Royce & Associates LP trimmed its stake in Tejon Ranch Co. (NYSE:TRC - Free Report) by 20.5% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 313,818 shares of the real estate development and agribusiness company's stock after selling 80,828 shares during the period. Royce & Associates LP owned 1.17% of Tejon Ranch worth $4,990,000 as of its most recent SEC filing.

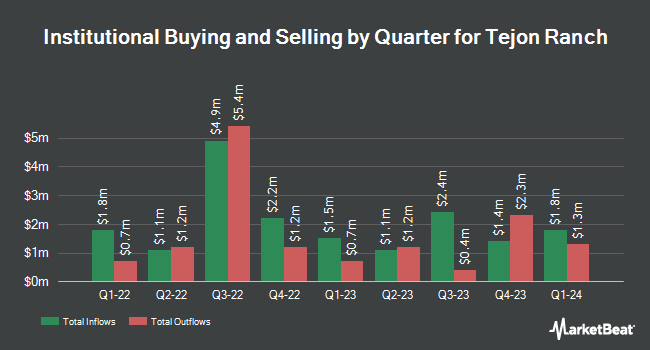

Other institutional investors and hedge funds have also recently modified their holdings of the company. Barclays PLC lifted its position in shares of Tejon Ranch by 298.1% in the 3rd quarter. Barclays PLC now owns 32,072 shares of the real estate development and agribusiness company's stock worth $563,000 after purchasing an additional 24,015 shares during the period. Proficio Capital Partners LLC purchased a new position in Tejon Ranch during the 4th quarter valued at about $312,000. SG Americas Securities LLC lifted its position in Tejon Ranch by 30.3% during the 4th quarter. SG Americas Securities LLC now owns 19,010 shares of the real estate development and agribusiness company's stock valued at $302,000 after acquiring an additional 4,424 shares during the period. OFI Invest Asset Management purchased a new position in Tejon Ranch during the 4th quarter valued at about $632,000. Finally, Geode Capital Management LLC lifted its position in Tejon Ranch by 0.8% during the 3rd quarter. Geode Capital Management LLC now owns 537,987 shares of the real estate development and agribusiness company's stock valued at $9,444,000 after acquiring an additional 4,247 shares during the period. 60.63% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Separately, StockNews.com raised shares of Tejon Ranch to a "sell" rating in a research report on Wednesday, March 5th.

Get Our Latest Analysis on Tejon Ranch

Tejon Ranch Stock Down 2.5 %

NYSE TRC traded down $0.40 during trading hours on Friday, reaching $15.67. 203,317 shares of the company's stock traded hands, compared to its average volume of 87,642. Tejon Ranch Co. has a 52-week low of $14.71 and a 52-week high of $19.82. The firm has a market cap of $420.83 million, a PE ratio of -1,567,000.00 and a beta of 0.59. The firm has a 50-day simple moving average of $15.92 and a 200 day simple moving average of $16.25. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.84 and a quick ratio of 2.46.

Tejon Ranch (NYSE:TRC - Get Free Report) last issued its quarterly earnings results on Thursday, March 6th. The real estate development and agribusiness company reported $0.17 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.03 by $0.14. The company had revenue of $17.94 million during the quarter, compared to analysts' expectations of $15.53 million. Tejon Ranch had a negative net margin of 0.57% and a negative return on equity of 0.05%. Sell-side analysts anticipate that Tejon Ranch Co. will post -0.04 EPS for the current fiscal year.

About Tejon Ranch

(

Free Report)

Tejon Ranch Co, together with its subsidiaries, operates as a diversified real estate development and agribusiness company. It operates through five segments: Commercial/Industrial Real Estate Development, Resort/Residential Real Estate Development, Mineral Resources, Farming, and Ranch Operations. The Commercial/Industrial Real Estate Development segment engages in the planning and permitting of land for development; construction of infrastructure projects, pre-leased buildings, and buildings to be leased or sold; and sale of land to third parties for their own development.

Further Reading

Before you consider Tejon Ranch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tejon Ranch wasn't on the list.

While Tejon Ranch currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.