Royal London Asset Management Ltd. lifted its position in shares of Jack Henry & Associates, Inc. (NASDAQ:JKHY - Free Report) by 8.8% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 37,619 shares of the technology company's stock after acquiring an additional 3,054 shares during the quarter. Royal London Asset Management Ltd. owned 0.05% of Jack Henry & Associates worth $6,641,000 at the end of the most recent quarter.

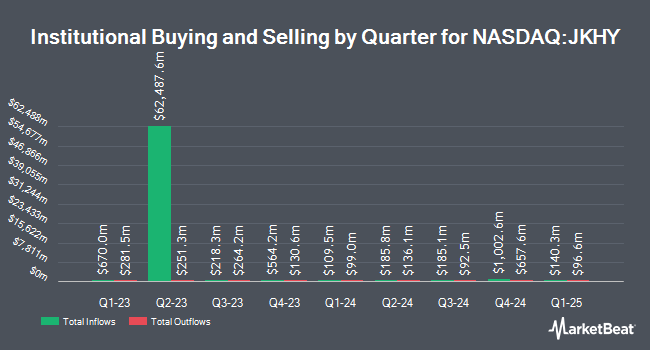

A number of other institutional investors and hedge funds have also made changes to their positions in JKHY. Strategic Financial Concepts LLC acquired a new position in shares of Jack Henry & Associates during the second quarter worth about $25,000. Tortoise Investment Management LLC increased its stake in shares of Jack Henry & Associates by 76.3% during the second quarter. Tortoise Investment Management LLC now owns 164 shares of the technology company's stock worth $27,000 after acquiring an additional 71 shares during the period. Blue Trust Inc. increased its stake in shares of Jack Henry & Associates by 148.9% during the second quarter. Blue Trust Inc. now owns 224 shares of the technology company's stock worth $39,000 after acquiring an additional 134 shares during the period. Catalyst Capital Advisors LLC acquired a new position in Jack Henry & Associates during the third quarter worth about $48,000. Finally, Point72 Asset Management L.P. acquired a new position in Jack Henry & Associates during the third quarter worth about $54,000. 98.75% of the stock is currently owned by institutional investors and hedge funds.

Jack Henry & Associates Trading Down 0.3 %

Shares of JKHY traded down $0.60 on Monday, hitting $173.01. 574,501 shares of the stock traded hands, compared to its average volume of 677,554. The company has a quick ratio of 1.11, a current ratio of 1.11 and a debt-to-equity ratio of 0.03. The firm has a market capitalization of $12.62 billion, a P/E ratio of 31.69, a P/E/G ratio of 3.26 and a beta of 0.61. The stock's 50 day moving average is $179.09 and its two-hundred day moving average is $171.68. Jack Henry & Associates, Inc. has a 1 year low of $157.00 and a 1 year high of $189.63.

Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The technology company reported $1.63 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.61 by $0.02. The business had revenue of $600.98 million for the quarter, compared to the consensus estimate of $599.56 million. Jack Henry & Associates had a net margin of 17.79% and a return on equity of 21.81%. The company's quarterly revenue was up 5.2% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $1.39 earnings per share. As a group, sell-side analysts predict that Jack Henry & Associates, Inc. will post 5.8 earnings per share for the current year.

Jack Henry & Associates Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Monday, December 2nd will be paid a dividend of $0.55 per share. This represents a $2.20 dividend on an annualized basis and a yield of 1.27%. The ex-dividend date is Monday, December 2nd. Jack Henry & Associates's dividend payout ratio is currently 40.29%.

Wall Street Analysts Forecast Growth

Several research analysts have weighed in on JKHY shares. UBS Group upped their target price on shares of Jack Henry & Associates from $180.00 to $190.00 and gave the stock a "neutral" rating in a research report on Thursday, November 7th. Stephens restated an "equal weight" rating and set a $170.00 target price on shares of Jack Henry & Associates in a research report on Wednesday, November 6th. Compass Point started coverage on shares of Jack Henry & Associates in a research report on Wednesday, September 4th. They set a "neutral" rating and a $186.00 target price on the stock. Oppenheimer started coverage on shares of Jack Henry & Associates in a research report on Tuesday, October 1st. They set an "outperform" rating and a $206.00 target price on the stock. Finally, Keefe, Bruyette & Woods increased their price target on shares of Jack Henry & Associates from $180.00 to $190.00 and gave the company a "market perform" rating in a research report on Thursday, November 7th. Eleven investment analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $189.00.

Check Out Our Latest Report on JKHY

Insiders Place Their Bets

In other Jack Henry & Associates news, insider David B. Foss sold 18,770 shares of the stock in a transaction that occurred on Tuesday, November 19th. The shares were sold at an average price of $171.32, for a total transaction of $3,215,676.40. Following the transaction, the insider now owns 138,665 shares of the company's stock, valued at $23,756,087.80. This trade represents a 11.92 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 1.37% of the stock is currently owned by insiders.

Jack Henry & Associates Profile

(

Free Report)

Jack Henry & Associates, Inc, a financial technology company that connects people and financial institutions through technology solutions and payment processing services that reduce the barriers to financial health. It operates through four segments: Core, Payments, Complementary, and Corporate and Other.

Further Reading

Before you consider Jack Henry & Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jack Henry & Associates wasn't on the list.

While Jack Henry & Associates currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.