Royce & Associates LP decreased its holdings in shares of Ziff Davis, Inc. (NASDAQ:ZD - Free Report) by 33.5% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,278,270 shares of the technology company's stock after selling 644,651 shares during the quarter. Ziff Davis comprises about 0.6% of Royce & Associates LP's investment portfolio, making the stock its 22nd largest position. Royce & Associates LP owned about 2.99% of Ziff Davis worth $69,461,000 at the end of the most recent quarter.

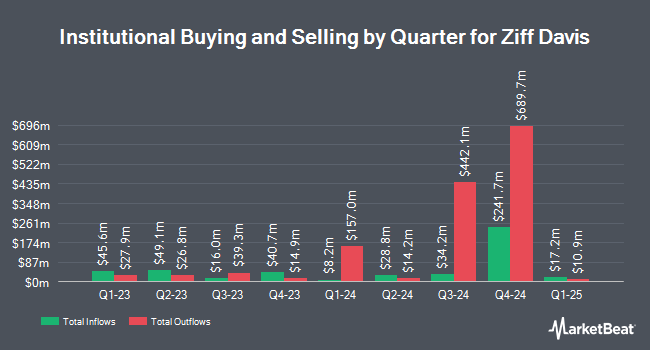

Other institutional investors have also bought and sold shares of the company. TD Private Client Wealth LLC boosted its holdings in shares of Ziff Davis by 19.2% in the 3rd quarter. TD Private Client Wealth LLC now owns 1,549 shares of the technology company's stock worth $75,000 after purchasing an additional 249 shares during the period. First Horizon Advisors Inc. boosted its stake in Ziff Davis by 42.9% during the fourth quarter. First Horizon Advisors Inc. now owns 866 shares of the technology company's stock worth $47,000 after buying an additional 260 shares during the period. Central Pacific Bank Trust Division increased its position in Ziff Davis by 17.9% during the fourth quarter. Central Pacific Bank Trust Division now owns 3,220 shares of the technology company's stock valued at $175,000 after acquiring an additional 490 shares during the last quarter. Hunter Perkins Capital Management LLC raised its stake in shares of Ziff Davis by 4.0% in the fourth quarter. Hunter Perkins Capital Management LLC now owns 14,855 shares of the technology company's stock valued at $807,000 after acquiring an additional 565 shares during the period. Finally, Atria Investments Inc lifted its holdings in shares of Ziff Davis by 8.9% in the 4th quarter. Atria Investments Inc now owns 9,143 shares of the technology company's stock worth $497,000 after acquiring an additional 747 shares during the last quarter. Institutional investors own 99.76% of the company's stock.

Ziff Davis Trading Up 0.2 %

Shares of Ziff Davis stock traded up $0.09 on Thursday, hitting $41.97. 464,365 shares of the company traded hands, compared to its average volume of 454,053. The company has a current ratio of 1.42, a quick ratio of 1.42 and a debt-to-equity ratio of 0.49. The company has a market cap of $1.80 billion, a PE ratio of 35.57 and a beta of 1.42. The stock's 50 day moving average price is $48.82 and its 200-day moving average price is $50.81. Ziff Davis, Inc. has a 52 week low of $37.62 and a 52 week high of $64.04.

Wall Street Analysts Forecast Growth

Several equities analysts recently commented on ZD shares. Citigroup reduced their price objective on shares of Ziff Davis from $58.00 to $52.00 and set a "neutral" rating on the stock in a research report on Wednesday, February 26th. UBS Group reduced their price target on Ziff Davis from $65.00 to $56.00 and set a "neutral" rating on the stock in a report on Wednesday, February 26th. Finally, JPMorgan Chase & Co. dropped their price objective on Ziff Davis from $70.00 to $60.00 and set an "overweight" rating for the company in a report on Wednesday, February 26th. Three equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $65.67.

Read Our Latest Report on ZD

Insiders Place Their Bets

In other Ziff Davis news, Director W Brian Kretzmer acquired 653 shares of Ziff Davis stock in a transaction that occurred on Thursday, March 6th. The stock was bought at an average price of $38.33 per share, with a total value of $25,029.49. Following the completion of the purchase, the director now directly owns 12,968 shares of the company's stock, valued at approximately $497,063.44. This represents a 5.30 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Sarah Ann Fay bought 1,282 shares of the stock in a transaction on Tuesday, March 4th. The shares were bought at an average price of $39.00 per share, with a total value of $49,998.00. Following the acquisition, the director now owns 18,655 shares of the company's stock, valued at $727,545. This trade represents a 7.38 % increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last ninety days, insiders bought 5,028 shares of company stock worth $198,024. 2.08% of the stock is currently owned by company insiders.

About Ziff Davis

(

Free Report)

Ziff Davis, Inc, together with its subsidiaries, operates as a digital media and internet company in the United States and internationally. The company offers PCMag, an online resource for laboratory-based product reviews, technology news, buying guides, and research papers; Mashable for publishing technology and culture content; Spiceworks Ziff Davis provides digital content of IT products and services; retailMeNot, a savings destination platform; Offers.com, a coupon and deals website; and event-based properties, including BlackFriday.com, TheBlackFriday.com, BestBlackFriday.com, and DealsofAmerica.com.

Further Reading

Before you consider Ziff Davis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ziff Davis wasn't on the list.

While Ziff Davis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.