Royce & Associates LP increased its stake in shares of Cathay General Bancorp (NASDAQ:CATY - Free Report) by 25.4% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 49,420 shares of the bank's stock after buying an additional 10,022 shares during the quarter. Royce & Associates LP owned about 0.07% of Cathay General Bancorp worth $2,123,000 as of its most recent SEC filing.

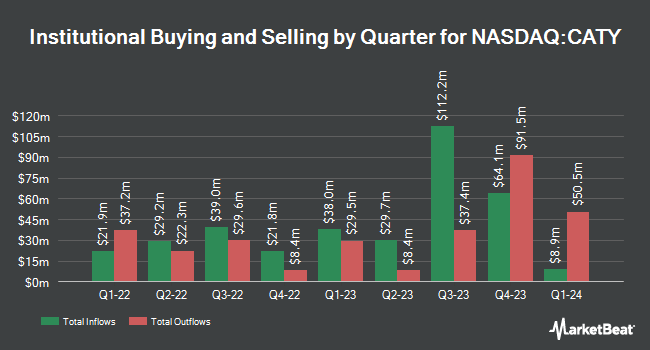

A number of other large investors have also recently made changes to their positions in CATY. Quarry LP lifted its position in Cathay General Bancorp by 76.3% during the second quarter. Quarry LP now owns 765 shares of the bank's stock valued at $29,000 after purchasing an additional 331 shares during the period. Quest Partners LLC acquired a new position in shares of Cathay General Bancorp in the second quarter worth about $40,000. CWM LLC raised its position in shares of Cathay General Bancorp by 168.6% in the second quarter. CWM LLC now owns 1,265 shares of the bank's stock worth $48,000 after acquiring an additional 794 shares during the period. GAMMA Investing LLC raised its position in shares of Cathay General Bancorp by 24.9% in the third quarter. GAMMA Investing LLC now owns 1,531 shares of the bank's stock worth $66,000 after acquiring an additional 305 shares during the period. Finally, Bessemer Group Inc. raised its position in shares of Cathay General Bancorp by 16.6% in the first quarter. Bessemer Group Inc. now owns 3,675 shares of the bank's stock worth $139,000 after acquiring an additional 523 shares during the period. 75.01% of the stock is owned by hedge funds and other institutional investors.

Cathay General Bancorp Trading Down 0.9 %

CATY traded down $0.44 during trading hours on Wednesday, reaching $50.53. The company's stock had a trading volume of 50,672 shares, compared to its average volume of 325,554. Cathay General Bancorp has a fifty-two week low of $33.88 and a fifty-two week high of $54.07. The stock has a market cap of $3.60 billion, a PE ratio of 12.84 and a beta of 1.10. The business's 50-day moving average is $45.48 and its 200-day moving average is $41.56. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.03 and a quick ratio of 1.03.

Cathay General Bancorp (NASDAQ:CATY - Get Free Report) last released its quarterly earnings results on Monday, October 21st. The bank reported $0.94 EPS for the quarter, missing analysts' consensus estimates of $0.95 by ($0.01). Cathay General Bancorp had a return on equity of 11.30% and a net margin of 20.57%. The firm had revenue of $359.86 million for the quarter, compared to analyst estimates of $182.70 million. During the same quarter last year, the company earned $1.13 earnings per share. As a group, equities research analysts predict that Cathay General Bancorp will post 4 earnings per share for the current fiscal year.

Cathay General Bancorp Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 9th. Stockholders of record on Wednesday, November 27th will be given a dividend of $0.34 per share. This represents a $1.36 dividend on an annualized basis and a dividend yield of 2.69%. The ex-dividend date of this dividend is Wednesday, November 27th. Cathay General Bancorp's dividend payout ratio is currently 34.26%.

Insider Transactions at Cathay General Bancorp

In related news, Chairman Dunson K. Cheng sold 12,401 shares of the stock in a transaction on Monday, August 26th. The stock was sold at an average price of $44.79, for a total value of $555,440.79. Following the transaction, the chairman now owns 149,566 shares of the company's stock, valued at $6,699,061.14. This represents a 7.66 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Also, Vice Chairman Peter Wu sold 40,000 shares of the stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $52.87, for a total value of $2,114,800.00. Following the completion of the transaction, the insider now directly owns 295,252 shares in the company, valued at $15,609,973.24. This trade represents a 11.93 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 60,590 shares of company stock valued at $3,055,488. 4.76% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on CATY. Piper Sandler boosted their target price on Cathay General Bancorp from $32.00 to $36.00 and gave the stock an "underweight" rating in a report on Tuesday, July 23rd. Truist Financial upped their price objective on Cathay General Bancorp from $45.00 to $47.00 and gave the company a "hold" rating in a report on Friday, September 20th. Finally, Wedbush upped their price objective on Cathay General Bancorp from $50.00 to $52.00 and gave the company an "outperform" rating in a report on Wednesday, October 23rd. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and one has given a buy rating to the company. Based on data from MarketBeat, Cathay General Bancorp currently has an average rating of "Hold" and an average target price of $44.00.

Get Our Latest Analysis on Cathay General Bancorp

Cathay General Bancorp Profile

(

Free Report)

Cathay General Bancorp operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States. The company offers various deposit products, including passbook accounts, checking accounts, money market deposit accounts, certificates of deposit, individual retirement accounts, and public funds deposits.

Recommended Stories

Before you consider Cathay General Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cathay General Bancorp wasn't on the list.

While Cathay General Bancorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.