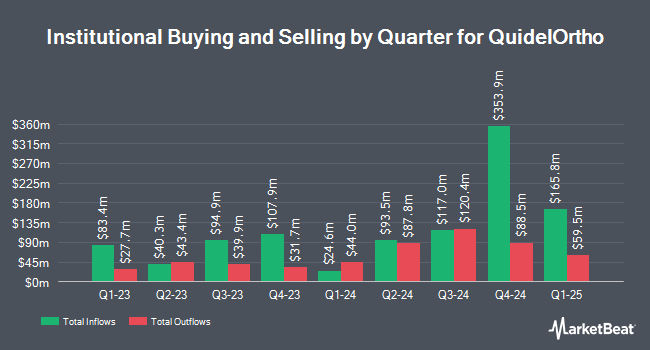

Royce & Associates LP purchased a new position in shares of QuidelOrtho Co. (NASDAQ:QDEL - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 70,869 shares of the company's stock, valued at approximately $3,232,000. Royce & Associates LP owned approximately 0.11% of QuidelOrtho at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently made changes to their positions in QDEL. Texas Permanent School Fund Corp increased its position in QuidelOrtho by 0.6% during the 2nd quarter. Texas Permanent School Fund Corp now owns 43,532 shares of the company's stock valued at $1,446,000 after purchasing an additional 257 shares during the period. Balanced Rock Investment Advisors LLC lifted its holdings in QuidelOrtho by 5.1% during the second quarter. Balanced Rock Investment Advisors LLC now owns 6,784 shares of the company's stock worth $225,000 after buying an additional 329 shares during the period. GAMMA Investing LLC boosted its position in QuidelOrtho by 27.0% during the 2nd quarter. GAMMA Investing LLC now owns 1,778 shares of the company's stock valued at $59,000 after acquiring an additional 378 shares in the last quarter. Algert Global LLC increased its holdings in shares of QuidelOrtho by 1.0% in the 2nd quarter. Algert Global LLC now owns 46,846 shares of the company's stock valued at $1,556,000 after acquiring an additional 450 shares during the period. Finally, Hunter Perkins Capital Management LLC raised its position in shares of QuidelOrtho by 2.9% in the 3rd quarter. Hunter Perkins Capital Management LLC now owns 18,588 shares of the company's stock worth $848,000 after acquiring an additional 530 shares in the last quarter. 99.00% of the stock is currently owned by institutional investors.

QuidelOrtho Stock Performance

Shares of QuidelOrtho stock traded up $1.19 during midday trading on Tuesday, hitting $38.58. The company had a trading volume of 510,114 shares, compared to its average volume of 967,936. The company has a fifty day simple moving average of $41.88 and a 200 day simple moving average of $40.42. The stock has a market cap of $2.59 billion, a price-to-earnings ratio of -1.38 and a beta of 0.12. The company has a quick ratio of 0.81, a current ratio of 1.38 and a debt-to-equity ratio of 0.68. QuidelOrtho Co. has a 12-month low of $29.74 and a 12-month high of $75.86.

QuidelOrtho (NASDAQ:QDEL - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The company reported $0.85 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.30 by $0.55. The business had revenue of $727.00 million during the quarter, compared to analysts' expectations of $642.16 million. QuidelOrtho had a negative net margin of 66.25% and a positive return on equity of 4.24%. The business's quarterly revenue was down 2.3% on a year-over-year basis. During the same quarter last year, the company posted $0.90 earnings per share. As a group, analysts predict that QuidelOrtho Co. will post 1.72 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several research firms have issued reports on QDEL. Royal Bank of Canada reiterated an "outperform" rating and issued a $61.00 target price on shares of QuidelOrtho in a research note on Friday, August 16th. Craig Hallum upgraded shares of QuidelOrtho from a "hold" rating to a "buy" rating and boosted their price objective for the stock from $40.00 to $57.00 in a research note on Thursday, September 5th. Finally, UBS Group began coverage on shares of QuidelOrtho in a research note on Thursday, September 19th. They issued a "neutral" rating and a $50.00 target price for the company. One investment analyst has rated the stock with a sell rating, three have given a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, QuidelOrtho has a consensus rating of "Hold" and a consensus target price of $58.83.

Check Out Our Latest Research Report on QDEL

QuidelOrtho Profile

(

Free Report)

QuidelOrtho Corporation provides diagnostic testing solutions. The company operates through Labs, Transfusion Medicine, Point-of-Care, and Molecular Diagnostics business units. The Labs business unit provides clinical chemistry laboratory instruments and tests that measure target chemicals in bodily fluids for the evaluation of health and the clinical management of patients; immunoassay laboratory instruments and tests, which measure proteins as they act as antigens in the spread of disease, antibodies in the immune response spurred by disease, or markers of proper organ function and health; testing products to detect and monitor disease progression across a spectrum of therapeutic areas; and specialized diagnostic solutions.

Further Reading

Before you consider QuidelOrtho, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuidelOrtho wasn't on the list.

While QuidelOrtho currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.