Royal London Asset Management Ltd. trimmed its holdings in Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) by 6.7% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 45,424 shares of the technology company's stock after selling 3,269 shares during the quarter. Royal London Asset Management Ltd.'s holdings in Check Point Software Technologies were worth $8,758,000 as of its most recent SEC filing.

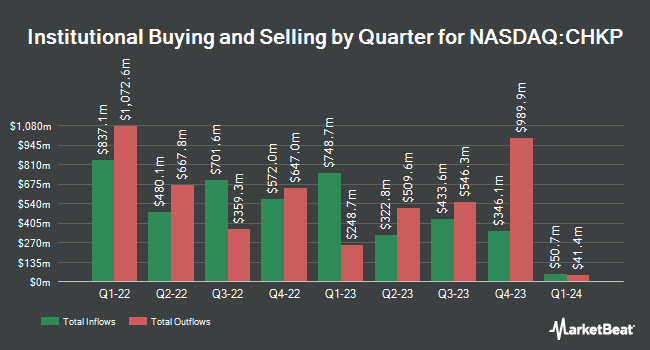

A number of other institutional investors have also bought and sold shares of the business. Massachusetts Financial Services Co. MA raised its position in shares of Check Point Software Technologies by 2.1% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 5,527,700 shares of the technology company's stock valued at $912,070,000 after buying an additional 114,938 shares during the period. Acadian Asset Management LLC increased its holdings in Check Point Software Technologies by 10.5% in the 2nd quarter. Acadian Asset Management LLC now owns 4,108,685 shares of the technology company's stock valued at $677,869,000 after purchasing an additional 391,983 shares during the last quarter. Ninety One UK Ltd increased its holdings in Check Point Software Technologies by 1.1% in the 2nd quarter. Ninety One UK Ltd now owns 3,608,785 shares of the technology company's stock valued at $595,450,000 after purchasing an additional 39,092 shares during the last quarter. Robeco Institutional Asset Management B.V. increased its holdings in Check Point Software Technologies by 10.7% in the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 1,836,799 shares of the technology company's stock valued at $354,153,000 after purchasing an additional 177,104 shares during the last quarter. Finally, FMR LLC increased its holdings in Check Point Software Technologies by 28.7% in the 3rd quarter. FMR LLC now owns 1,133,175 shares of the technology company's stock valued at $218,488,000 after purchasing an additional 252,581 shares during the last quarter. 87.62% of the stock is owned by hedge funds and other institutional investors.

Check Point Software Technologies Stock Down 0.7 %

CHKP traded down $1.23 on Friday, reaching $186.82. The company had a trading volume of 466,738 shares, compared to its average volume of 614,080. Check Point Software Technologies Ltd. has a 1 year low of $143.28 and a 1 year high of $210.70. The stock has a market capitalization of $20.55 billion, a PE ratio of 25.52, a P/E/G ratio of 3.25 and a beta of 0.63. The stock has a 50-day moving average price of $188.46 and a 200-day moving average price of $179.47.

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) last announced its earnings results on Tuesday, October 29th. The technology company reported $2.25 EPS for the quarter, meeting analysts' consensus estimates of $2.25. Check Point Software Technologies had a net margin of 33.17% and a return on equity of 31.84%. The business had revenue of $635.10 million during the quarter, compared to analysts' expectations of $634.96 million. During the same period in the prior year, the company earned $1.80 earnings per share. The business's revenue was up 6.5% compared to the same quarter last year. As a group, analysts expect that Check Point Software Technologies Ltd. will post 7.86 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several analysts recently weighed in on the stock. Royal Bank of Canada reiterated a "sector perform" rating and issued a $187.00 target price on shares of Check Point Software Technologies in a report on Wednesday, October 30th. Mizuho boosted their price target on shares of Check Point Software Technologies from $178.00 to $205.00 and gave the stock a "neutral" rating in a research note on Thursday, October 17th. Wedbush boosted their price target on shares of Check Point Software Technologies from $200.00 to $230.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 9th. Evercore ISI boosted their price target on shares of Check Point Software Technologies from $180.00 to $185.00 and gave the stock an "in-line" rating in a research note on Wednesday, October 30th. Finally, Needham & Company LLC restated a "hold" rating on shares of Check Point Software Technologies in a research note on Wednesday, October 30th. Fifteen equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $197.74.

View Our Latest Report on Check Point Software Technologies

About Check Point Software Technologies

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Recommended Stories

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.