Royal London Asset Management Ltd. grew its holdings in shares of Equifax Inc. (NYSE:EFX - Free Report) by 4.6% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 57,039 shares of the credit services provider's stock after buying an additional 2,530 shares during the period. Royal London Asset Management Ltd.'s holdings in Equifax were worth $16,761,000 as of its most recent SEC filing.

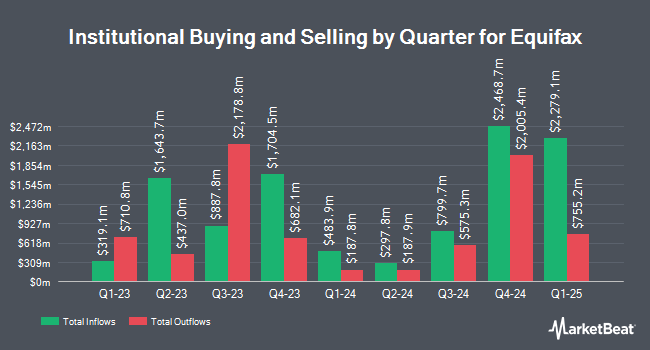

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Massachusetts Financial Services Co. MA boosted its stake in Equifax by 4.9% during the second quarter. Massachusetts Financial Services Co. MA now owns 4,276,798 shares of the credit services provider's stock worth $1,036,952,000 after acquiring an additional 200,665 shares in the last quarter. FMR LLC grew its stake in shares of Equifax by 37.4% in the 3rd quarter. FMR LLC now owns 3,233,744 shares of the credit services provider's stock worth $950,268,000 after buying an additional 880,162 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC grew its stake in shares of Equifax by 2.4% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 3,044,561 shares of the credit services provider's stock worth $738,184,000 after buying an additional 70,091 shares during the last quarter. International Assets Investment Management LLC increased its position in Equifax by 76,913.8% during the 3rd quarter. International Assets Investment Management LLC now owns 960,362 shares of the credit services provider's stock valued at $282,212,000 after buying an additional 959,115 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its stake in Equifax by 13.1% during the third quarter. Charles Schwab Investment Management Inc. now owns 767,136 shares of the credit services provider's stock valued at $225,431,000 after buying an additional 88,895 shares during the last quarter. 96.20% of the stock is owned by hedge funds and other institutional investors.

Equifax Stock Performance

Shares of Equifax stock traded up $6.04 on Friday, hitting $266.82. 776,420 shares of the company's stock were exchanged, compared to its average volume of 977,665. Equifax Inc. has a 1 year low of $213.02 and a 1 year high of $309.63. The company has a 50-day simple moving average of $270.48 and a 200-day simple moving average of $268.93. The company has a debt-to-equity ratio of 0.96, a quick ratio of 0.88 and a current ratio of 0.88. The stock has a market capitalization of $33.07 billion, a PE ratio of 59.30, a PEG ratio of 3.27 and a beta of 1.57.

Equifax (NYSE:EFX - Get Free Report) last released its earnings results on Wednesday, October 16th. The credit services provider reported $1.85 earnings per share for the quarter, beating the consensus estimate of $1.84 by $0.01. The company had revenue of $1.44 billion for the quarter, compared to the consensus estimate of $1.44 billion. Equifax had a return on equity of 18.56% and a net margin of 10.07%. Equifax's quarterly revenue was up 9.3% compared to the same quarter last year. During the same period in the previous year, the business earned $1.76 earnings per share. As a group, equities analysts anticipate that Equifax Inc. will post 7.28 EPS for the current year.

Equifax Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Friday, November 22nd will be paid a dividend of $0.39 per share. This represents a $1.56 dividend on an annualized basis and a yield of 0.58%. The ex-dividend date of this dividend is Friday, November 22nd. Equifax's payout ratio is 34.67%.

Insider Buying and Selling at Equifax

In other Equifax news, CEO Mark W. Begor sold 58,304 shares of the company's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $270.49, for a total value of $15,770,648.96. Following the completion of the transaction, the chief executive officer now directly owns 109,183 shares in the company, valued at $29,532,909.67. This represents a 34.81 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, EVP John J. Kelley III sold 1,000 shares of Equifax stock in a transaction that occurred on Friday, October 25th. The shares were sold at an average price of $272.92, for a total transaction of $272,920.00. Following the sale, the executive vice president now owns 11,269 shares in the company, valued at approximately $3,075,535.48. The trade was a 8.15 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 59,855 shares of company stock valued at $16,187,044 over the last 90 days. 1.57% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of equities research analysts have recently commented on the company. Wells Fargo & Company reissued a "buy" rating on shares of Equifax in a research note on Friday, October 18th. JPMorgan Chase & Co. reduced their price objective on shares of Equifax from $304.00 to $283.00 and set an "overweight" rating for the company in a research note on Tuesday, November 19th. The Goldman Sachs Group increased their price target on shares of Equifax from $277.00 to $307.00 and gave the company a "neutral" rating in a report on Tuesday, August 20th. Needham & Company LLC reiterated a "buy" rating and set a $350.00 price target on shares of Equifax in a report on Monday, October 28th. Finally, Robert W. Baird boosted their price objective on shares of Equifax from $290.00 to $333.00 and gave the stock an "outperform" rating in a report on Friday, October 18th. Four investment analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $306.74.

Get Our Latest Report on EFX

Equifax Company Profile

(

Free Report)

Equifax Inc operates as a data, analytics, and technology company. The company operates through three segments: Workforce Solutions, U.S. Information Solutions (USIS), and International. The Workforce Solutions segment offers services that enables customers to verify income, employment, educational history, criminal justice data, healthcare professional licensure, and sanctions of people in the United States; and employer customers with services that assist them in complying with and automating payroll-related and human resource management processes throughout the entire cycle of the employment relationship.

Recommended Stories

Before you consider Equifax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equifax wasn't on the list.

While Equifax currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report