Royce & Associates LP lifted its holdings in shares of MarineMax, Inc. (NYSE:HZO - Free Report) by 45.2% during the 3rd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 368,826 shares of the specialty retailer's stock after acquiring an additional 114,880 shares during the period. Royce & Associates LP owned 1.65% of MarineMax worth $13,008,000 at the end of the most recent reporting period.

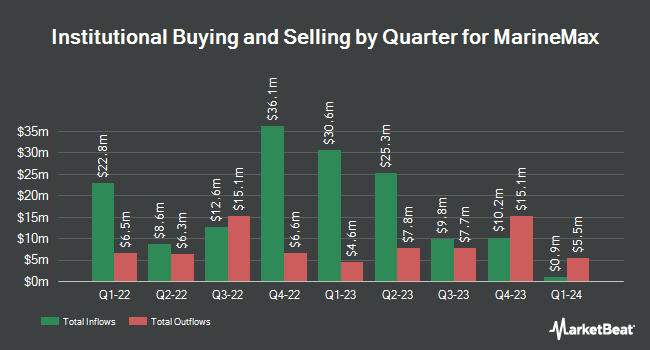

Other institutional investors have also recently added to or reduced their stakes in the company. Victory Capital Management Inc. raised its holdings in MarineMax by 134.3% during the third quarter. Victory Capital Management Inc. now owns 129,416 shares of the specialty retailer's stock worth $4,565,000 after purchasing an additional 74,173 shares in the last quarter. Private Management Group Inc. grew its position in shares of MarineMax by 11.5% in the 3rd quarter. Private Management Group Inc. now owns 534,023 shares of the specialty retailer's stock valued at $18,835,000 after buying an additional 55,033 shares during the last quarter. James Investment Research Inc. acquired a new stake in MarineMax during the 3rd quarter worth $203,000. Assenagon Asset Management S.A. lifted its position in MarineMax by 212.4% in the third quarter. Assenagon Asset Management S.A. now owns 93,056 shares of the specialty retailer's stock valued at $3,282,000 after acquiring an additional 63,271 shares during the last quarter. Finally, Bfsg LLC boosted its stake in MarineMax by 19.1% in the third quarter. Bfsg LLC now owns 4,248 shares of the specialty retailer's stock valued at $150,000 after acquiring an additional 681 shares in the last quarter. Hedge funds and other institutional investors own 92.85% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on HZO. Truist Financial boosted their target price on MarineMax from $35.00 to $44.00 and gave the company a "buy" rating in a report on Friday, July 26th. Citigroup raised MarineMax from a "neutral" rating to a "buy" rating and increased their price objective for the company from $40.00 to $44.00 in a report on Monday, September 9th. Benchmark assumed coverage on shares of MarineMax in a report on Tuesday, October 15th. They issued a "buy" rating and a $40.00 target price on the stock. DA Davidson increased their price target on shares of MarineMax from $34.00 to $37.00 and gave the stock a "buy" rating in a research note on Wednesday, July 24th. Finally, StockNews.com lowered shares of MarineMax from a "hold" rating to a "sell" rating in a research note on Tuesday, September 3rd. One analyst has rated the stock with a sell rating and six have issued a buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $41.83.

Check Out Our Latest Research Report on MarineMax

MarineMax Stock Performance

NYSE:HZO opened at $29.39 on Friday. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.19 and a quick ratio of 0.34. The firm has a market cap of $655.98 million, a price-to-earnings ratio of 17.81 and a beta of 1.85. The firm's fifty day moving average price is $31.90 and its 200 day moving average price is $31.40. MarineMax, Inc. has a 1-year low of $22.51 and a 1-year high of $39.85.

MarineMax (NYSE:HZO - Get Free Report) last issued its earnings results on Thursday, October 31st. The specialty retailer reported $0.24 earnings per share for the quarter, beating the consensus estimate of $0.18 by $0.06. The business had revenue of $563.10 million for the quarter, compared to the consensus estimate of $576.49 million. MarineMax had a net margin of 1.57% and a return on equity of 5.09%. The business's quarterly revenue was down 5.3% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.69 earnings per share. On average, sell-side analysts expect that MarineMax, Inc. will post 2.33 EPS for the current year.

MarineMax Company Profile

(

Free Report)

MarineMax, Inc operates as a recreational boat and yacht retailer and superyacht services company in the United States. It operates in two segments, Retail Operations and Product Manufacturing. The company sells new and used recreational boats, including pleasure and fishing boats, mega-yachts, yachts, sport cruisers, motor yachts, e-power yachts, pontoon boats, ski boats, jet boats, and other recreational boats.

Read More

Before you consider MarineMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarineMax wasn't on the list.

While MarineMax currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.