Royce & Associates LP increased its stake in shares of Cognex Co. (NASDAQ:CGNX - Free Report) by 1.4% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,384,341 shares of the scientific and technical instruments company's stock after buying an additional 19,774 shares during the quarter. Royce & Associates LP owned about 0.81% of Cognex worth $56,066,000 at the end of the most recent quarter.

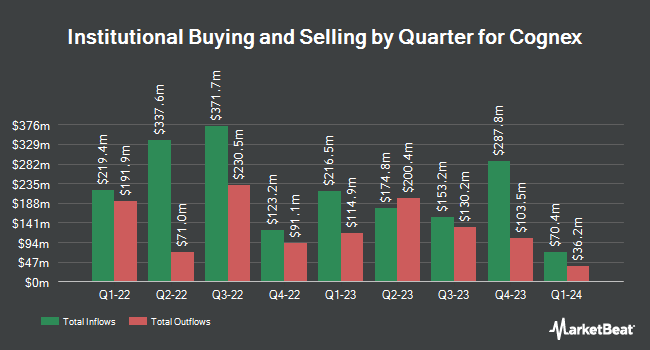

Several other large investors have also recently added to or reduced their stakes in CGNX. Sei Investments Co. grew its position in Cognex by 4.9% in the 1st quarter. Sei Investments Co. now owns 209,304 shares of the scientific and technical instruments company's stock worth $8,879,000 after purchasing an additional 9,748 shares during the last quarter. Avantax Advisory Services Inc. bought a new position in Cognex in the 1st quarter worth approximately $259,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its position in Cognex by 45.9% in the 1st quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 105,768 shares of the scientific and technical instruments company's stock valued at $4,487,000 after acquiring an additional 33,256 shares during the period. State Board of Administration of Florida Retirement System raised its stake in Cognex by 9.7% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 188,607 shares of the scientific and technical instruments company's stock valued at $8,001,000 after acquiring an additional 16,715 shares in the last quarter. Finally, Blair William & Co. IL boosted its position in Cognex by 11.0% during the 1st quarter. Blair William & Co. IL now owns 35,363 shares of the scientific and technical instruments company's stock worth $1,500,000 after acquiring an additional 3,493 shares during the period. 88.12% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Cognex news, CFO Dennis Fehr bought 6,570 shares of the stock in a transaction on Wednesday, September 4th. The shares were bought at an average price of $38.04 per share, with a total value of $249,922.80. Following the purchase, the chief financial officer now directly owns 6,570 shares in the company, valued at $249,922.80. The trade was a ∞ increase in their position. The acquisition was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Corporate insiders own 1.10% of the company's stock.

Cognex Stock Performance

Shares of NASDAQ:CGNX traded down $0.92 during midday trading on Friday, reaching $39.61. The company had a trading volume of 911,405 shares, compared to its average volume of 1,277,298. The company has a fifty day simple moving average of $39.80 and a two-hundred day simple moving average of $43.08. The firm has a market cap of $6.79 billion, a price-to-earnings ratio of 77.94 and a beta of 1.40. Cognex Co. has a 1-year low of $34.79 and a 1-year high of $53.13.

Cognex Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Investors of record on Thursday, November 14th will be paid a $0.08 dividend. This is a positive change from Cognex's previous quarterly dividend of $0.08. The ex-dividend date is Thursday, November 14th. This represents a $0.32 dividend on an annualized basis and a yield of 0.81%. Cognex's dividend payout ratio (DPR) is currently 57.69%.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on CGNX shares. The Goldman Sachs Group cut their price objective on shares of Cognex from $45.00 to $39.00 and set a "sell" rating on the stock in a research note on Friday, August 2nd. Needham & Company LLC decreased their price objective on shares of Cognex from $50.00 to $47.00 and set a "buy" rating for the company in a report on Friday, November 1st. StockNews.com raised Cognex from a "sell" rating to a "hold" rating in a report on Friday, August 9th. Vertical Research started coverage on Cognex in a research note on Tuesday, July 23rd. They set a "buy" rating and a $58.00 price target for the company. Finally, DA Davidson dropped their price objective on Cognex from $41.00 to $39.00 and set a "neutral" rating on the stock in a research note on Monday, August 5th. One analyst has rated the stock with a sell rating, five have issued a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Cognex presently has a consensus rating of "Hold" and an average price target of $47.91.

Check Out Our Latest Research Report on CGNX

Cognex Profile

(

Free Report)

Cognex Corporation provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide. Its machine vision products are used to automate the manufacturing and tracking of discrete items, including mobile phones, electric vehicle batteries, and e-commerce packages by locating, identifying, inspecting, and measuring them during the manufacturing or distribution process.

Featured Stories

Before you consider Cognex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognex wasn't on the list.

While Cognex currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.