Royce & Associates LP increased its holdings in Vimeo, Inc. (NASDAQ:VMEO - Free Report) by 15.2% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 706,415 shares of the company's stock after purchasing an additional 93,354 shares during the quarter. Royce & Associates LP owned approximately 0.43% of Vimeo worth $4,521,000 at the end of the most recent reporting period.

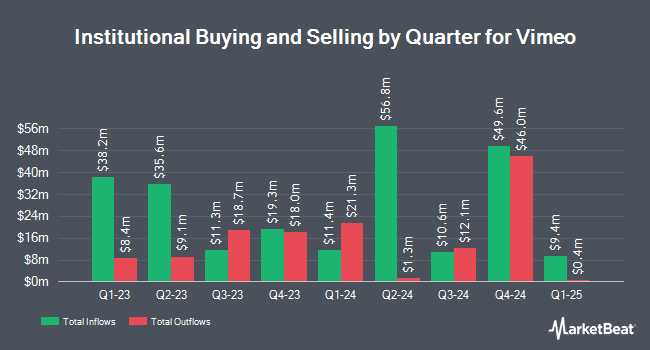

Several other institutional investors also recently modified their holdings of the business. Harvey Partners LLC grew its stake in shares of Vimeo by 7.0% in the third quarter. Harvey Partners LLC now owns 4,035,000 shares of the company's stock worth $20,377,000 after purchasing an additional 265,000 shares during the last quarter. Geode Capital Management LLC boosted its position in Vimeo by 5.0% during the third quarter. Geode Capital Management LLC now owns 3,770,805 shares of the company's stock valued at $19,046,000 after acquiring an additional 181,137 shares during the last quarter. FMR LLC boosted its position in Vimeo by 65.1% during the third quarter. FMR LLC now owns 1,392,457 shares of the company's stock valued at $7,032,000 after acquiring an additional 548,812 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its position in Vimeo by 0.7% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,268,020 shares of the company's stock valued at $8,115,000 after acquiring an additional 9,135 shares during the last quarter. Finally, JPMorgan Chase & Co. boosted its position in Vimeo by 18.1% during the third quarter. JPMorgan Chase & Co. now owns 324,420 shares of the company's stock valued at $1,638,000 after acquiring an additional 49,699 shares during the last quarter. Institutional investors own 84.97% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Piper Sandler raised shares of Vimeo from a "neutral" rating to an "overweight" rating and upped their price target for the company from $7.00 to $10.00 in a research report on Tuesday, December 10th.

Read Our Latest Stock Report on Vimeo

Vimeo Stock Down 0.9 %

VMEO traded down $0.05 during trading on Friday, reaching $5.47. 2,690,362 shares of the stock traded hands, compared to its average volume of 1,740,659. The stock has a market capitalization of $901.74 million, a PE ratio of 34.19 and a beta of 2.22. The stock's 50-day moving average is $6.10 and its 200 day moving average is $5.96. Vimeo, Inc. has a 12 month low of $3.43 and a 12 month high of $7.90.

Vimeo (NASDAQ:VMEO - Get Free Report) last released its quarterly earnings data on Wednesday, February 19th. The company reported $0.01 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.01. The company had revenue of $103.16 million for the quarter, compared to analysts' expectations of $100.60 million. Vimeo had a net margin of 6.48% and a return on equity of 6.72%. As a group, equities research analysts anticipate that Vimeo, Inc. will post 0.16 EPS for the current year.

Vimeo Profile

(

Free Report)

Vimeo, Inc, together with its subsidiaries, provides video software solutions worldwide. It provides the video tools through a software-as-a-service model, which enables its users to create, collaborate, and communicate with video on a single platform. The company also offers over-the-top OTT streaming and monetization services; AI-driven video creation and editing tools; and interactive and shoppable video tools.

Further Reading

Before you consider Vimeo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vimeo wasn't on the list.

While Vimeo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.