Royce & Associates LP grew its stake in shares of Cross Country Healthcare, Inc. (NASDAQ:CCRN - Free Report) by 51.4% in the third quarter, according to its most recent disclosure with the SEC. The fund owned 1,132,566 shares of the business services provider's stock after buying an additional 384,374 shares during the period. Royce & Associates LP owned approximately 3.35% of Cross Country Healthcare worth $15,222,000 as of its most recent filing with the SEC.

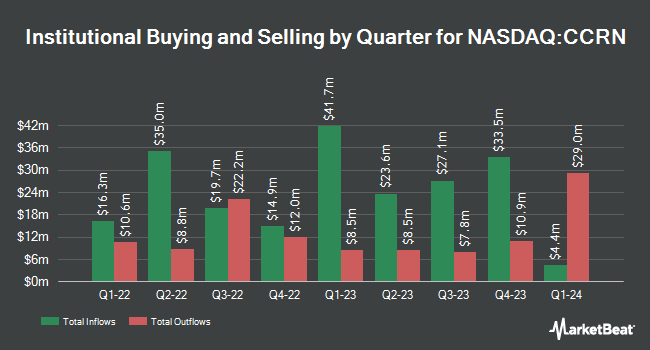

Other hedge funds have also made changes to their positions in the company. nVerses Capital LLC acquired a new position in Cross Country Healthcare in the 2nd quarter valued at approximately $50,000. US Bancorp DE lifted its position in Cross Country Healthcare by 10,909.3% in the third quarter. US Bancorp DE now owns 4,734 shares of the business services provider's stock worth $64,000 after purchasing an additional 4,691 shares during the period. GAMMA Investing LLC boosted its stake in Cross Country Healthcare by 622.4% during the second quarter. GAMMA Investing LLC now owns 5,678 shares of the business services provider's stock worth $79,000 after buying an additional 4,892 shares in the last quarter. SG Americas Securities LLC bought a new stake in Cross Country Healthcare in the 3rd quarter valued at $135,000. Finally, EMC Capital Management acquired a new position in shares of Cross Country Healthcare in the 1st quarter valued at $155,000. Institutional investors own 96.03% of the company's stock.

Cross Country Healthcare Stock Performance

Cross Country Healthcare stock traded down $0.20 during trading hours on Friday, hitting $9.81. 482,583 shares of the stock were exchanged, compared to its average volume of 534,872. The stock has a market capitalization of $322.92 million, a P/E ratio of -196.20, a P/E/G ratio of 1.91 and a beta of 0.65. The business's 50-day moving average is $12.52 and its two-hundred day moving average is $14.10. Cross Country Healthcare, Inc. has a 12 month low of $9.58 and a 12 month high of $23.64.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on CCRN shares. Benchmark decreased their target price on shares of Cross Country Healthcare from $19.00 to $18.00 and set a "buy" rating on the stock in a research report on Thursday, November 7th. Truist Financial lowered their price objective on Cross Country Healthcare from $17.00 to $15.00 and set a "hold" rating on the stock in a research note on Monday, October 21st. Finally, Barrington Research cut their target price on Cross Country Healthcare from $21.00 to $19.00 and set an "outperform" rating for the company in a research report on Thursday, August 8th. Three analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, Cross Country Healthcare has an average rating of "Hold" and a consensus price target of $18.50.

Read Our Latest Analysis on Cross Country Healthcare

Cross Country Healthcare Company Profile

(

Free Report)

Cross Country Healthcare, Inc provides talent management and other consultative services for healthcare clients in the United States. The company's Nurse and Allied Staffing segment provides traditional staffing, recruiting, and value-added total talent solutions, including temporary and permanent placement of travel and local nurse and, allied professionals; temporary placement of healthcare leaders within nursing, allied, physician, and human resources; vendor neutral and managed services programs; education healthcare services; in-home care services; and outsourcing services.

Featured Articles

Before you consider Cross Country Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cross Country Healthcare wasn't on the list.

While Cross Country Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.