Royce & Associates LP grew its stake in shares of TaskUs, Inc. (NASDAQ:TASK - Free Report) by 8.9% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 669,579 shares of the company's stock after buying an additional 54,770 shares during the period. Royce & Associates LP owned 0.75% of TaskUs worth $8,651,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

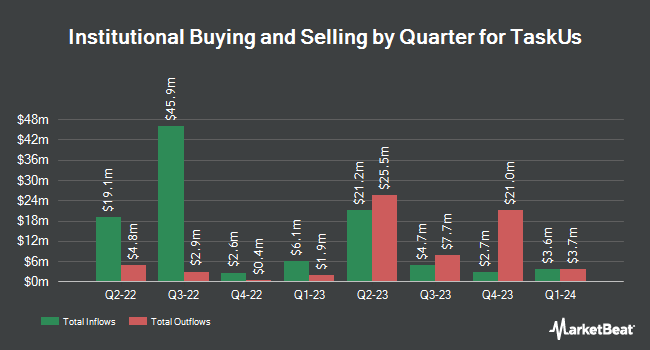

Several other hedge funds have also recently modified their holdings of TASK. nVerses Capital LLC purchased a new position in TaskUs during the 2nd quarter valued at approximately $28,000. US Bancorp DE grew its holdings in shares of TaskUs by 101.2% in the third quarter. US Bancorp DE now owns 5,001 shares of the company's stock valued at $65,000 after purchasing an additional 2,516 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in shares of TaskUs by 55.3% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 5,581 shares of the company's stock valued at $74,000 after purchasing an additional 1,988 shares in the last quarter. CWM LLC increased its position in TaskUs by 25,053.3% in the third quarter. CWM LLC now owns 7,546 shares of the company's stock worth $97,000 after purchasing an additional 7,516 shares during the last quarter. Finally, Olympiad Research LP bought a new position in TaskUs during the third quarter valued at $143,000. Hedge funds and other institutional investors own 44.64% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts recently commented on TASK shares. Bank of America upgraded TaskUs from an "underperform" rating to a "neutral" rating and lifted their price target for the stock from $12.00 to $18.00 in a research report on Monday, July 22nd. JPMorgan Chase & Co. decreased their price target on TaskUs from $17.00 to $15.00 and set a "neutral" rating on the stock in a report on Friday, September 6th. Robert W. Baird boosted their price objective on shares of TaskUs from $16.00 to $20.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Citigroup raised their target price on shares of TaskUs from $18.00 to $19.00 and gave the stock a "buy" rating in a report on Monday, August 12th. Finally, Royal Bank of Canada raised their price objective on shares of TaskUs from $17.00 to $18.00 and gave the stock a "sector perform" rating in a research note on Friday, August 9th. One research analyst has rated the stock with a sell rating, four have assigned a hold rating and two have assigned a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $16.43.

Check Out Our Latest Stock Report on TASK

TaskUs Trading Up 2.8 %

Shares of NASDAQ:TASK traded up $0.39 during trading on Monday, reaching $14.15. 246,676 shares of the company were exchanged, compared to its average volume of 225,783. The business's fifty day simple moving average is $12.85 and its 200-day simple moving average is $13.77. The company has a debt-to-equity ratio of 0.50, a current ratio of 3.02 and a quick ratio of 3.23. TaskUs, Inc. has a 12-month low of $10.56 and a 12-month high of $19.60. The firm has a market capitalization of $1.26 billion, a PE ratio of 23.68, a P/E/G ratio of 3.62 and a beta of 2.28.

About TaskUs

(

Free Report)

TaskUs, Inc provides digital outsourcing services for companies in Philippines, the United States, India, and internationally. It offers digital customer experience that consists of omni-channel customer care services primarily delivered through non-voice digital channels; and other solutions, including experience and customer care services for new product or market launches, and customer acquisition solutions.

Recommended Stories

Before you consider TaskUs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TaskUs wasn't on the list.

While TaskUs currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.