Royce & Associates LP acquired a new position in Talkspace, Inc. (NASDAQ:TALK - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 500,000 shares of the company's stock, valued at approximately $1,045,000. Royce & Associates LP owned about 0.30% of Talkspace at the end of the most recent quarter.

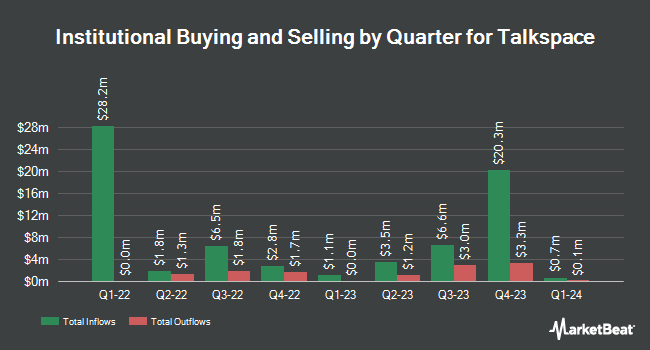

Other institutional investors have also recently bought and sold shares of the company. Principal Financial Group Inc. purchased a new position in shares of Talkspace during the 2nd quarter valued at $38,000. Virtu Financial LLC purchased a new position in shares of Talkspace in the 1st quarter worth about $74,000. Creative Planning increased its position in shares of Talkspace by 30.6% during the 3rd quarter. Creative Planning now owns 26,386 shares of the company's stock valued at $55,000 after purchasing an additional 6,179 shares during the last quarter. Aigen Investment Management LP lifted its position in Talkspace by 37.8% in the 3rd quarter. Aigen Investment Management LP now owns 35,568 shares of the company's stock worth $74,000 after buying an additional 9,766 shares during the last quarter. Finally, Clear Harbor Asset Management LLC bought a new position in Talkspace during the third quarter valued at approximately $84,000. Institutional investors own 57.37% of the company's stock.

Insider Activity

In related news, CFO Ian Jiro Harris acquired 19,500 shares of Talkspace stock in a transaction that occurred on Tuesday, September 17th. The stock was bought at an average price of $2.20 per share, with a total value of $42,900.00. Following the transaction, the chief financial officer now directly owns 347,057 shares in the company, valued at approximately $763,525.40. This represents a 5.95 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. 21.70% of the stock is currently owned by company insiders.

Talkspace Price Performance

Talkspace stock traded up $0.15 during mid-day trading on Thursday, reaching $3.31. 1,769,345 shares of the company traded hands, compared to its average volume of 1,614,508. Talkspace, Inc. has a 52-week low of $1.60 and a 52-week high of $3.92. The firm's 50 day moving average price is $2.64 and its 200 day moving average price is $2.36. The firm has a market capitalization of $559.13 million, a price-to-earnings ratio of -334.00 and a beta of 1.11.

Talkspace (NASDAQ:TALK - Get Free Report) last released its earnings results on Tuesday, October 29th. The company reported $0.01 EPS for the quarter. The company had revenue of $47.40 million during the quarter, compared to analysts' expectations of $47.50 million. Talkspace had a negative return on equity of 1.17% and a negative net margin of 0.76%. During the same quarter last year, the business posted ($0.03) EPS. On average, sell-side analysts anticipate that Talkspace, Inc. will post -0.03 EPS for the current year.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the stock. Needham & Company LLC restated a "hold" rating on shares of Talkspace in a research report on Wednesday, October 30th. Northland Securities assumed coverage on shares of Talkspace in a research report on Wednesday. They set an "outperform" rating and a $5.00 price target for the company. Finally, Barclays boosted their price objective on shares of Talkspace from $2.00 to $3.00 and gave the company an "equal weight" rating in a research report on Tuesday, October 29th.

Get Our Latest Stock Analysis on Talkspace

About Talkspace

(

Free Report)

Talkspace, Inc operates as a virtual behavioral healthcare company in the United States. The company offers psychotherapy and psychiatry services through its platform to individuals, enterprises, and health plans and employee assistance programs. It provides text, audio, and video-based psychotherapy from licensed therapists.

Recommended Stories

Before you consider Talkspace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talkspace wasn't on the list.

While Talkspace currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.