Royce & Associates LP lessened its stake in Ingles Markets, Incorporated (NASDAQ:IMKTA - Free Report) by 6.3% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 407,000 shares of the company's stock after selling 27,386 shares during the period. Royce & Associates LP owned 2.14% of Ingles Markets worth $26,227,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

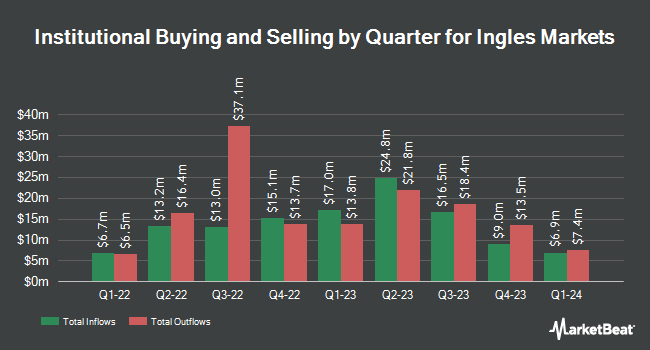

Other hedge funds also recently made changes to their positions in the company. FNY Investment Advisers LLC acquired a new position in shares of Ingles Markets in the 4th quarter valued at $96,000. Caprock Group LLC purchased a new position in Ingles Markets during the 3rd quarter worth $203,000. Captrust Financial Advisors acquired a new position in Ingles Markets in the third quarter valued at $206,000. Intech Investment Management LLC purchased a new stake in shares of Ingles Markets in the third quarter valued at about $266,000. Finally, Exchange Traded Concepts LLC boosted its stake in shares of Ingles Markets by 4.5% during the fourth quarter. Exchange Traded Concepts LLC now owns 4,369 shares of the company's stock worth $282,000 after buying an additional 187 shares during the period. Hedge funds and other institutional investors own 62.54% of the company's stock.

Ingles Markets Stock Performance

Shares of Ingles Markets stock traded up $0.12 during trading hours on Thursday, hitting $63.01. 85,331 shares of the company were exchanged, compared to its average volume of 106,603. The company has a current ratio of 3.24, a quick ratio of 1.45 and a debt-to-equity ratio of 0.33. The business has a 50-day moving average of $63.99 and a 200-day moving average of $66.86. Ingles Markets, Incorporated has a 1 year low of $58.92 and a 1 year high of $82.01. The stock has a market capitalization of $1.20 billion, a price-to-earnings ratio of 15.22 and a beta of 0.71.

Ingles Markets (NASDAQ:IMKTA - Get Free Report) last announced its quarterly earnings data on Thursday, February 6th. The company reported $0.87 EPS for the quarter. Ingles Markets had a net margin of 1.45% and a return on equity of 5.09%.

Ingles Markets Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, January 16th. Investors of record on Thursday, January 9th were given a $0.165 dividend. The ex-dividend date was Friday, January 10th. This represents a $0.66 dividend on an annualized basis and a yield of 1.05%. Ingles Markets's payout ratio is currently 15.94%.

Analyst Ratings Changes

Separately, StockNews.com cut Ingles Markets from a "buy" rating to a "hold" rating in a research report on Monday, February 10th.

View Our Latest Analysis on IMKTA

Ingles Markets Profile

(

Free Report)

Ingles Markets, Incorporated, together with its subsidiaries, operates a chain of supermarkets in the southeast United States. It offers food products, including grocery, meat and dairy products, produce, frozen foods, and other perishables; and non-food products, which include fuel centers, pharmacies, health and beauty care products, and general merchandise, as well as private label items.

See Also

Before you consider Ingles Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingles Markets wasn't on the list.

While Ingles Markets currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.