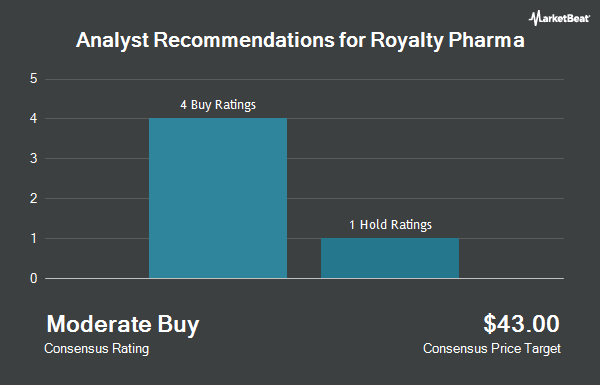

Royalty Pharma plc (NASDAQ:RPRX - Get Free Report) has received a consensus rating of "Buy" from the six ratings firms that are covering the stock, MarketBeat reports. One research analyst has rated the stock with a hold recommendation, four have given a buy recommendation and one has given a strong buy recommendation to the company. The average twelve-month target price among brokers that have updated their coverage on the stock in the last year is $41.60.

Several equities analysts recently weighed in on the company. Citigroup reiterated a "buy" rating on shares of Royalty Pharma in a research report on Friday. TD Cowen raised shares of Royalty Pharma to a "strong-buy" rating in a report on Tuesday, December 24th.

Read Our Latest Stock Report on RPRX

Institutional Investors Weigh In On Royalty Pharma

Several institutional investors and hedge funds have recently modified their holdings of RPRX. Brooklyn Investment Group boosted its position in shares of Royalty Pharma by 1,006.9% during the fourth quarter. Brooklyn Investment Group now owns 963 shares of the biopharmaceutical company's stock worth $25,000 after acquiring an additional 876 shares during the last quarter. Allworth Financial LP boosted its holdings in shares of Royalty Pharma by 417.6% during the 4th quarter. Allworth Financial LP now owns 1,087 shares of the biopharmaceutical company's stock valued at $28,000 after purchasing an additional 877 shares during the last quarter. Riverview Trust Co grew its position in shares of Royalty Pharma by 3,953.3% during the fourth quarter. Riverview Trust Co now owns 1,216 shares of the biopharmaceutical company's stock valued at $31,000 after purchasing an additional 1,186 shares in the last quarter. Fifth Third Bancorp increased its holdings in shares of Royalty Pharma by 187.1% in the fourth quarter. Fifth Third Bancorp now owns 1,530 shares of the biopharmaceutical company's stock worth $39,000 after purchasing an additional 997 shares during the last quarter. Finally, Rakuten Securities Inc. lifted its position in shares of Royalty Pharma by 160.5% in the fourth quarter. Rakuten Securities Inc. now owns 1,628 shares of the biopharmaceutical company's stock worth $42,000 after buying an additional 1,003 shares in the last quarter. Institutional investors own 54.35% of the company's stock.

Royalty Pharma Stock Performance

NASDAQ:RPRX traded down $0.24 during trading hours on Friday, reaching $31.13. The company had a trading volume of 7,631,835 shares, compared to its average volume of 3,121,245. The firm has a market cap of $17.94 billion, a price-to-earnings ratio of 21.47, a PEG ratio of 2.31 and a beta of 0.47. The company has a current ratio of 1.44, a quick ratio of 1.44 and a debt-to-equity ratio of 0.64. The firm's 50 day moving average price is $32.44 and its 200-day moving average price is $28.86. Royalty Pharma has a 52 week low of $24.05 and a 52 week high of $34.20.

Royalty Pharma (NASDAQ:RPRX - Get Free Report) last released its quarterly earnings results on Tuesday, February 11th. The biopharmaceutical company reported $1.15 EPS for the quarter, beating the consensus estimate of $0.99 by $0.16. Royalty Pharma had a net margin of 37.94% and a return on equity of 24.40%. On average, analysts forecast that Royalty Pharma will post 4.49 EPS for the current year.

Royalty Pharma Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, March 10th. Investors of record on Friday, February 21st were issued a $0.22 dividend. The ex-dividend date of this dividend was Friday, February 21st. This is a boost from Royalty Pharma's previous quarterly dividend of $0.21. This represents a $0.88 dividend on an annualized basis and a yield of 2.83%. Royalty Pharma's payout ratio is currently 60.69%.

About Royalty Pharma

(

Get Free ReportRoyalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

Further Reading

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.