Royce & Associates LP lifted its stake in shares of Aviat Networks, Inc. (NASDAQ:AVNW - Free Report) by 8.5% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 696,394 shares of the communications equipment provider's stock after buying an additional 54,339 shares during the quarter. Royce & Associates LP owned about 5.49% of Aviat Networks worth $15,063,000 as of its most recent filing with the Securities & Exchange Commission.

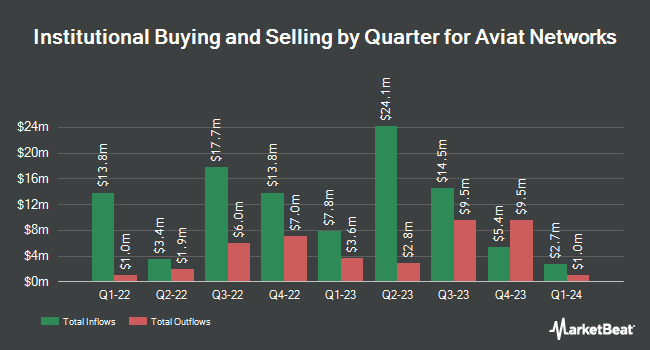

Other hedge funds also recently modified their holdings of the company. Hodges Capital Management Inc. boosted its holdings in Aviat Networks by 80.8% in the second quarter. Hodges Capital Management Inc. now owns 365,535 shares of the communications equipment provider's stock worth $10,487,000 after acquiring an additional 163,365 shares in the last quarter. Select Equity Group L.P. lifted its holdings in shares of Aviat Networks by 8.7% in the 2nd quarter. Select Equity Group L.P. now owns 380,184 shares of the communications equipment provider's stock worth $10,907,000 after purchasing an additional 30,582 shares in the last quarter. Assenagon Asset Management S.A. acquired a new stake in Aviat Networks in the 3rd quarter valued at $589,000. Aristides Capital LLC grew its position in Aviat Networks by 12.2% in the 1st quarter. Aristides Capital LLC now owns 137,472 shares of the communications equipment provider's stock valued at $5,271,000 after purchasing an additional 15,000 shares during the period. Finally, Bright Futures Wealth Management LLC. bought a new stake in Aviat Networks during the 1st quarter valued at $562,000. Institutional investors own 78.62% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently issued reports on AVNW shares. Roth Mkm reduced their price objective on shares of Aviat Networks from $43.00 to $39.00 and set a "buy" rating for the company in a report on Wednesday, November 6th. B. Riley cut their price target on Aviat Networks from $55.00 to $42.00 and set a "buy" rating for the company in a research note on Friday, September 13th. JMP Securities reissued a "market outperform" rating and set a $50.00 price objective on shares of Aviat Networks in a report on Tuesday, October 8th. StockNews.com lowered Aviat Networks from a "hold" rating to a "sell" rating in a report on Thursday, November 7th. Finally, Northland Securities decreased their price target on Aviat Networks from $40.00 to $35.00 and set an "outperform" rating for the company in a report on Tuesday, October 8th. One analyst has rated the stock with a sell rating and five have given a buy rating to the company. According to MarketBeat.com, Aviat Networks has a consensus rating of "Moderate Buy" and a consensus target price of $38.60.

Check Out Our Latest Stock Report on AVNW

Aviat Networks Stock Performance

Shares of AVNW stock traded down $0.12 during trading on Friday, hitting $13.79. The company's stock had a trading volume of 304,596 shares, compared to its average volume of 124,703. The business has a fifty day moving average of $20.62 and a 200-day moving average of $26.14. The company has a market cap of $175.00 million, a PE ratio of -44.48 and a beta of 1.81. Aviat Networks, Inc. has a 52 week low of $12.95 and a 52 week high of $38.85. The company has a current ratio of 1.72, a quick ratio of 1.40 and a debt-to-equity ratio of 0.33.

Aviat Networks (NASDAQ:AVNW - Get Free Report) last announced its quarterly earnings data on Friday, October 4th. The communications equipment provider reported $0.58 earnings per share (EPS) for the quarter. Aviat Networks had a positive return on equity of 4.94% and a negative net margin of 0.98%. The firm had revenue of $116.66 million during the quarter. As a group, research analysts anticipate that Aviat Networks, Inc. will post 0.74 earnings per share for the current year.

Insider Activity at Aviat Networks

In other news, CFO Michael Connaway acquired 3,500 shares of the firm's stock in a transaction that occurred on Friday, November 8th. The stock was bought at an average price of $14.13 per share, with a total value of $49,455.00. Following the acquisition, the chief financial officer now owns 57,893 shares in the company, valued at $818,028.09. The trade was a 6.43 % increase in their position. The acquisition was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CEO Pete A. Smith acquired 3,000 shares of the stock in a transaction that occurred on Friday, November 8th. The stock was purchased at an average price of $14.13 per share, for a total transaction of $42,390.00. Following the completion of the purchase, the chief executive officer now directly owns 298,539 shares in the company, valued at $4,218,356.07. This trade represents a 1.02 % increase in their position. The disclosure for this purchase can be found here. 4.10% of the stock is owned by company insiders.

Aviat Networks Company Profile

(

Free Report)

Aviat Networks, Inc provides microwave networking and wireless access networking solutions in North America, Africa, the Middle East, Europe, Latin America, and the Asia Pacific. The company offers outdoor, indoor, and split-mount radios; microwave routers, switches, and trunking; and private LTE, virtual fiber, and element management products; and hosted software products, such as aviat design, frequency assurance software, and health assurance software.

Featured Articles

Before you consider Aviat Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aviat Networks wasn't on the list.

While Aviat Networks currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.