Royce & Associates LP trimmed its holdings in John Wiley & Sons, Inc. (NYSE:WLY - Free Report) by 30.1% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 33,007 shares of the company's stock after selling 14,181 shares during the period. Royce & Associates LP owned 0.06% of John Wiley & Sons worth $1,593,000 as of its most recent filing with the Securities and Exchange Commission.

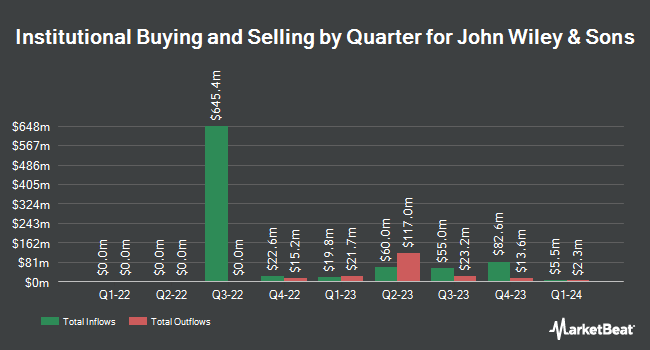

A number of other large investors have also recently added to or reduced their stakes in WLY. Arjuna Capital lifted its holdings in John Wiley & Sons by 1.5% in the 3rd quarter. Arjuna Capital now owns 55,208 shares of the company's stock valued at $2,664,000 after purchasing an additional 830 shares in the last quarter. Victory Capital Management Inc. lifted its holdings in shares of John Wiley & Sons by 113.6% during the 3rd quarter. Victory Capital Management Inc. now owns 35,762 shares of the company's stock worth $1,726,000 after acquiring an additional 19,017 shares during the period. Atria Investments Inc raised its holdings in John Wiley & Sons by 39.6% in the third quarter. Atria Investments Inc now owns 13,509 shares of the company's stock valued at $652,000 after buying an additional 3,833 shares during the period. Verdence Capital Advisors LLC raised its holdings in John Wiley & Sons by 5.8% in the third quarter. Verdence Capital Advisors LLC now owns 7,617 shares of the company's stock valued at $368,000 after buying an additional 417 shares during the period. Finally, Consolidated Planning Corp purchased a new position in John Wiley & Sons in the third quarter valued at approximately $682,000. 73.94% of the stock is owned by institutional investors and hedge funds.

John Wiley & Sons Trading Down 0.2 %

NYSE WLY traded down $0.12 during mid-day trading on Wednesday, hitting $49.77. The company's stock had a trading volume of 42,334 shares, compared to its average volume of 338,068. John Wiley & Sons, Inc. has a 52-week low of $29.04 and a 52-week high of $53.79. The stock's fifty day simple moving average is $49.28 and its two-hundred day simple moving average is $44.87. The company has a debt-to-equity ratio of 1.27, a current ratio of 0.57 and a quick ratio of 0.53. The firm has a market capitalization of $2.70 billion, a P/E ratio of -24.91 and a beta of 0.85.

John Wiley & Sons (NYSE:WLY - Get Free Report) last posted its quarterly earnings results on Thursday, September 5th. The company reported $0.47 EPS for the quarter, missing the consensus estimate of $0.55 by ($0.08). John Wiley & Sons had a negative net margin of 6.00% and a positive return on equity of 21.59%. The business had revenue of $403.81 million during the quarter, compared to analysts' expectations of $387.40 million. During the same quarter in the previous year, the business posted $0.27 EPS. The company's quarterly revenue was down 10.5% on a year-over-year basis.

John Wiley & Sons Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 24th. Investors of record on Tuesday, October 8th were issued a $0.352 dividend. The ex-dividend date was Tuesday, October 8th. This represents a $1.41 annualized dividend and a yield of 2.83%. John Wiley & Sons's payout ratio is -70.50%.

Insider Buying and Selling at John Wiley & Sons

In other John Wiley & Sons news, EVP Danielle Mcmahan sold 2,318 shares of the stock in a transaction that occurred on Tuesday, October 8th. The shares were sold at an average price of $49.41, for a total value of $114,532.38. Following the completion of the sale, the executive vice president now owns 8,978 shares of the company's stock, valued at $443,602.98. This trade represents a 20.52 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 0.62% of the stock is owned by corporate insiders.

John Wiley & Sons Company Profile

(

Free Report)

John Wiley & Sons, Inc operates as a research and education company worldwide. The company operates through three segments: Research, Academic, and Talent. The company offers scientific, technical, medical, and scholarly journals, as well as related content and services to learned societies, individual researchers, other professionals, and academic, corporate, and government libraries.

Further Reading

Before you consider John Wiley & Sons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and John Wiley & Sons wasn't on the list.

While John Wiley & Sons currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.