Royce & Associates LP purchased a new stake in shares of Patterson Companies, Inc. (NASDAQ:PDCO - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 311,682 shares of the company's stock, valued at approximately $6,807,000. Royce & Associates LP owned approximately 0.35% of Patterson Companies as of its most recent SEC filing.

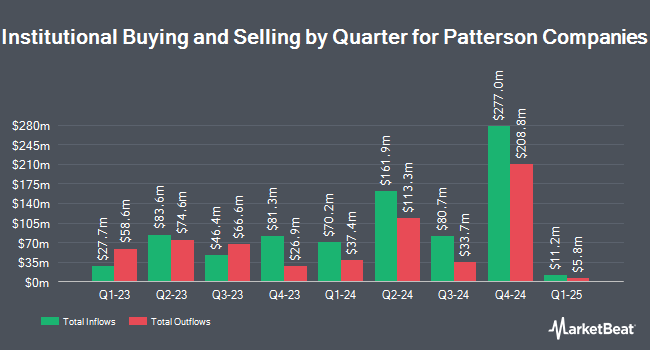

Other hedge funds and other institutional investors have also bought and sold shares of the company. Equity Investment Corp bought a new stake in shares of Patterson Companies in the second quarter worth approximately $37,935,000. Private Management Group Inc. lifted its stake in shares of Patterson Companies by 268.5% during the 2nd quarter. Private Management Group Inc. now owns 1,431,666 shares of the company's stock valued at $34,532,000 after buying an additional 1,043,201 shares in the last quarter. Vanguard Group Inc. raised its stake in Patterson Companies by 7.9% during the 1st quarter. Vanguard Group Inc. now owns 10,018,184 shares of the company's stock valued at $277,003,000 after purchasing an additional 730,819 shares during the period. LSV Asset Management boosted its position in shares of Patterson Companies by 58.8% during the second quarter. LSV Asset Management now owns 1,391,344 shares of the company's stock worth $33,559,000 after acquiring an additional 515,299 shares during the last quarter. Finally, American Century Companies Inc. grew its position in shares of Patterson Companies by 83.6% during the second quarter. American Century Companies Inc. now owns 902,759 shares of the company's stock valued at $21,775,000 after purchasing an additional 411,012 shares in the last quarter. Hedge funds and other institutional investors own 85.43% of the company's stock.

Patterson Companies Stock Performance

NASDAQ:PDCO traded up $1.15 during mid-day trading on Monday, reaching $20.90. The stock had a trading volume of 1,143,632 shares, compared to its average volume of 944,594. The firm has a market capitalization of $1.84 billion, a price-to-earnings ratio of 10.79, a PEG ratio of 1.44 and a beta of 1.02. Patterson Companies, Inc. has a twelve month low of $19.45 and a twelve month high of $32.58. The business has a 50 day simple moving average of $21.05 and a 200 day simple moving average of $23.22. The company has a debt-to-equity ratio of 0.34, a quick ratio of 0.67 and a current ratio of 1.30.

Patterson Companies (NASDAQ:PDCO - Get Free Report) last issued its earnings results on Wednesday, August 28th. The company reported $0.24 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.32 by ($0.08). The firm had revenue of $1.54 billion for the quarter, compared to analysts' expectations of $1.59 billion. Patterson Companies had a return on equity of 19.87% and a net margin of 2.58%. The firm's revenue for the quarter was down 2.3% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.40 EPS. On average, analysts expect that Patterson Companies, Inc. will post 2.32 earnings per share for the current fiscal year.

Patterson Companies Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, November 1st. Investors of record on Wednesday, October 16th were issued a dividend of $0.26 per share. This represents a $1.04 dividend on an annualized basis and a yield of 4.98%. The ex-dividend date of this dividend was Friday, October 18th. Patterson Companies's payout ratio is 56.83%.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on PDCO. Robert W. Baird dropped their target price on Patterson Companies from $30.00 to $28.00 and set a "neutral" rating for the company in a report on Thursday, August 29th. UBS Group dropped their price objective on shares of Patterson Companies from $27.00 to $24.00 and set a "neutral" rating on the stock in a research note on Thursday, September 5th. Evercore ISI lowered their target price on shares of Patterson Companies from $23.00 to $22.00 and set an "in-line" rating for the company in a research note on Tuesday, October 8th. JPMorgan Chase & Co. dropped their price target on Patterson Companies from $29.00 to $26.00 and set a "neutral" rating on the stock in a research note on Thursday, August 29th. Finally, Bank of America reduced their target price on Patterson Companies from $31.00 to $29.00 and set a "buy" rating for the company in a research note on Thursday, August 29th. Nine equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat, Patterson Companies currently has a consensus rating of "Hold" and an average price target of $28.30.

View Our Latest Stock Analysis on Patterson Companies

About Patterson Companies

(

Free Report)

Patterson Companies, Inc engages in the distribution of dental and animal health products in the United States, the United Kingdom, and Canada. The company operates through three segments: Dental, Animal Health, and Corporate segments. The Dental segment offers consumable products, including infection control, restorative materials, and instruments; basic and advanced technology and dental equipment; practice optimization solutions, such as practice management software, e-commerce, revenue cycle management, patient engagement solutions, and clinical and patient education systems.

Read More

Before you consider Patterson Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patterson Companies wasn't on the list.

While Patterson Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.