Royal London Asset Management Ltd. grew its stake in shares of ONEOK, Inc. (NYSE:OKE - Free Report) by 3.2% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 301,797 shares of the utilities provider's stock after acquiring an additional 9,281 shares during the period. Royal London Asset Management Ltd. owned about 0.05% of ONEOK worth $27,503,000 at the end of the most recent quarter.

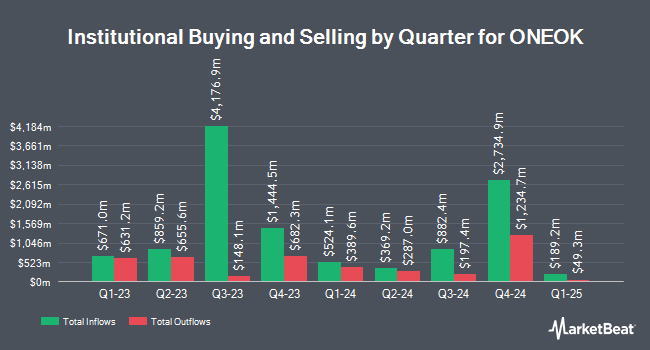

A number of other large investors have also recently modified their holdings of the company. International Assets Investment Management LLC increased its position in ONEOK by 9,439.9% during the 3rd quarter. International Assets Investment Management LLC now owns 3,230,989 shares of the utilities provider's stock valued at $294,440,000 after purchasing an additional 3,197,121 shares during the period. Charles Schwab Investment Management Inc. raised its stake in ONEOK by 3.9% in the third quarter. Charles Schwab Investment Management Inc. now owns 17,480,774 shares of the utilities provider's stock worth $1,593,023,000 after buying an additional 661,854 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund purchased a new stake in ONEOK during the third quarter worth $47,957,000. Bahl & Gaynor Inc. boosted its position in ONEOK by 3,648.4% during the 2nd quarter. Bahl & Gaynor Inc. now owns 514,954 shares of the utilities provider's stock valued at $41,995,000 after acquiring an additional 501,216 shares in the last quarter. Finally, Strategic Financial Concepts LLC increased its holdings in shares of ONEOK by 3,137.6% in the 2nd quarter. Strategic Financial Concepts LLC now owns 405,158 shares of the utilities provider's stock valued at $330,000 after acquiring an additional 392,644 shares during the period. Hedge funds and other institutional investors own 69.13% of the company's stock.

ONEOK Stock Performance

Shares of NYSE:OKE traded down $1.12 during trading on Friday, hitting $109.00. The stock had a trading volume of 2,160,043 shares, compared to its average volume of 3,390,932. The stock has a 50-day simple moving average of $102.06 and a two-hundred day simple moving average of $90.78. The stock has a market capitalization of $63.68 billion, a price-to-earnings ratio of 22.80, a price-to-earnings-growth ratio of 5.48 and a beta of 1.69. ONEOK, Inc. has a 12-month low of $65.49 and a 12-month high of $118.07. The company has a quick ratio of 0.59, a current ratio of 0.81 and a debt-to-equity ratio of 1.59.

ONEOK (NYSE:OKE - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The utilities provider reported $1.18 earnings per share for the quarter, missing analysts' consensus estimates of $1.23 by ($0.05). ONEOK had a net margin of 14.05% and a return on equity of 16.84%. The company had revenue of $5.02 billion for the quarter, compared to analysts' expectations of $5.81 billion. During the same quarter in the previous year, the business posted $0.99 EPS. On average, equities research analysts expect that ONEOK, Inc. will post 5.1 earnings per share for the current fiscal year.

ONEOK Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Thursday, November 14th. Shareholders of record on Friday, November 1st were given a $0.99 dividend. The ex-dividend date of this dividend was Friday, November 1st. This represents a $3.96 annualized dividend and a yield of 3.63%. ONEOK's dividend payout ratio is presently 82.85%.

Analyst Ratings Changes

OKE has been the subject of a number of analyst reports. Wells Fargo & Company upped their price objective on ONEOK from $100.00 to $107.00 and gave the stock an "overweight" rating in a research note on Friday, November 1st. Mizuho raised shares of ONEOK to a "hold" rating in a research report on Thursday, November 7th. Truist Financial lifted their price objective on shares of ONEOK from $99.00 to $107.00 and gave the stock a "hold" rating in a research report on Tuesday. Morgan Stanley upgraded shares of ONEOK from an "equal weight" rating to an "overweight" rating and boosted their price objective for the stock from $103.00 to $111.00 in a research note on Monday, September 16th. Finally, US Capital Advisors upgraded shares of ONEOK from a "hold" rating to a "moderate buy" rating in a research note on Tuesday, November 26th. Seven investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to data from MarketBeat, ONEOK presently has an average rating of "Moderate Buy" and a consensus price target of $101.00.

Get Our Latest Stock Report on OKE

ONEOK Company Profile

(

Free Report)

ONEOK, Inc engages in gathering, processing, fractionation, storage, transportation, and marketing of natural gas and natural gas liquids (NGL) in the United States. It operates through four segments: Natural Gas Gathering and Processing, Natural Gas Liquids, Natural Gas Pipelines, and Refined Products and Crude.

Read More

Before you consider ONEOK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ONEOK wasn't on the list.

While ONEOK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.