Royce & Associates LP lessened its position in shares of Hovnanian Enterprises, Inc. (NYSE:HOV - Free Report) by 17.1% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 24,200 shares of the construction company's stock after selling 5,000 shares during the period. Royce & Associates LP owned approximately 0.40% of Hovnanian Enterprises worth $4,946,000 as of its most recent filing with the Securities and Exchange Commission.

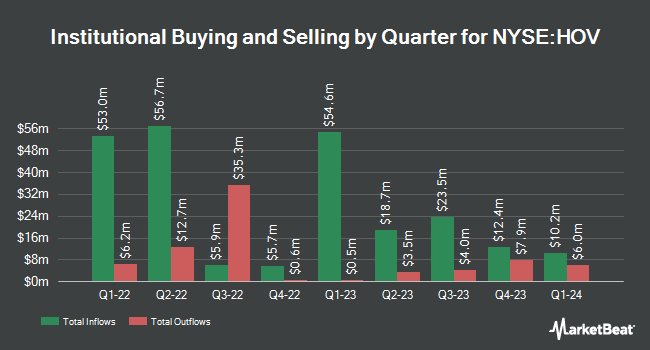

Other institutional investors and hedge funds have also bought and sold shares of the company. Russell Investments Group Ltd. boosted its position in shares of Hovnanian Enterprises by 177.0% during the 1st quarter. Russell Investments Group Ltd. now owns 2,191 shares of the construction company's stock valued at $344,000 after acquiring an additional 1,400 shares during the last quarter. Vanguard Group Inc. grew its stake in Hovnanian Enterprises by 6.1% in the 1st quarter. Vanguard Group Inc. now owns 280,435 shares of the construction company's stock worth $44,011,000 after buying an additional 16,012 shares in the last quarter. EntryPoint Capital LLC increased its holdings in shares of Hovnanian Enterprises by 309.9% in the 1st quarter. EntryPoint Capital LLC now owns 828 shares of the construction company's stock worth $130,000 after buying an additional 626 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in shares of Hovnanian Enterprises by 2.4% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 7,917 shares of the construction company's stock valued at $1,243,000 after buying an additional 188 shares in the last quarter. Finally, SG Americas Securities LLC raised its position in shares of Hovnanian Enterprises by 2,143.3% during the 2nd quarter. SG Americas Securities LLC now owns 14,402 shares of the construction company's stock valued at $2,044,000 after buying an additional 13,760 shares in the last quarter. 65.40% of the stock is currently owned by hedge funds and other institutional investors.

Hovnanian Enterprises Trading Up 3.9 %

Hovnanian Enterprises stock traded up $6.40 during mid-day trading on Tuesday, hitting $172.31. The company's stock had a trading volume of 51,348 shares, compared to its average volume of 79,361. The business has a 50 day moving average price of $192.40 and a 200-day moving average price of $179.06. Hovnanian Enterprises, Inc. has a 12 month low of $86.61 and a 12 month high of $240.34. The stock has a market cap of $1.04 billion, a price-to-earnings ratio of 5.32 and a beta of 2.60. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.45 and a quick ratio of 0.27.

Hovnanian Enterprises (NYSE:HOV - Get Free Report) last posted its earnings results on Thursday, August 22nd. The construction company reported $9.75 earnings per share (EPS) for the quarter. The firm had revenue of $722.70 million for the quarter. Hovnanian Enterprises had a return on equity of 52.22% and a net margin of 8.41%. During the same period last year, the firm posted $7.38 earnings per share. As a group, analysts forecast that Hovnanian Enterprises, Inc. will post 30 EPS for the current year.

Analyst Ratings Changes

Separately, StockNews.com lowered Hovnanian Enterprises from a "buy" rating to a "hold" rating in a research note on Friday, August 23rd.

Read Our Latest Stock Analysis on Hovnanian Enterprises

Insider Activity

In other Hovnanian Enterprises news, CEO Ara K. Hovnanian sold 20,000 shares of Hovnanian Enterprises stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $229.45, for a total transaction of $4,589,000.00. Following the completion of the transaction, the chief executive officer now owns 12,890 shares in the company, valued at approximately $2,957,610.50. The trade was a 60.81 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Edward A. Kangas sold 4,000 shares of the stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $232.21, for a total value of $928,840.00. Following the completion of the sale, the director now directly owns 14,790 shares in the company, valued at approximately $3,434,385.90. This represents a 21.29 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 58,057 shares of company stock valued at $12,824,040. Corporate insiders own 17.67% of the company's stock.

About Hovnanian Enterprises

(

Free Report)

Hovnanian Enterprises, Inc, through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States. It offers single-family detached homes, attached townhomes and condominiums, urban infill, and active lifestyle homes with amenities, such as clubhouses, swimming pools, tennis courts, tot lots, and open areas.

Read More

Before you consider Hovnanian Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hovnanian Enterprises wasn't on the list.

While Hovnanian Enterprises currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.