its earnings results on Tuesday, October 29th. The company reported $5.20 earnings per share for the quarter, topping the consensus estimate of $5.05 by $0.15. The company had revenue of $4.89 billion during the quarter, compared to the consensus estimate of $4.89 billion. Royal Caribbean Cruises had a return on equity of 52.92% and a net margin of 16.21%. The company's revenue was up 17.5% compared to the same quarter last year. During the same quarter in the prior year, the business earned $3.85 earnings per share. Equities research analysts forecast that Royal Caribbean Cruises Ltd. will post 11.64 earnings per share for the current fiscal year.

Royal Caribbean Cruises Profile

(

Free Report)

Royal Caribbean Cruises Ltd. operates as a cruise company worldwide. The company operates cruises under the Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands, which comprise a range of itineraries. As of February 21, 2024, it operated 65 ships. Royal Caribbean Cruises Ltd.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Royal Caribbean Cruises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Caribbean Cruises wasn't on the list.

While Royal Caribbean Cruises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.