Royce & Associates LP acquired a new position in shares of Liquidity Services, Inc. (NASDAQ:LQDT - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 21,423 shares of the business services provider's stock, valued at approximately $488,000. Royce & Associates LP owned about 0.07% of Liquidity Services as of its most recent SEC filing.

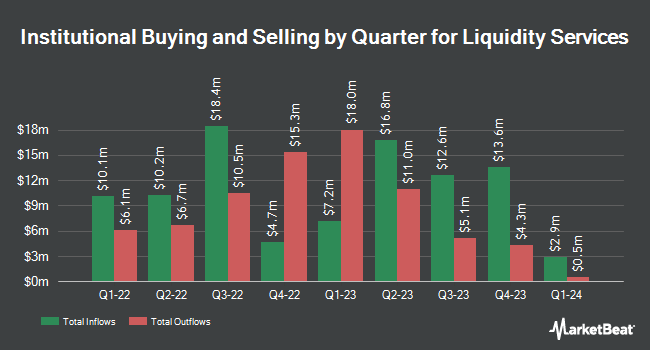

Several other hedge funds have also added to or reduced their stakes in the company. Essex Investment Management Co. LLC acquired a new position in Liquidity Services in the third quarter valued at about $2,749,000. Acadian Asset Management LLC increased its position in Liquidity Services by 15.7% during the 2nd quarter. Acadian Asset Management LLC now owns 503,600 shares of the business services provider's stock valued at $10,060,000 after purchasing an additional 68,407 shares during the period. Silvercrest Asset Management Group LLC raised its holdings in Liquidity Services by 8.9% during the 1st quarter. Silvercrest Asset Management Group LLC now owns 777,960 shares of the business services provider's stock worth $14,470,000 after purchasing an additional 63,571 shares during the last quarter. Allspring Global Investments Holdings LLC bought a new stake in shares of Liquidity Services in the 3rd quarter valued at $1,311,000. Finally, Vanguard Group Inc. increased its position in shares of Liquidity Services by 3.0% during the first quarter. Vanguard Group Inc. now owns 1,821,231 shares of the business services provider's stock worth $33,875,000 after buying an additional 52,997 shares during the period. 71.15% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, Barrington Research restated an "outperform" rating and set a $27.00 target price on shares of Liquidity Services in a research report on Monday, August 26th.

Get Our Latest Stock Report on Liquidity Services

Liquidity Services Trading Down 1.4 %

LQDT opened at $25.00 on Thursday. The company has a market cap of $763.25 million, a price-to-earnings ratio of 39.68 and a beta of 1.39. The company's fifty day moving average price is $22.83 and its two-hundred day moving average price is $21.27. Liquidity Services, Inc. has a 1-year low of $13.99 and a 1-year high of $25.79.

Insider Buying and Selling at Liquidity Services

In related news, EVP John Daunt sold 7,403 shares of the business's stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $21.26, for a total transaction of $157,387.78. Following the transaction, the executive vice president now directly owns 43,309 shares in the company, valued at approximately $920,749.34. The trade was a 14.60 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Jorge Celaya sold 10,000 shares of the company's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $22.03, for a total transaction of $220,300.00. Following the completion of the sale, the chief financial officer now directly owns 52,407 shares of the company's stock, valued at $1,154,526.21. The trade was a 16.02 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 124,203 shares of company stock worth $2,722,058. Insiders own 29.77% of the company's stock.

Liquidity Services Company Profile

(

Free Report)

Liquidity Services, Inc provides e-commerce marketplaces, self-directed auction listing tools, and value-added services in the United States and internationally. The company operates through four segments: GovDeals, Retail Supply Chain Group (RSCG), Capital Assets Group (CAG), and Machinio. Its marketplaces include liquidation.com that enable corporations to sell surplus and salvage consumer goods and retail capital assets; GovDeals marketplace, which provides self-directed service solutions in which sellers list their own assets that enables local and state government entities, and commercial businesses located in the United States and Canada to sell surplus and salvage assets; and AllSurplus, a centralized marketplace that connects global buyer base with assets from across the network of marketplaces in a single destination.

Featured Articles

Before you consider Liquidity Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liquidity Services wasn't on the list.

While Liquidity Services currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.