Royal London Asset Management Ltd. lessened its stake in shares of Paycom Software, Inc. (NYSE:PAYC - Free Report) by 48.2% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 20,896 shares of the software maker's stock after selling 19,458 shares during the quarter. Royal London Asset Management Ltd.'s holdings in Paycom Software were worth $3,481,000 at the end of the most recent reporting period.

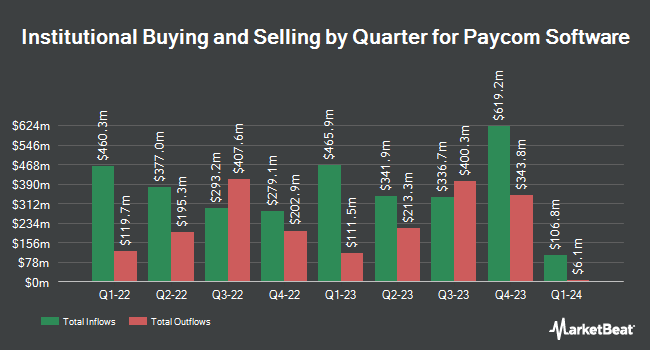

A number of other hedge funds have also made changes to their positions in PAYC. Armstrong Advisory Group Inc. acquired a new position in Paycom Software in the third quarter worth approximately $26,000. Brooklyn Investment Group acquired a new stake in shares of Paycom Software during the 3rd quarter valued at $28,000. Ashton Thomas Private Wealth LLC acquired a new stake in shares of Paycom Software during the 2nd quarter valued at $25,000. Pin Oak Investment Advisors Inc. boosted its stake in shares of Paycom Software by 73.3% during the 3rd quarter. Pin Oak Investment Advisors Inc. now owns 182 shares of the software maker's stock valued at $30,000 after buying an additional 77 shares during the period. Finally, MFA Wealth Advisors LLC acquired a new stake in shares of Paycom Software in the 2nd quarter valued at $26,000. Institutional investors and hedge funds own 87.77% of the company's stock.

Paycom Software Trading Down 1.0 %

PAYC stock traded down $2.40 during trading on Monday, hitting $234.08. The company had a trading volume of 464,569 shares, compared to its average volume of 791,352. The company has a fifty day moving average price of $198.43 and a two-hundred day moving average price of $171.33. The company has a market cap of $13.50 billion, a P/E ratio of 28.22, a P/E/G ratio of 3.15 and a beta of 1.11. Paycom Software, Inc. has a fifty-two week low of $139.50 and a fifty-two week high of $238.57.

Paycom Software Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 9th. Shareholders of record on Monday, November 25th will be given a $0.375 dividend. The ex-dividend date is Monday, November 25th. This represents a $1.50 annualized dividend and a yield of 0.64%. Paycom Software's payout ratio is 18.05%.

Insider Buying and Selling at Paycom Software

In other Paycom Software news, CEO Chad R. Richison sold 1,950 shares of Paycom Software stock in a transaction on Monday, September 16th. The stock was sold at an average price of $170.27, for a total value of $332,026.50. Following the completion of the transaction, the chief executive officer now owns 2,932,058 shares in the company, valued at approximately $499,241,515.66. The trade was a 0.07 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In the last quarter, insiders sold 50,700 shares of company stock worth $9,098,135. 12.60% of the stock is currently owned by insiders.

Analyst Ratings Changes

Several equities analysts have weighed in on PAYC shares. TD Cowen raised their target price on Paycom Software from $193.00 to $248.00 and gave the company a "hold" rating in a report on Monday. Piper Sandler raised their price objective on Paycom Software from $160.00 to $191.00 and gave the company a "neutral" rating in a research note on Thursday, October 31st. Jefferies Financial Group raised their price objective on Paycom Software from $170.00 to $175.00 and gave the company a "hold" rating in a research note on Thursday, October 31st. Barclays raised their price objective on Paycom Software from $172.00 to $181.00 and gave the company an "equal weight" rating in a research note on Thursday, October 31st. Finally, BMO Capital Markets raised their price objective on Paycom Software from $183.00 to $197.00 and gave the company a "market perform" rating in a research note on Thursday, October 31st. Twelve equities research analysts have rated the stock with a hold rating and one has given a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $200.33.

Read Our Latest Stock Report on Paycom Software

Paycom Software Company Profile

(

Free Report)

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

Recommended Stories

Before you consider Paycom Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycom Software wasn't on the list.

While Paycom Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.