Royce & Associates LP purchased a new position in World Acceptance Co. (NASDAQ:WRLD - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 5,312 shares of the credit services provider's stock, valued at approximately $627,000. Royce & Associates LP owned approximately 0.09% of World Acceptance at the end of the most recent reporting period.

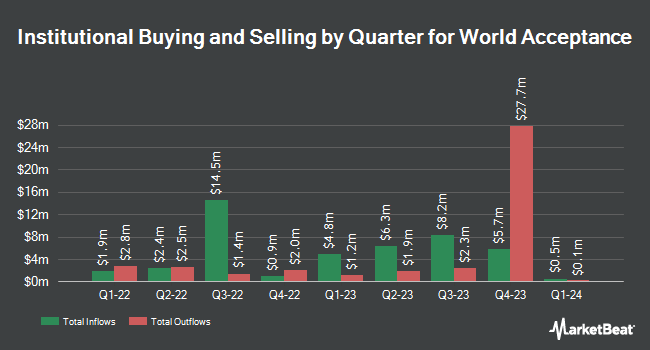

Other hedge funds and other institutional investors have also bought and sold shares of the company. Quadrature Capital Ltd grew its stake in World Acceptance by 89.5% in the 1st quarter. Quadrature Capital Ltd now owns 23,869 shares of the credit services provider's stock worth $3,455,000 after buying an additional 11,275 shares in the last quarter. Millennium Management LLC lifted its holdings in shares of World Acceptance by 125.2% in the 2nd quarter. Millennium Management LLC now owns 22,184 shares of the credit services provider's stock worth $2,741,000 after acquiring an additional 12,333 shares during the last quarter. Comerica Bank raised its holdings in World Acceptance by 63.1% during the 1st quarter. Comerica Bank now owns 2,562 shares of the credit services provider's stock valued at $371,000 after buying an additional 991 shares during the last quarter. CWM LLC raised its holdings in World Acceptance by 122.4% during the 2nd quarter. CWM LLC now owns 585 shares of the credit services provider's stock valued at $72,000 after buying an additional 322 shares during the last quarter. Finally, O Shaughnessy Asset Management LLC raised its holdings in World Acceptance by 2.5% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 3,770 shares of the credit services provider's stock valued at $547,000 after buying an additional 93 shares during the last quarter. Hedge funds and other institutional investors own 83.63% of the company's stock.

Insider Transactions at World Acceptance

In related news, insider Luke J. Umstetter sold 550 shares of the stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $114.30, for a total transaction of $62,865.00. Following the sale, the insider now directly owns 11,370 shares of the company's stock, valued at approximately $1,299,591. This represents a 4.61 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 43.20% of the company's stock.

Analysts Set New Price Targets

Separately, Stephens began coverage on shares of World Acceptance in a report on Wednesday, November 13th. They issued an "equal weight" rating and a $10.00 price objective for the company.

Read Our Latest Research Report on WRLD

World Acceptance Stock Up 0.5 %

NASDAQ:WRLD opened at $116.69 on Thursday. The firm's 50-day moving average price is $117.27 and its 200-day moving average price is $121.48. The company has a market capitalization of $670.97 million, a PE ratio of 7.93 and a beta of 1.40. The company has a debt-to-equity ratio of 1.21, a current ratio of 19.53 and a quick ratio of 19.53. World Acceptance Co. has a 1-year low of $101.85 and a 1-year high of $149.31.

About World Acceptance

(

Free Report)

World Acceptance Corporation engages in consumer finance business in the United States. The company provides short-term small installment loans, medium-term larger installment loans, related credit insurance, and ancillary products and services to individuals. It offers income tax return preparation and filing services; and automobile club memberships.

Recommended Stories

Before you consider World Acceptance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and World Acceptance wasn't on the list.

While World Acceptance currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.