Royce & Associates LP bought a new stake in Sonos, Inc. (NASDAQ:SONO - Free Report) in the 4th quarter, according to its most recent disclosure with the SEC. The fund bought 23,766 shares of the company's stock, valued at approximately $357,000.

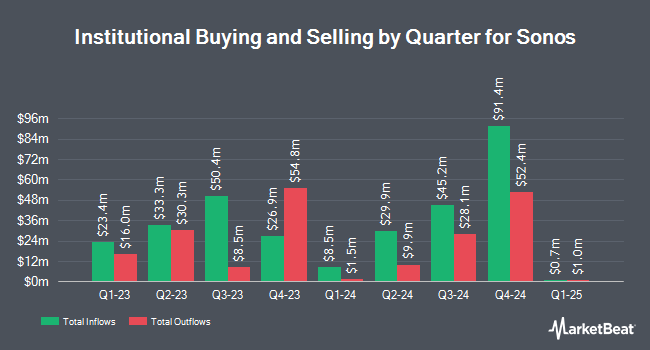

A number of other institutional investors and hedge funds also recently bought and sold shares of the business. SBI Securities Co. Ltd. purchased a new position in shares of Sonos in the fourth quarter valued at approximately $30,000. Smartleaf Asset Management LLC grew its stake in shares of Sonos by 191.2% in the fourth quarter. Smartleaf Asset Management LLC now owns 2,621 shares of the company's stock worth $39,000 after acquiring an additional 1,721 shares in the last quarter. KBC Group NV increased its position in shares of Sonos by 52.5% during the third quarter. KBC Group NV now owns 4,852 shares of the company's stock worth $60,000 after acquiring an additional 1,670 shares during the period. GAMMA Investing LLC raised its stake in shares of Sonos by 50.1% in the fourth quarter. GAMMA Investing LLC now owns 4,048 shares of the company's stock valued at $61,000 after acquiring an additional 1,352 shares in the last quarter. Finally, Hohimer Wealth Management LLC acquired a new stake in shares of Sonos in the third quarter valued at $148,000. 85.82% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, Rosenblatt Securities restated a "buy" rating and set a $18.00 price target on shares of Sonos in a report on Friday, February 7th.

Get Our Latest Report on Sonos

Sonos Stock Down 1.5 %

NASDAQ SONO traded down $0.17 on Wednesday, hitting $11.45. 971,310 shares of the stock were exchanged, compared to its average volume of 1,796,302. Sonos, Inc. has a fifty-two week low of $10.23 and a fifty-two week high of $19.45. The company has a 50-day moving average price of $13.07 and a 200-day moving average price of $13.27. The company has a market cap of $1.36 billion, a PE ratio of -20.09 and a beta of 1.98.

Sonos (NASDAQ:SONO - Get Free Report) last posted its earnings results on Thursday, February 6th. The company reported $0.40 EPS for the quarter, beating the consensus estimate of $0.36 by $0.04. Sonos had a negative return on equity of 13.17% and a negative net margin of 4.73%. As a group, equities research analysts predict that Sonos, Inc. will post -0.37 EPS for the current fiscal year.

Sonos declared that its Board of Directors has initiated a share buyback plan on Monday, February 24th that allows the company to repurchase $150.00 million in shares. This repurchase authorization allows the company to repurchase up to 10.1% of its shares through open market purchases. Shares repurchase plans are typically a sign that the company's leadership believes its stock is undervalued.

Sonos Profile

(

Free Report)

Sonos, Inc, together with its subsidiaries, designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers wireless, portable, and home theater speakers; components; and accessories. The company offers its products through approximately 10,000 third-party retail stores, including custom installers of home audio systems; and e-commerce retailers, as well as through its website.

See Also

Before you consider Sonos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonos wasn't on the list.

While Sonos currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.