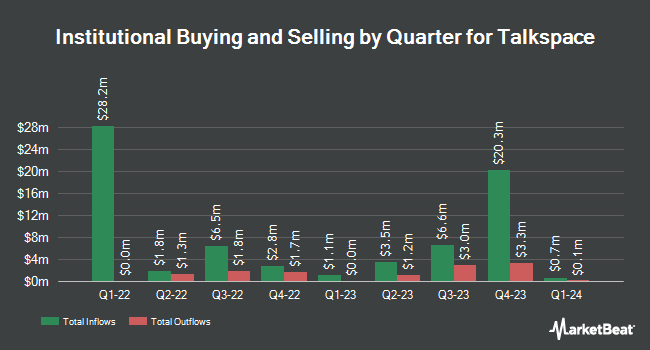

Royce & Associates LP boosted its position in Talkspace, Inc. (NASDAQ:TALK - Free Report) by 39.7% in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 698,722 shares of the company's stock after buying an additional 198,722 shares during the quarter. Royce & Associates LP owned approximately 0.41% of Talkspace worth $2,159,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds have also recently made changes to their positions in the company. Belvedere Trading LLC bought a new stake in Talkspace in the 4th quarter valued at about $37,000. Bay Colony Advisory Group Inc d b a Bay Colony Advisors bought a new stake in Talkspace during the 4th quarter valued at $69,000. Intech Investment Management LLC bought a new stake in Talkspace during the 3rd quarter valued at $56,000. Sugar Maple Asset Management LLC lifted its position in shares of Talkspace by 75.0% during the fourth quarter. Sugar Maple Asset Management LLC now owns 28,000 shares of the company's stock worth $87,000 after acquiring an additional 12,000 shares in the last quarter. Finally, Globeflex Capital L P bought a new position in shares of Talkspace in the fourth quarter worth $117,000. 57.37% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of analysts recently issued reports on TALK shares. Mizuho assumed coverage on Talkspace in a research note on Wednesday, December 4th. They set an "outperform" rating and a $5.00 price objective on the stock. Needham & Company LLC reiterated a "hold" rating on shares of Talkspace in a research report on Friday, February 21st. Finally, KeyCorp began coverage on shares of Talkspace in a research report on Monday, December 9th. They issued an "overweight" rating and a $4.50 price objective for the company. Two equities research analysts have rated the stock with a hold rating, two have given a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Buy" and an average price target of $4.38.

Check Out Our Latest Research Report on Talkspace

Insider Activity

In other Talkspace news, CEO Jon R. Cohen acquired 75,000 shares of the business's stock in a transaction dated Friday, February 28th. The shares were purchased at an average cost of $2.86 per share, for a total transaction of $214,500.00. Following the transaction, the chief executive officer now owns 2,267,980 shares in the company, valued at $6,486,422.80. This represents a 3.42 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Over the last 90 days, insiders purchased 82,270 shares of company stock valued at $235,312. 21.70% of the stock is currently owned by company insiders.

Talkspace Price Performance

TALK stock traded down $0.03 during midday trading on Tuesday, reaching $2.84. The company had a trading volume of 1,387,514 shares, compared to its average volume of 1,792,826. The firm has a 50-day moving average price of $3.18 and a 200-day moving average price of $2.97. The company has a market capitalization of $478.36 million, a P/E ratio of 284.28 and a beta of 1.15. Talkspace, Inc. has a 1 year low of $1.60 and a 1 year high of $4.36.

Talkspace (NASDAQ:TALK - Get Free Report) last issued its earnings results on Thursday, February 20th. The company reported $0.01 EPS for the quarter, hitting analysts' consensus estimates of $0.01. The company had revenue of $48.72 million for the quarter, compared to analysts' expectations of $49.94 million. Talkspace had a net margin of 0.61% and a return on equity of 0.98%. On average, equities analysts predict that Talkspace, Inc. will post 0.08 EPS for the current year.

About Talkspace

(

Free Report)

Talkspace, Inc operates as a virtual behavioral healthcare company in the United States. The company offers psychotherapy and psychiatry services through its platform to individuals, enterprises, and health plans and employee assistance programs. It provides text, audio, and video-based psychotherapy from licensed therapists.

Featured Stories

Before you consider Talkspace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talkspace wasn't on the list.

While Talkspace currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.