Royce & Associates LP reduced its stake in shares of Hudson Technologies, Inc. (NASDAQ:HDSN - Free Report) by 97.7% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 20,293 shares of the industrial products company's stock after selling 847,404 shares during the period. Royce & Associates LP's holdings in Hudson Technologies were worth $113,000 as of its most recent SEC filing.

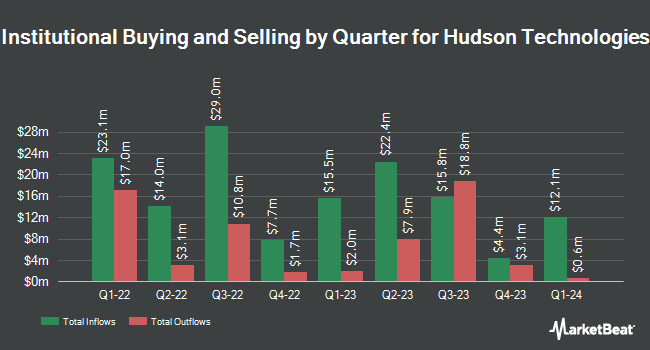

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Aigen Investment Management LP lifted its position in shares of Hudson Technologies by 13.6% in the fourth quarter. Aigen Investment Management LP now owns 18,052 shares of the industrial products company's stock valued at $101,000 after acquiring an additional 2,167 shares in the last quarter. Rhumbline Advisers grew its stake in Hudson Technologies by 3.9% in the 4th quarter. Rhumbline Advisers now owns 69,541 shares of the industrial products company's stock worth $388,000 after acquiring an additional 2,601 shares during the period. West Tower Group LLC acquired a new position in Hudson Technologies in the 3rd quarter valued at $28,000. FMR LLC lifted its stake in shares of Hudson Technologies by 299.8% during the 3rd quarter. FMR LLC now owns 4,670 shares of the industrial products company's stock worth $39,000 after purchasing an additional 3,502 shares during the period. Finally, Quarry LP boosted its holdings in shares of Hudson Technologies by 901.1% during the third quarter. Quarry LP now owns 4,675 shares of the industrial products company's stock worth $39,000 after purchasing an additional 4,208 shares during the last quarter. Hedge funds and other institutional investors own 71.34% of the company's stock.

Wall Street Analyst Weigh In

Separately, Canaccord Genuity Group reduced their target price on Hudson Technologies from $8.00 to $6.25 and set a "hold" rating on the stock in a research report on Monday, March 10th. Six investment analysts have rated the stock with a hold rating, According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $7.50.

Get Our Latest Analysis on HDSN

Hudson Technologies Stock Performance

Shares of HDSN traded up $0.05 during trading hours on Wednesday, hitting $6.29. The stock had a trading volume of 346,485 shares, compared to its average volume of 500,445. The company's fifty day simple moving average is $5.85 and its 200 day simple moving average is $6.43. Hudson Technologies, Inc. has a 12-month low of $5.17 and a 12-month high of $11.65. The firm has a market cap of $276.92 million, a P/E ratio of 9.68, a P/E/G ratio of 0.49 and a beta of 1.12.

About Hudson Technologies

(

Free Report)

Hudson Technologies, Inc, through its subsidiary, Hudson Technologies Company, engages in the provision of solutions to recurring problems within the refrigeration industry in the United States. The company engages in the sale of refrigerant and industrial gas; provision of refrigerant management services consisting primarily of reclamation of refrigerants, re-usable cylinder refurbishment, and hydrostatic testing services; and RefrigerantSide services comprising system decontamination and recovery to remove moisture, oils, and other contaminants.

See Also

Before you consider Hudson Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudson Technologies wasn't on the list.

While Hudson Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.